- Apple is down more than 20% since its January peak

- It has a history of weathering economic downturns

- Apple’s cash pile offers another solid support

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

The most valuable company in the US, Apple (NASDAQ:AAPL), has just hit bear market territory, sending investors a strong signal that the current rout may have more room to run.

Once considered one of the safest bets during times of turmoil, the iPhone maker shed more than 19% since its peak in early January. Apple closed Thursday at $142.56.

The Cupertino, California-based behemoth also lost its status as the world’s most valuable company. On Thursday, Saudi Aramco (TADAWUL:2222) traded near its highest level on record, with a market capitalization of about $2.43 trillion, surpassing Apple for the first time since 2020.

How long this sell-off continues is anybody’s guess, but there is a strong case for believing that Apple shares will rebound after this correction.

Investors consider Apple a safe-haven play due to its vast global market share in the cellphone market, its long-term track record of profitability, and its fortress balance sheet. The current market turmoil doesn’t indicate that Apple’s lead in these areas is under threat.

Year-to-date, Apple is down about 19% compared with a more than 27% decline in the NASDAQ 100 Index. Microsoft (NASDAQ:MSFT), the second-largest stock, with a market cap of $1.99 trillion, is down 24% this year.

Record Quarterly Profit

Apple is also a highly profitable company. Its gross margin, which hovered around 38% before the pandemic, has now surpassed 43%, fueled by its revenue shift towards higher-end products that carry better margins, such as its newer iPhone models with 5G capabilities.

The company reported $97.3 billion in sales last month for the period ended on Mar. 31, marking a record for a non-holiday quarter. The December quarter was a blowout sales period, exceeding Wall Street estimates with an all-time revenue high of nearly $124 billion.

Apple’s cash pile offers another solid reason for investors looking to take refuge in the current uncertain times. With the world’s largest corporate cash reserves of more than $200 billion, the company has enough firepower to support its stock through share buybacks.

Investors like repurchase programs as they reduce a company’s share count and lift earnings, especially during turbulent times like the ones we’re now facing.

Warren Buffett, whose investment firm is one of the largest shareholders of Apple, has immensely benefited from this trend. Buffett has built a $159-billion stake in Apple since his Berkshire Hathaway (NYSE:BRKa) started buying the stock in late 2016.

Buffett told CNBC this month that he bought $600-million worth of Apple shares following a three-day decline in the stock last quarter. Apple is the conglomerate’s single largest stock holding, with a value of $159.1 billion at the end of March, taking up about 40% of its equity portfolio.

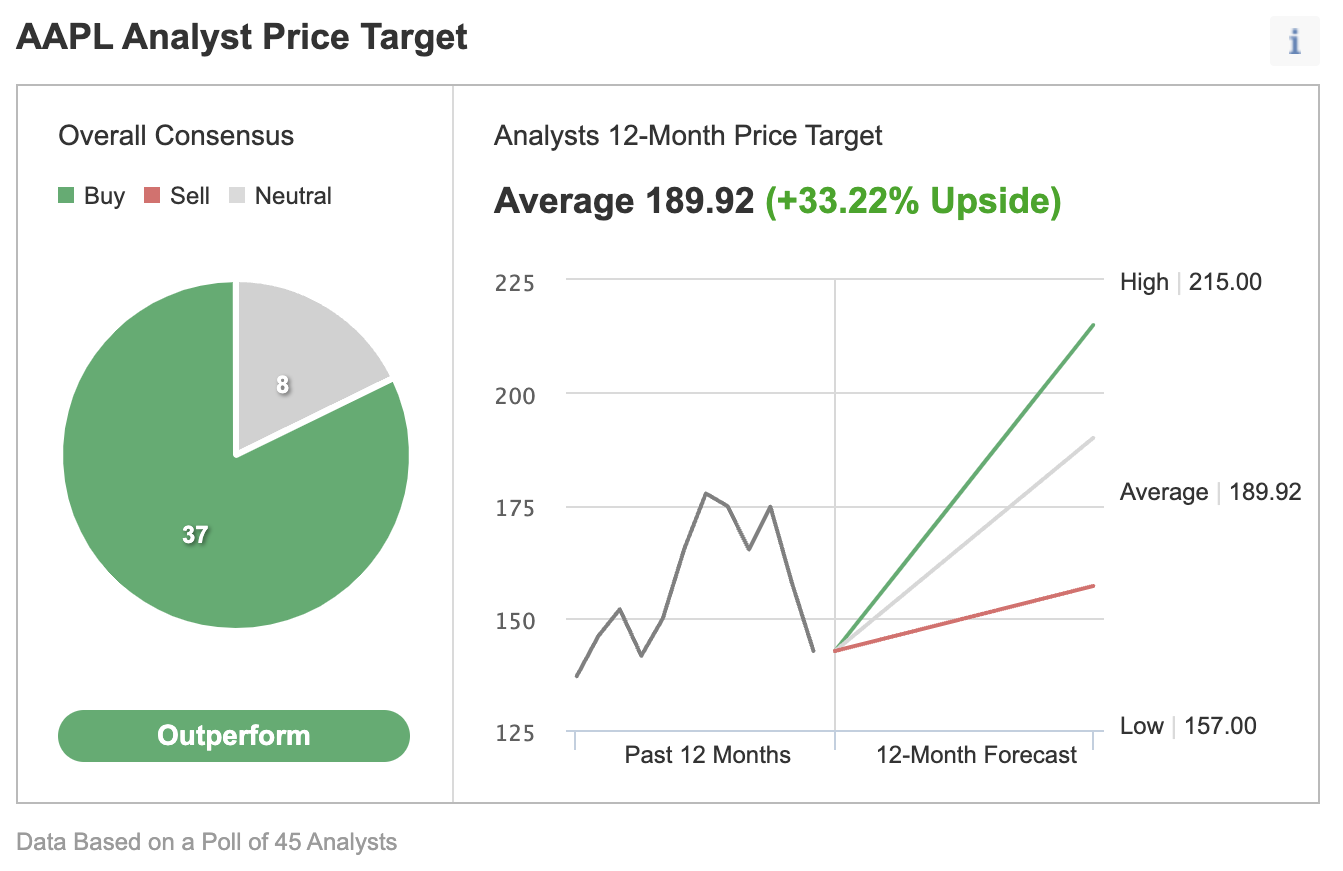

Due to the stock’s long-term solid appeal, most of the 45 analysts polled by Investing.com recommend buying Apple stock, with their consensus 12-month price target implying a 33% upside potential.

Source: Investing.com

Bottom Line

It’s hard to predict when the current bearish spell will end for Apple and other mega-cap technology stocks. But this weakness is an opportunity for long-term, buy-and-hold investors to build a position in Apple that is likely to rebound strongly, backed by its robust share buyback plan, the resurgence in its iPhone sales, and its impressive margins.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »