Graincorp Ltd (ASX:GNC) a prominent agribusiness and processing company, has reported exceptional half-year results for the period ending March 31, 2023. The firm recorded earnings before interest, taxes, depreciation, and amortization (EBITDA) of $383 million and a net profit after tax (NPAT) of $200 million – both significant increases from the previous year's figures.

Let's take a closer look at the company’s fundamentals using InvestingPro tools.

What Does the Company Do?

GrainCorp is a diversified agribusiness company based in Australia, with operations in the storage and logistics, marketing, and processing of grains and oils. Its focus is on four core grains - wheat, barley, canola, and sorghum. The company has two segments: Agribusiness, which sells and distributes grains and oils to over 50 countries and operates seven bulk import/export terminals in eastern Australia and four grain elevators; and Processing, which produces and distributes edible oil in Australia and New Zealand through two oilseed crushing plants and two processing and refining facilities.

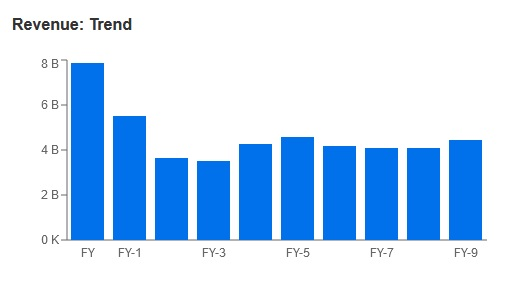

Let's start by going through the financial statement history using the InvestingPro tools. This gives us several useful insights.

Source: InvestingPro

Following surging revenues in the previous financial year, continued robust performances among GrainCorp's agribusiness and processing divisions as well as excellent operational execution combined with solid supply chain margins contributed to these outstanding results.

The company also benefited from high demand for Australian grains and oilseeds during this period due to a third consecutive bumper crop on Australia's east coast. GrainCorp continued its focus on improving supply chain efficiencies throughout this time.

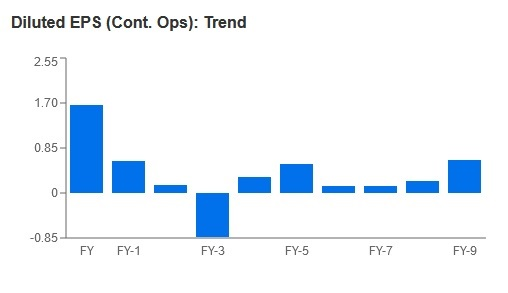

Source: InvestingPro

In light of these achievements, GrainCorp raised its FY23 earnings guidance for both EBITDA ($500-$560 million) and NPAT ($220-$260 million).

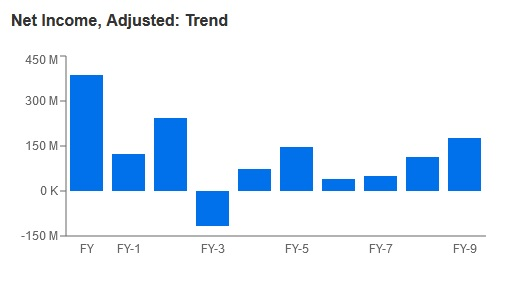

Source: InvestingPro

GrainCorp also announced plans to increase their Australian crush capacity following their successful financial performance in recent months. This decision was influenced by increased efficiency rather than capacity alone; they crushed an impressive volume of 256,000 tons during the first half of the fiscal year compared to last year’s figure at just over 232,000 tons.

CEO Robert Spurway explained that increasing crush capacity would allow them to meet strong market demands across food production sectors while supporting Australia’s renewable energy efforts long-term.

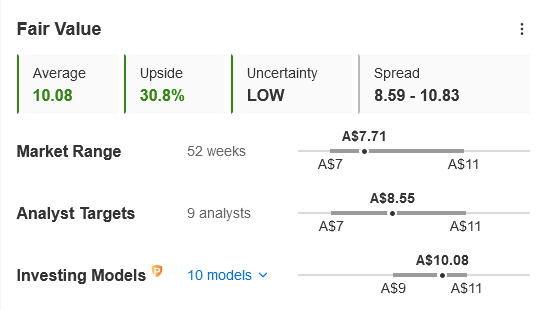

Fair Value Estimate

Currently, the stock is trading at A$7.71, indicating a significantly underpriced value when compared to the fair value of A$10.08. The fair value estimate is based on 10 different mathematical models, available on InvestingPro.

Source: InvestingPro

GrainCorp’s strong financial standing has allowed them to explore strategic growth opportunities within alternative protein, digital and agri-tech, animal nutrition, and grower services sectors. This solid financial position also enables the company to offer significant flexibility going forward.

The analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.