This past week, yet another report pointed to slower growth. The J.P. Morgan global growth indicator was barely positive:

The growth rate of the global manufacturing sector ground to a near-standstill at the start of the second quarter. At 50.1 in April, the J.P.Morgan Global Manufacturing PMI™ – a composite index1 produced by J.P.Morgan and Markit in association with ISM and IFPSM – posted a reading barely above its no-change level of 50.0 and the second weakest during the past forty months.

Rates of expansion in output and new orders also decelerated back towards the broadly stagnant outcomes registered in February. Conditions remained muted in many domestic markets, while international trade flows continued to deteriorate. The level of new export business fell for the third straight month and to the greatest extent since September of last year.

The performances of the main industry groups covered by the survey all remained lacklustre during April. Output growth slowed to marginal rates at both consumer and intermediate goods producers, while the investment goods sector stagnated.

This report isn't surprising. Earlier this year the OECD and World Bank lowered their respective global growth forecasts. First quarter growth for the EU and US was weak while Japan contracted. This report from J.P. Morgan is more of an afterthought that confirms already reported weakness.

Australia released this past week’s most important news: the RBA lowered interest rates 25 basis points to 1.75. The release contained the following paragraph:

Inflation has been quite low for some time and recent data were unexpectedly low. While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast.

Like other developed countries, Australian inflation is low – and moving lower:

The RBA is hoping to stimulate additional demand which will, in turn, increase prices. The AIG PMI manufacturing index dropped 4.7 points to 53.4, marking 10 consecutive months of expansion. All sub-indexes save employment expanded. The services index, however, contracted again with a headline number of 49.7. 3/5 sub-indexes contracted. The construction number increased 5.6 to 50.8. But only 1 of 4 sub-sectors expanded, indicating a fairly weak environment overall. These indexes indicated that beneath the surface, Australia is struggling with slower growth.

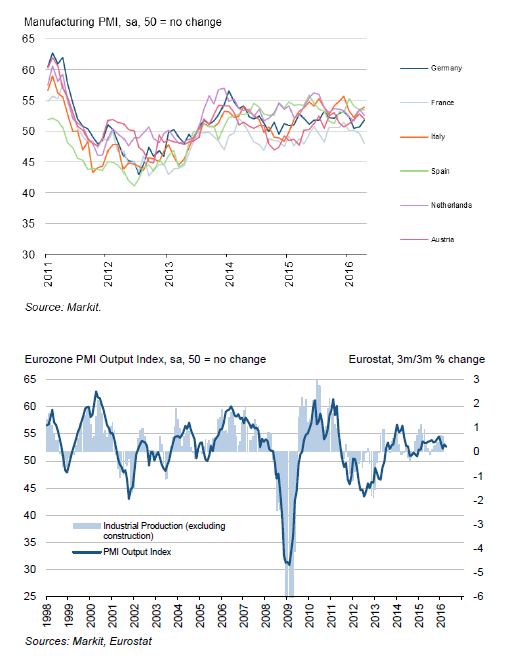

Markit released their manufacturing, services and composite readings for the EU. Manufacturing rose .1 to 51.7, with 5 of the largest 6 countries expanding (France contracted). Production and new orders, while positive, decreased slightly. Backlogs were slightly higher.

The following chart contains readings for various countries and the relationship between the PMI number and GDP:

The service number was 53.1; all of the 4 largest economies grew. And Markit’s composite reading was 53, pointing to a continued modest regional expansion.

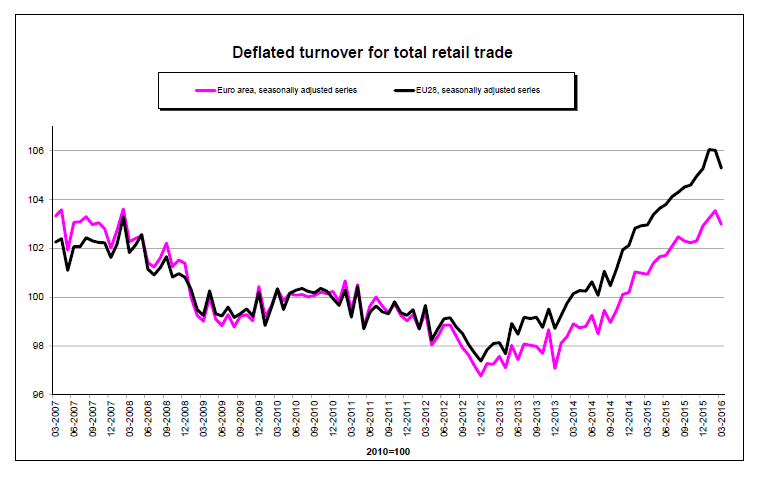

Finally, retail sales decreased .5% M/M but increased 2.1% Y/Y. When viewed as part of the historical series, last months’ decrease appears to be a pause in a solid uptrend:

The EU continues to grow slowly.

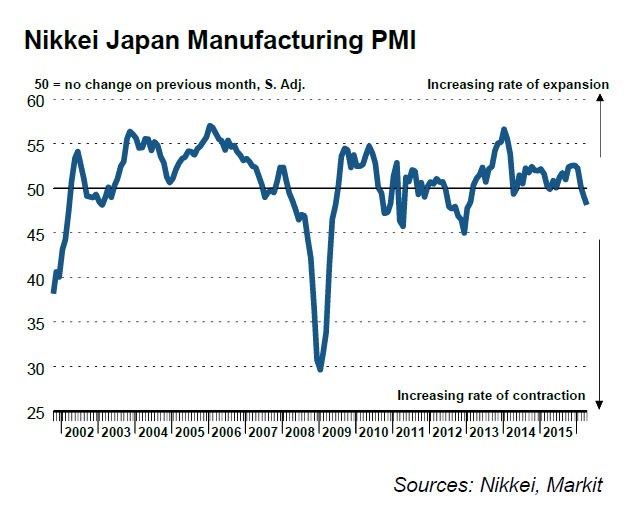

The Markit PMI was the only economic release for Japan, but it provided ample negative news. The headline number decreased from 49.1 to 48.2, marking a second month of outright contraction:

The internals were terrible: output dropped at the fastest pace in 2 years, new orders declined the most since 12/12 and new export orders fell at the quickest rate since 11/13. With numbers like these, it’s little wonder why Japanese opposition leaders are arguing that “Abenomics” is failing .

As with Japan, the only numbers for the UK came from Markit. Manufacturing contracted for the first time since March 2013. Decreased domestic and international demand contributed to lower production and new orders. The upcoming “Brexit” vote added to the malaise. Services fell from 53.7 to 52.3, a 38-month low. But new orders and production slightly increased. While construction is still expanding (headline number: 52) new business stagnated and confidence declined. The BBC described these reports as a “triple whammy:”

Chris Williamson, chief economist at Markit, said the surveys were a "triple-whammy of disappointing news".

"Some of the slowdown may be attributable to the early timing of Easter, though April also saw an increase in the number of companies reporting that uncertainty about the EU referendum caused customers to hold back on purchases, exacerbating already-weak demand linked to global growth jitters and ongoing government spending cuts," he said.

"The deterioration in April pushes the surveys into territory which has in the past seen the Bank of England start to worry about the need to revive growth."

The numbers continue to grind slower. Measures of overall global activity are just barely positive. The Brexit campaign is clearly hurting U.K. sentiment while the EU continues to grind higher.

It’s growing more and more likely that Abenomics is failing while Australia just joined the ranks of countries concerned about deflation. Watching global economics is like watching a slow motion train wreck.