Snap (NYSE:SNAP) stock plummeted dramatically last week when CEO Evan Spiegel warned that the instant messaging app's Q2 revenue and earnings growth would come in below the guidance issued earlier on April 21. On Monday, May 23, SNAP shares closed at $22.47, but the next morning the stock opened at $14.49.

Source: Investing.com

“…[T]he macroeconomic environment has deteriorated further and faster than anticipated,” stated Spiegel on May 23 in a regulatory filing with the Securities and Exchange Commission.

In September 2021, SNAP stock went over $83 to hit a record high, yet, so far in 2022, SNAP has lost about two-thirds of its value. Now, it is changing hands at $15.58.

By comparison, the tech-heavy NASDAQ 100 Index has lost 22.3% since January. The dire update from Snap has also dragged down the shares of other social media plays, including Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Meta Platforms (NASDAQ:FB), Pinterest (NYSE:PINS) and Twitter (NYSE:TWTR).

Ad spending is among the first to get slashed when budgets tighten. Thus, in the event of a recession, social media names that rely on digital ad revenue are poised for slower growth. Still, contrarian investors could see a buying opportunity in the recent weakness.

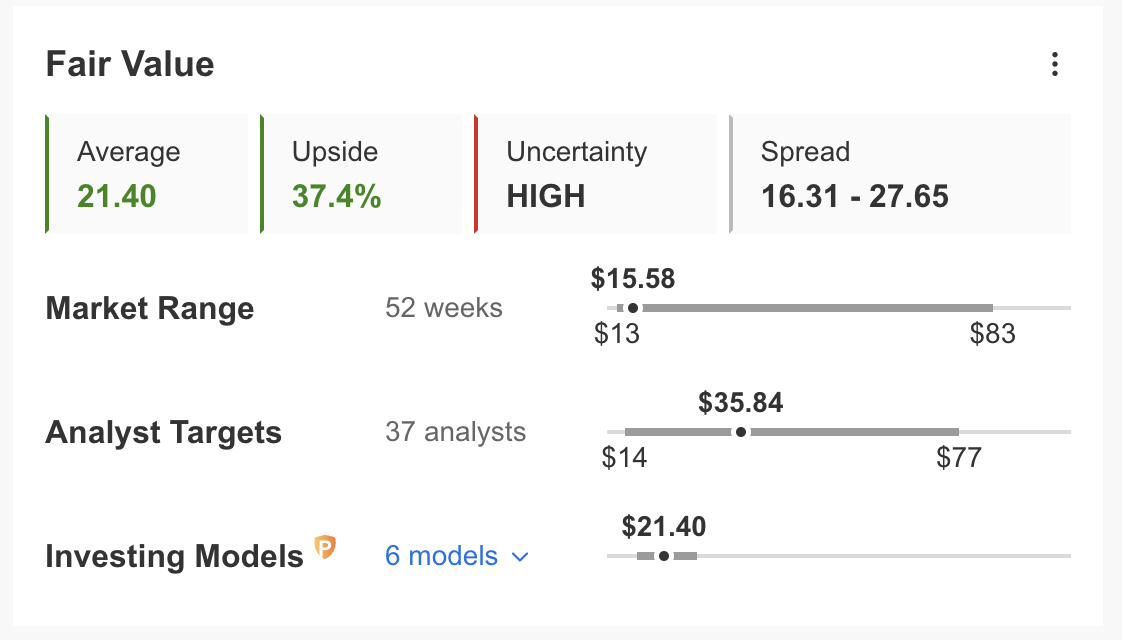

For instance, according to a number of valuation models, including P/E or P/B multiples or terminal values, the average fair value for Snap stock on InvestingPro stands at $21.40. Put another way, SNAP shares could rally over 37% from the current level.

Source: InvestingPro

With that information, here are two exchange-traded funds (ETFs) that also offer exposure to SNAP stock.

1. Global X Social Media ETF

Current Price: $36.22

52-Week Range: $32.97 - $72.64

Expense Ratio: 0.65% per year

The Global X Social Media ETF (NASDAQ:SOCL) currently invests in 44 social media stocks worldwide. The fund was first listed in November 2011.

Source: Investing.com

SOCL tracks the Solactive Social Media Total Return Index. In terms of sectoral allocation, we predominantly see communication services shares at 97.5%. Next are names from information technology, consumer discretionary, and financials sectors.

Almost half of the portfolio is in US-based businesses. Others come from China, South Korea, Japan, Luxembourg, and Germany. The top 10 stocks comprise close to 73% of about $200 million in net assets.

Among them are Tencent (OTC:TCEHY), Meta Platforms, Naver (KS:035420) (OTC:NHNCF), Twitter, NetEase (NASDAQ:NTES), and Baidu (NASDAQ:BIDU). At present, more than 4.2% of the fund is in SNAP stock.

On June 29, 2021, SOCL hit a record high of $72.64. Yet, so far this year, it is down 32.7%.

Trailing price-to-earnings (P/E) and price-to-book (P/B) ratios stand at 29.57x and 2.59x. Those who expect digital advertising spending to stay strong globally could consider buying the dip in SOCL.

2. ProShares On-Demand ETF

Current Price: $21.44

52-Week Range: $19.08 - $41.00

Dividend Yield: 0.31%

Expense Ratio: 0.58% per year

The ProShares On-Demand ETF (NYSE:OND) gives access to e-connectivity and digital content names that offer services over platforms. In addition to social media names, these companies typically include entertainment, games, e-sports, fitness, logistics, and food delivery.

Source: Investing.com

OND, which tracks the FactSet On-Demand Index, currently holds 35 stocks. It started trading in October 2021. Its net assets stand at $1.67 million. In other words, it is a small and relatively new fund that does not have much trading history.

Around two-thirds of the portfolio is in communication services names. Next come consumer discretionary (19.72%) and industrials (10.91%) stocks. More than 55% of the companies are US-based. Others are based in Japan, China, South Korea, and Luxembourg.

More than half of the fund is in the top 10 stocks. The leading names on the roster include Activision Blizzard (NASDAQ:ATVI), Electronic Arts (NASDAQ:EA), Uber Technologies (NYSE:UBER), Take-Two Interactive Software (NASDAQ:TTWO), Nexon (TYO:3659) (OTC:NEXOY), and Lyft (NASDAQ:LYFT). Meanwhile, Snap’s current weighting is at 2.41%.

Year-to-date, OND has lost more than a third of its value. Readers looking for global exposure to on-demand platform names may want to do further due diligence on this thematic fund.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »