Investing.com - This year has seen a surge in ASX gold shares, propelled by two primary factors. Firstly, the price of gold has continued to trade near record highs, despite minor fluctuations over recent weeks. Secondly, rampant inflation has escalated capital expenditure and running costs while both major and junior players scramble to extract as much gold as possible before prices drop.

Investors with an appetite for risk may find these soaring gold shares increasingly appealing, however, it is crucial to manage your risk exposure considering that smaller mining companies tend to be more volatile compared to blue-chip stocks.

With this strategy in mind, here are 2 gold companies on the ASX 200 that hold the potential to outperform current market conditions, according to InvestingPro.

Northern Star Resources

What Does the Company Do?

Northern Star Resources Ltd (ASX:NST) is an Australian gold producer with projects in Australia and North America. It is engaged in exploration, development, mining, and processing of gold deposits and sale of refined gold. The company operates through five segments: Kalgoorlie Operations, Yandal Operations, Pogo, KCGM Joint Venture, and Exploration. Its projects are located in highly prospective and low sovereign risk regions

Daily price action action data reveals the stock trading at 3-month lows of A$12.08:

Source: InvestingPro

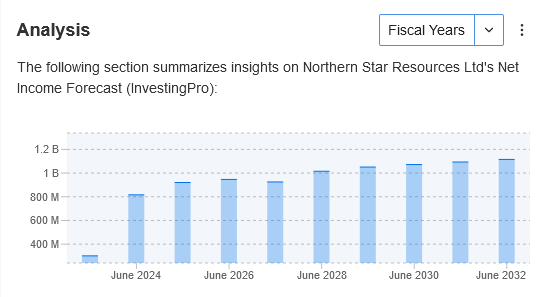

Northern Star Resources offers investors with a low price volatility, strong cash flows and a recently increased income forecast after reporting that it had entered into a binding asset sale agreement with Strickland Metals for acquiring Millrose Gold project based in Western Australia for $61 million — $41 million paid upfront and rest through issue of Northern Star shares post-completion that will be held for twelve months under escrow along with an initial good faith deposit worth $2 million.

The acquired site promises considerable returns given its high-grade mineral resource quality located conveniently just kilometres away from Northern’s Jundee operation.

Source: InvestingPro

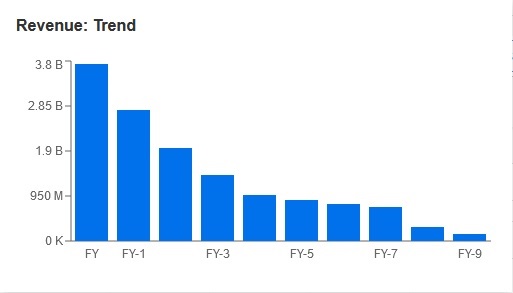

Strengthening revenues also bode well for the precious metal miner:

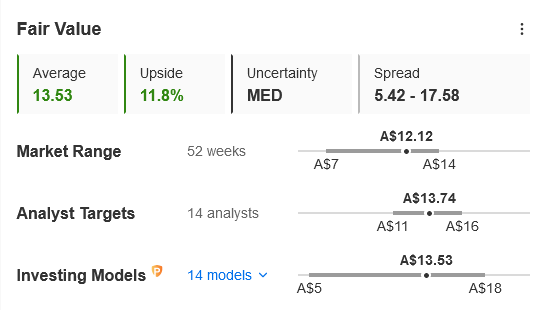

Fair Value Estimate

Currently, the stock is trading at A$12.11, while the average of 14 Fair Value Investing Models revealed a price target of A$13.53, indicating an upside of 11.8%.

Source: InvestingPro

Perseus Mining Limited

What Does the Company Do?

Perseus Mining Ltd (ASX:PRU) is an Australian gold producer, developer, and explorer that conducts mineral exploration and evaluation activities in Africa. The company operates three gold mines in Africa, namely Edikan in Ghana, Sissingue and Yaoure in Cote d'Ivoire, and owns the Meyas Sand Gold Project in Sudan. The company employs around 590 people and has operations in Australia, Canada, the UK, Guernsey, and Africa, with its head office located in Subiaco, Western Australia.

Daily price action reveals the stock trading at 8-month lows:

Source: InvestingPro

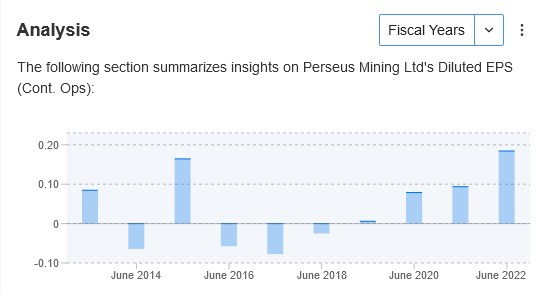

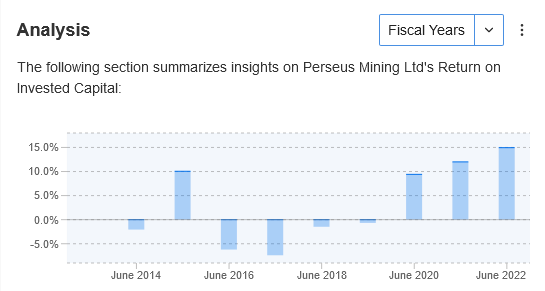

However, the company’s earnings per share and return on invested capital have been consistently increasing:

Source: InvestingPro

Source: InvestingPro

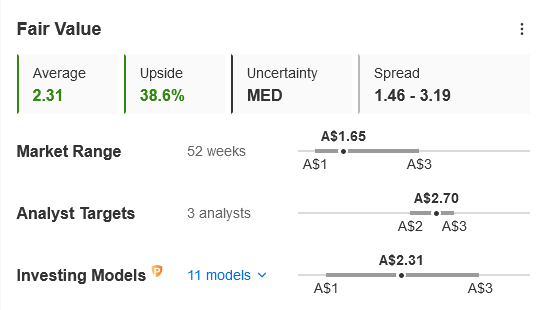

Fair Value Estimate

Currently, the stock is trading at A$1.67, while the average of 11 Fair Value Investing Models revealed a price target of $2.31 indicating an upside of 38.6%.

This analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.