It was a bit of a sketchy day for markets yesterday, but they were able to recover by the close of business. I would have preferred indexes to have honored my earlier drawn 'bull flags', but markets don't do what you want, so instead, we have to play by the rules they give us.

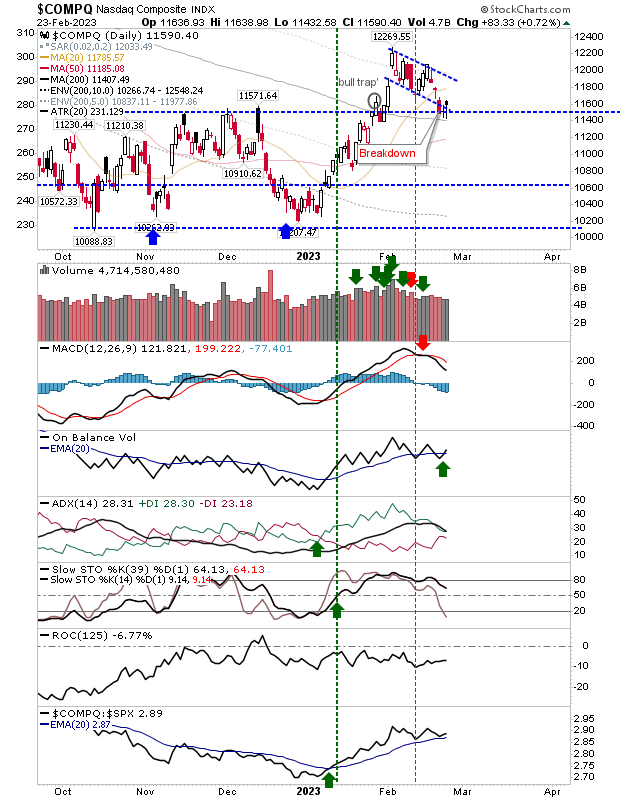

The Nasdaq has managed to dig in at support defined by the swing highs of November/December, but also the 200-day MA. Yesterday's candlestick registered as a bullish hammer and there was a new 'buy' tick in On-Balance-Volume. The index continues to outperform peer indices.

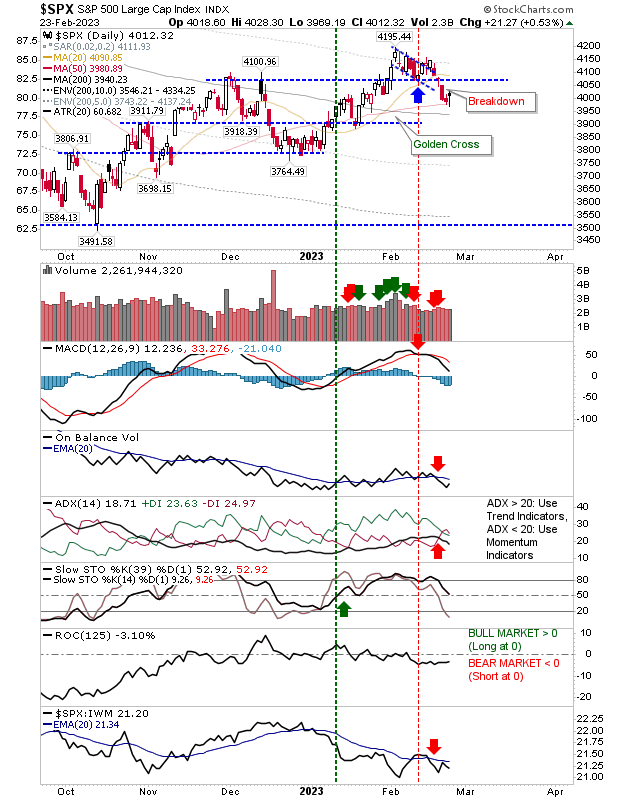

The S&P 500 had undercut its November/December peak and now finds itself defending its 50-day MA (which has come off a 'golden cross', so it has bullish intent). Technicals have weakened throughout February with the +DI/-DI bearish cross now joining the earlier bearish 'sell' signals in On-Balance-Volume and MACD.

