Despite rising interest rates and a slowing economy, it seems that Australia’s housing market is proving resilient, with housing prices continuing to tick higher across the country.

In this environment, investing in A-REITs (Australian Real Estate Investment Trusts) may provide strong dividend payouts amid rising commercial and residential rental prices.

With this strategy in mind, here are 2 companies on the S&P/ASX 200 that hold the potential to outperform current market conditions, according to InvestingPro.

Charter Hall Group (ASX:CHC)

What does the company do?

Charter Hall is a prominent fully integrated property investment and funds management group in Australia. The company leverages its expertise to access, deploy, manage, and invest equity, aiming to create value and deliver excellent returns for its investor customers. Charter Hall has curated a diverse portfolio of high-quality properties across key sectors such as Office, Industrial & Logistics, Retail, and Social Infrastructure. With a focus on partnerships and financial discipline, the company is dedicated to creating and investing in places that foster growth for its customers, employees, and communities.

Daily price action action data shows the company trading in a tight range, near yearly lows of A$10.50:

Source: Investing.com

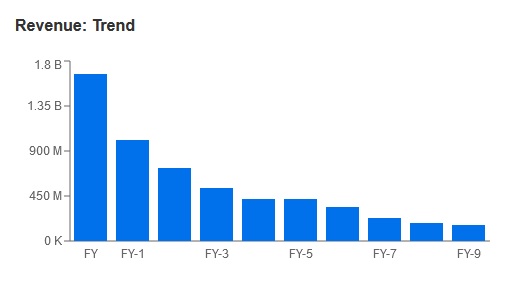

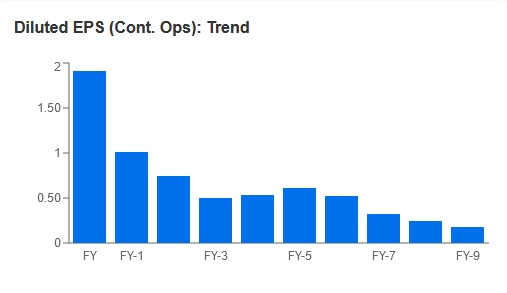

However, stronger than expected revenues and earnings indicate strength amid the current higher interest rate environment:

Source: InvestingPro

Source: InvestingPro

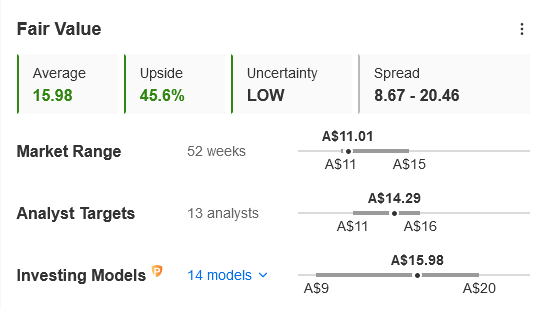

Fair Value Estimate

Currently, the stock is trading at A$10.95, while the average of 14 Fair Value Investing Models revealed a price target of A$15.98, indicating an upside of 45.6%.

Source: InvestingPro

Stockland Corporation Ltd (ASX:SGP)

Stockland Corp Ltd (Stockland) is a real estate development company based in Sydney, Australia. The company specializes in property development, management, and investment services for retail, industrial, office, and residential properties. Its property portfolio includes retirement living villages, shopping centers, office assets, logistics centers, business parks, and residential communities. Stockland also develops serviced apartments in urban areas and operates aged care facilities. Additionally, the company offers property trust management and property management services. Stockland manages properties across multiple Australian states, including New South Wales, Queensland, Victoria, and Western Australia.

Stockland’s share prices have increased 11.5% year-to-date, and strong fundamentals indicate that the company is in good condition to weather upcoming recession risks.

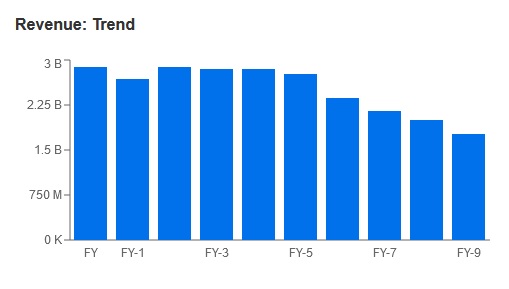

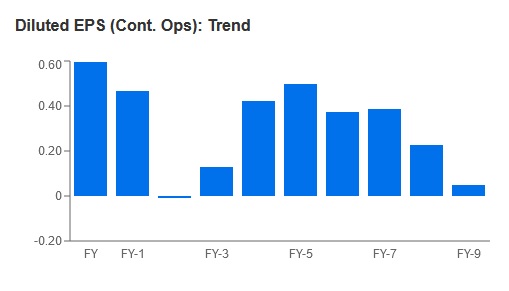

Both revenues and earnings per share have performed well in the previous financial year:

Source: InvestingPro

Source: InvestingPro

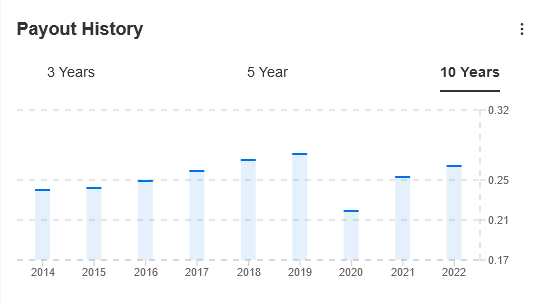

The company also offers a strong payout history, maintaining dividend payouts for 31 consecutive years:

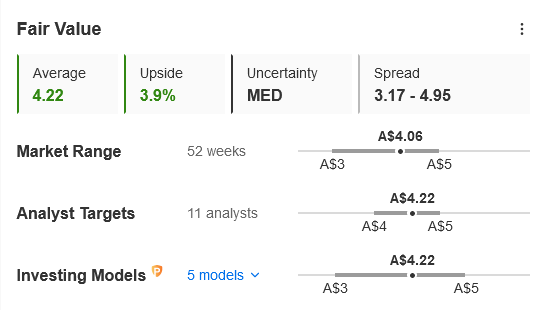

Fair Value Estimate

Currently, the stock is trading at A$4.06, while the average of 5 Fair Value Investing Models revealed a price target of $4.22 indicating an upside of 3.9%.

This analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.