Street Calls of the Week

Many economists and financial experts currently anticipate a soft landing for the US economy and the same is true for Australia.

However, while one might think forecasted recessions were completely wrong, I believe that it could be actually a matter of timing. I'm not saying that a recession is necessarily looming, but, while there aren't many signs of a drastically cooling down economic activity in the very short term, concerning issues cloud the near future, but, as usual, the true impact and timeline remain uncertain.

You don't have to understand much of economics to grasp some logical problems with the current state of the economy:

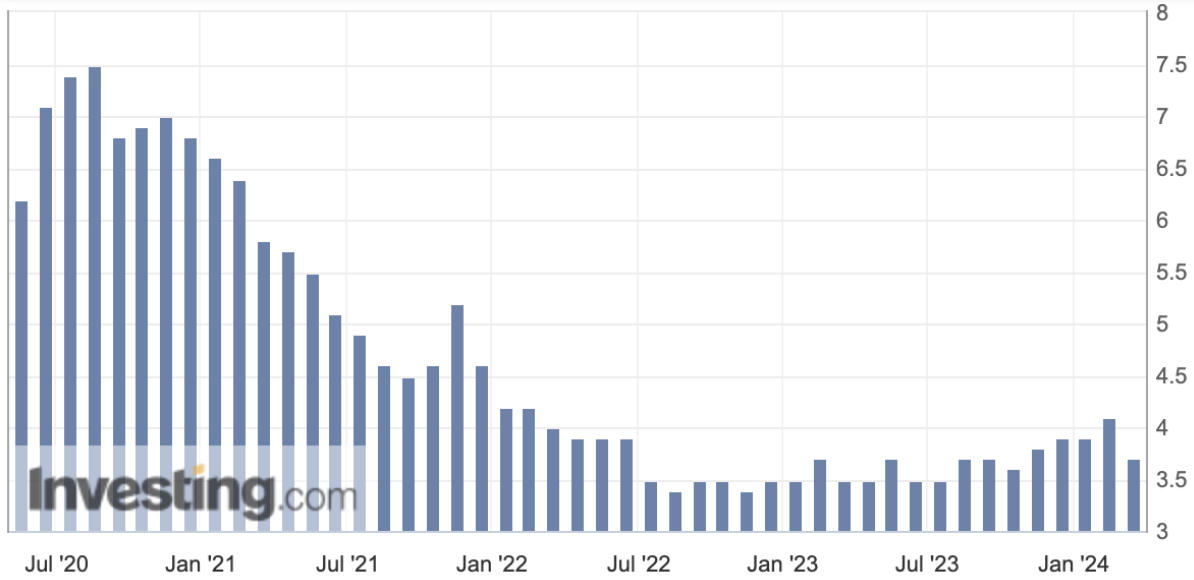

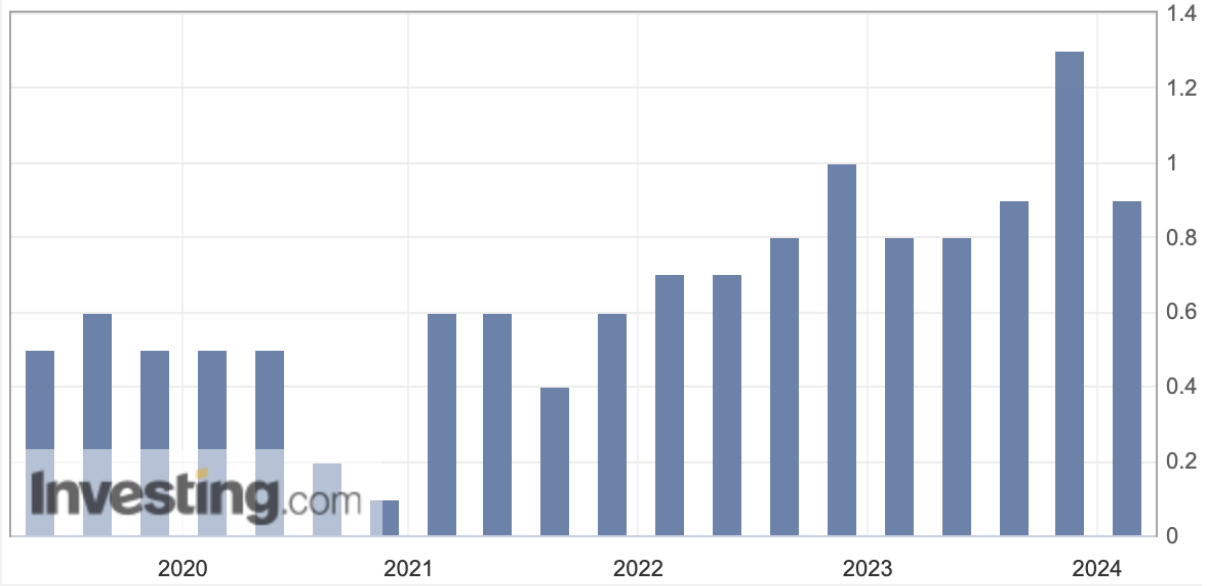

The economy is not cooling down as quickly as expected. Whereas it is a good sign of resilience, its consequence is a sticky inflation that has already dipped slightly, but remains above desired levels (currently at 4.1%).

Of course rate hikes are expected to cool inflation, but there is a lag between the changes in the rates and the effects in the economy, which might be the reason unemployment rates

and wage data suggest continued price pressures in the short term.

On the other hand, interest rates are still relatively high (4.35%), which can discourage significant business investments. This rate also make it harder for individuals to obtain loans for homes, cars, and other needs.

On top of these all, geopolitical tensions around the world, including ongoing conflicts and potential escalations, as well as the looming US elections can further complicate the economic picture.

Rising government spending whether to support struggling families, fund military operations, or subsidise domestic companies, will add further pressure.

It is a potential Domino Effect.

Shortly, that is the scenario we encounter today. It is not hard to imagine a near future where:

- High inflation combined with high interest rates, even with strong employment and decent wages, will squeeze household budgets, squeezing the potential spending power of families.

- As the economy is circular, as families cut back on spending, businesses will experience declining sales, potentially leading to layoffs and a broader economic downturn.

- If this isn't enough, rising government spending, whether to support struggling families, fund military operations, or subsidise domestic companies, will add further pressure

A downward spiral can begin when lower family budgets lead to decreased business sales. This triggers layoffs, further reducing household spending power, and feeding back into lower sales – a vicious cycle that can slowly pull the economy into recession.

While a soft landing is still possible, the level of uncertainty surrounding the economic future is high. The timing and severity of potential challenges remain unclear. This lack of clarity can lead to misinterpretations. A period of stagnation might be mistaken for a soft landing, when in reality, deeper problems may be brewing.

InvestingPro has been a valuable tool for my investment research, assisting in my analysis and in identifying global investment opportunities. Subscribe using coupon code proadb24 and get a 10% discount.