- Apple is less than 5% shy of its all-time high after the past two-month rally

- The world’s most valuable company significantly influences the S&P 500 Index due to its $2.8 trillion market capitalization

- The biggest question lurking in investors’ minds is whether this rally is sustainable against a recessionary backdrop

Shares of Apple Inc (NASDAQ:AAPL) have been showing incredible momentum over the last couple of months. Despite this year’s bear market, the world’s most valuable company is currently hovering near all-time highs after surging 35% from its June low.

The biggest question for investors now is whether this rally is sustainable amid current broad market conditions. The iPhone maker significantly influences the S&P 500 index due to its $2.8 trillion market capitalization, making this rally essential for the market to continue its upward journey.

A Toxic Combination

Many risks can still derail Apple’s uptrend in the short run. The economy is still struggling amid inflation close to the highest in four decades and rising interest rates, a toxic combination that could hurt demand for Apple’s products and services.

In its most recent earnings release, Apple’s revenue and profit narrowly topped analysts’ estimates, with iPhone sales holding up better than expected.

Earlier this year, the Cupertino, California-based company had warned that the third quarter could be rough, with supply chain snags cutting sales by $4 billion to $8 billion.

However, as earnings displayed, the damage was significantly lower, building expectations that the company’s hardware products are still in great demand.

On the other hand, Apple’s suppliers have begun to show signs that the demand slowdown might be spreading. Micron Technology (NASDAQ:MU) warned last week that sales in the current quarter should be weaker than its earlier forecast less than six weeks ago. That followed disappointing revenue projections from Qualcomm Incorporated (NASDAQ:QCOM), Intel Corporation (NASDAQ:INTC), and NVIDIA Corporation (NASDAQ:NVDA).

Furthermore, China’s strict COVID policies could still be a hurdle in Apple’s growth plans if a new wave of the virus arrives in the coming winter, choking Apple’s supply lines.

Beyond these risks, Apple stock looks expensive after this rally. It’s now priced at 27 times profits projected over the next 12 months, compared with an average of 17 over the past decade. That valuation will be hard to justify if the market enters another rough patch in the near term.

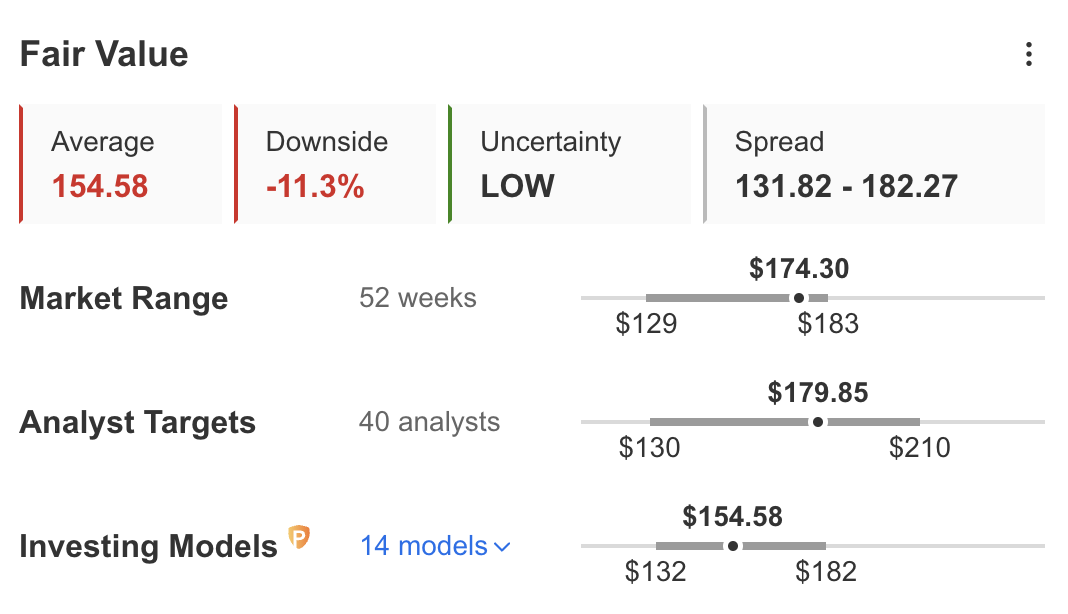

For these potential headwinds, according to several financial models like those that value companies based on P/E or P/S multiples or terminal values, the average fair value for Apple on InvestingPro stands at around $154, implying an 11.3% downside potential.

Source: InvestingPro

Apple stock remains a solid pick for long-term investors who should add this name to their portfolio when the next dip arrives. In a recent note to clients, Morgan Stanley made a compelling case to own Apple stock, predicting the stock could soon hit the $200 mark with a market capitalization of $3 trillion.

According to the investment bank, the market still values the iPhone maker as a hardware company when it should use a “lifetime value” based approach. This lifetime value model assumes that Apple users will spend $2 per day on Apple products or services, a figure already achieved by US iPhone owners.

Another strength that makes Apple a great bet over the long run is its safe-haven status and ability to return massive amounts of cash during a potential recession. With about $200 billion in cash, Apple is in an enviable position to quickly increase its share repurchase program whenever needed, thus supporting its stock amid difficult times.

Bottom Line

Apple’s big upside move during the past two months has made its stock expensive, given the macroeconomic headwinds and demand uncertainty. That being said, Apple remains a great candidate for long-term investors who want to own a big-cap defensive stock to ride through a potential recession. The next dip could be the right time to make that move.

Disclosure: The writer owns Apple shares.