Daily FX Market Roundup 01.29.20

Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

The Federal Reserve’s monetary policy announcement proved to be marginally negative for the dollar. The central bank raised its IOER rate but described the move as a small technical adjustment. Chairman Powell highlighted the ongoing strength in the economy but also expressed concerns about uncertainties including the virus. Most importantly, the central bank made it clear it is not pleased with low inflation and wants prices to move toward the bank's goal, which is not a ceiling. On liquidity and repos, he admitted that repo may play a role as a backstop to support rate control but the aim is liquidity and they are prepared to adjust the amount as needed. For the time being, repo operations will last until at least April. With updates to their economic projections expected at the next meeting in March, no surprises were expected. Instead, the more market-moving event for the greenback will be tomorrow’s U.S. Q4 GDP report. Growth is expected to slow but with retail sales and trade improving at the end of the year, growth could surprise to the upside.

Meanwhile, it was also no surprise that the market shrugged off Australia’s stronger consumer price report. Inflation is a nominal concern when we have coronavirus posing such a major risk to regional growth. New Zealand trade numbers are due for release this evening and the sharp decline in the manufacturing signals weakness that could take NZD/USD to fresh 7 week lows.

The most market-moving event on this week’s calendar will be Thursday’s Bank of England monetary policy announcement. The BoE is closer than ever to lowering interest rates. On January 17, investors saw a 70% chance of easing this month but after stronger PMIs, the market thinks the odds are closer to 45%. Unfortunately those odds do not reflect the impact of the coronavirus so someone is bound to be surprised. Back in December, two members of the policy-making body voted for a quarter-point rate cut and there’s a very good chance that a third or even fourth member could follow this month. There’s also a small but serious possibility of an immediate rate cut. At its last meeting, the central bank also lowered its growth forecast and its outlook is probably even weaker with coronavirus.

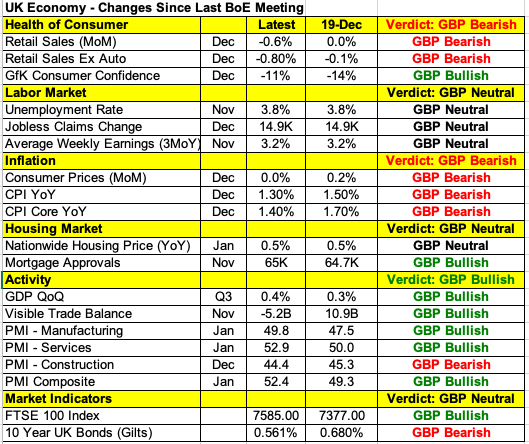

Since the last meeting, we’ve seen both improvements and deterioration in the UK economy. As shown in the table below, consumer spending fell despite holiday discounting, inflationary pressures eased and wage growth stagnated. Up until last week, most UK economic reports surprised to the downside – hence the surge in rate-cut expectations – but on Friday, January PMIs were released and they blew out expectations, coming in firmer than anticipated and in one fell swoop the chance of easing plunged.

This will also be Governor Carney’s very last meeting before he is replaced by Andrew Bailey. Could his swansong be a rate cut or will he choose to leave this key decision to his successor in March. We think he’ll wait but in lieu of easing, his tone should be unquestionably dovish. So between a strong possibility of more MPC members voting in favor of a rate cut and dovish comments from Governor Carney, we expect GBP to weaken before and after the rate decision against the U.S. dollar and euro. GBP/USD could easily slip to 1.2950 before the policy announcement.