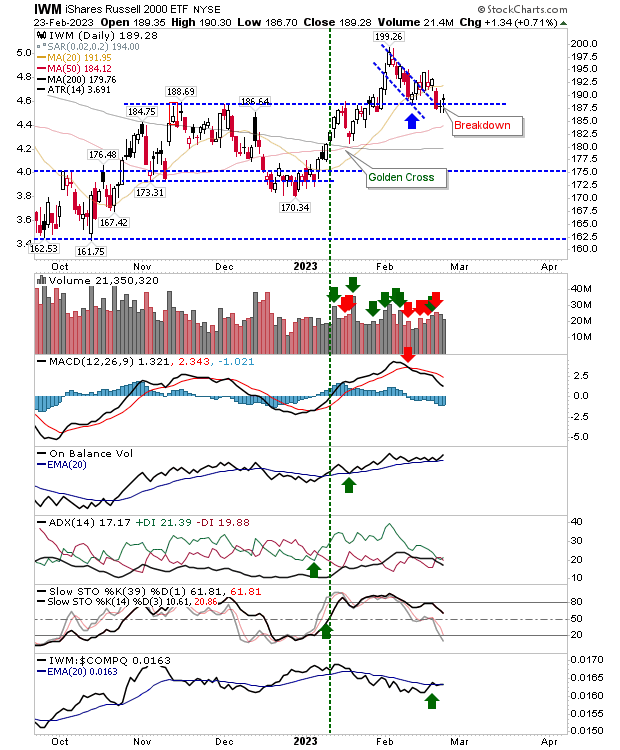

Luckily, the Russell 2000 (IWM) has more in common with the Nasdaq than the S&P 500. The index held on to the November swing high with yesterday's doji. On-Balance-Volume is also trending higher, which gives cause for optimism. There is even an edge advantage in relative performance against the Nasdaq.

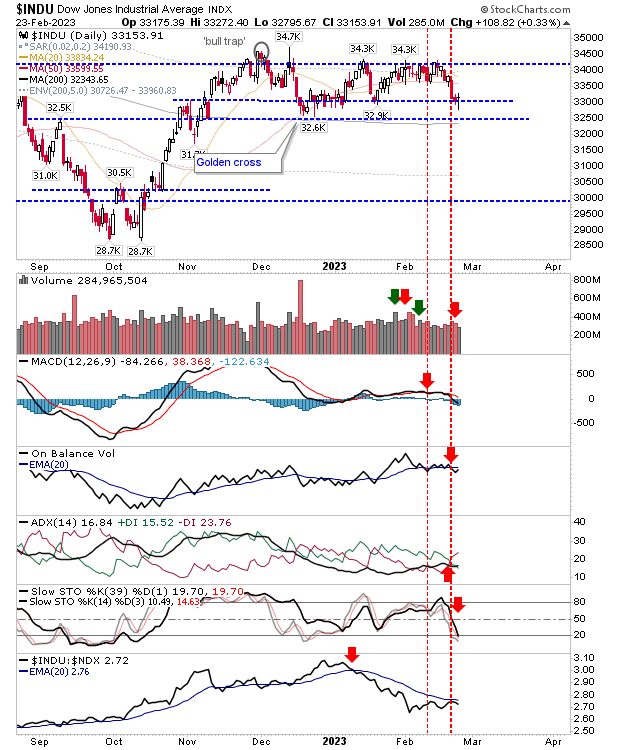

The Dow Jones Industrial Average had lost significant ground in its attempts to follow peer indices with a breakout of its own, but it did at least find support at the lows of its trading range.

Yesterday's action offered the foundation for a better day today. A move back into the spike lows, and in particular, a close inside such lows, would likely see a further acceleration of losses. However, there is cause for optimism, and I would be looking for early morning gains to drive prices above yesterday's highs.