Broader indices such as the S&P 500 and NASDAQ have had stellar run-ups since the March lows. Now the burning question for many market participants is, can they expect another robust performance in the second half of the year.

As the quarterly earnings season accelerates in the US, increased choppiness in stock prices has unnerved many. However, seasoned investors realize that well-established passive income shares can deliver strong results over time, especially if they invest for the long-haul.

Dividend refers to a portion of corporate earnings distributed to shareholders in return for their investment in a company's stock. In the US, these payouts are typically given as a dollar amount each share receives (i.e., dividend per share). And the yield quoted is the annual dividend payout per share divided by the price per share—which explains why yields fluctuate along with equity prices.

Below, we focus on exchange-traded funds (ETFs) that enable market participants to invest in a broad range of dividend-paying stocks.

The Importance Of Dividends

In the US, the Federal Reserve has slashed interest rates to record low levels in recent months, as part of its efforts to ease the economic effects of the COVID-19 pandemic. Generating fixed income via dividend stocks becomes especially attractive in such a macroeconomic environment.

With passive income-yielding businesses, investors can potentially profit from both capital gains and regular payouts. Reinvesting dividends from high-yielding shares serves to compound returns and while it is tempting to take out this passive income and spend it, we'd argue that it is advantageous to reinvest dividends and delay withdrawals.

Investing in dividend-paying, blue-chip stocks may also help portfolios weather different market conditions. Such shares typically have solid financials, stable cash flows, brands that are recognized by consumers worldwide and proven managerial track records. As well, dividend stocks tend to withstand economic shocks better than growth stocks, which often do not pay dividends.

So how do you decide where to invest? Each portfolio has a different investment style and risk/return profile. When equity markets become mercurial, many investors go for defensive stocks. Such businesses are less prone to macroeconomic and credit cycles than others. These industries would include consumer staples, healthcare, utilities, and defense.

Until the recent volatility, banks and energy stocks were among the darlings of Wall Street investors. However, economic realities have made these US-based companies reevaluate the sustainability of their high dividend yields. As a result, many boards have either slashed or fully eliminated dividends.

Investors who would like to invest in dividend stocks, but are not sure where to begin, may research exchange-traded funds. Here are a few worth considering.

Vanguard Dividend Appreciation ETF

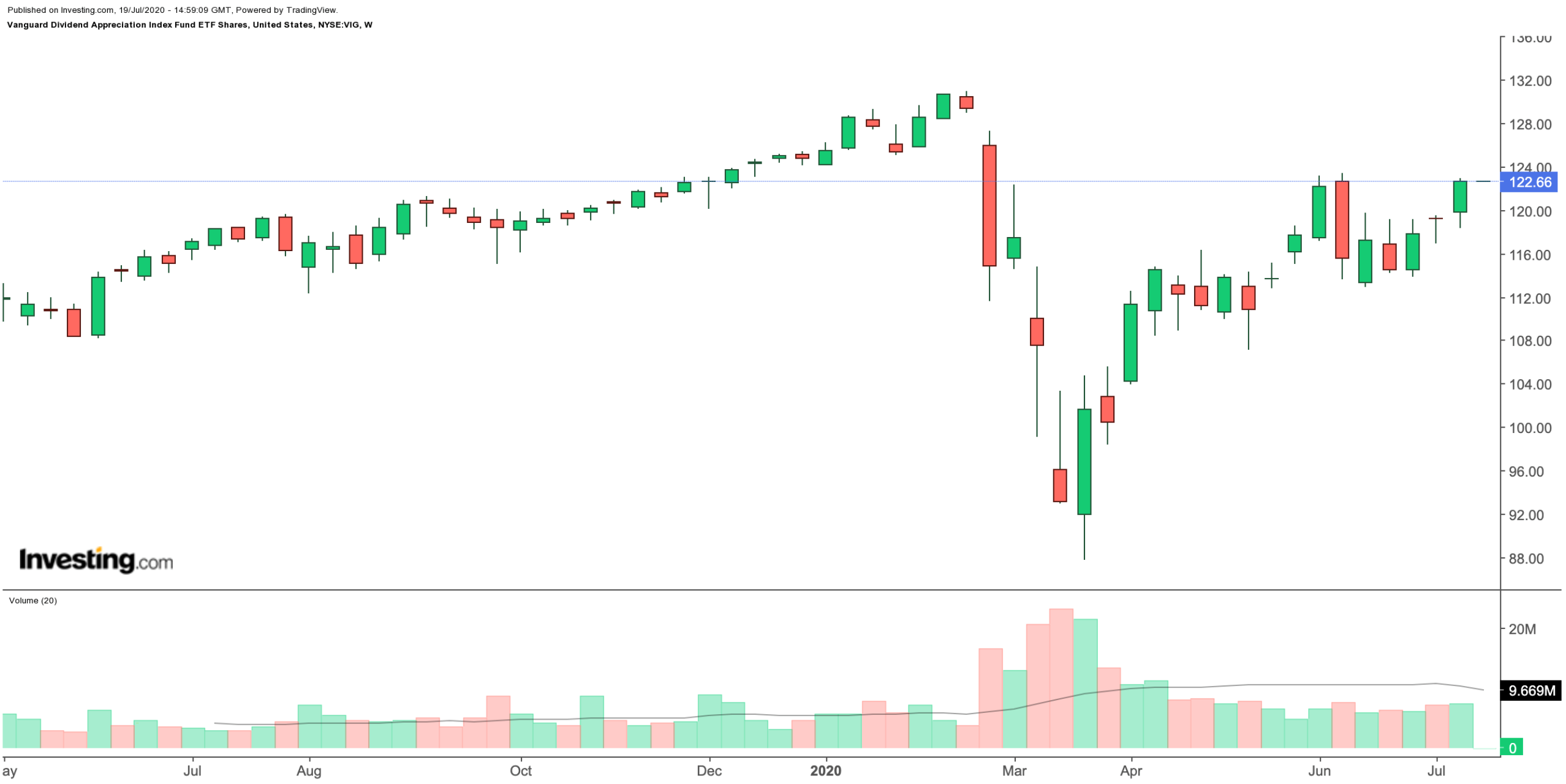

- Current Price: $122.66

- 52-week range: $87.71-$130.91

- Dividend Yield: 1.81%

- Expense Ratio: 0.06% per year, or $6 on a $10,000 investment.

Vanguard Dividend Appreciation ETF (NYSE:VIG) has over $50 billion in net assets.

As a passively managed fund, VIG seeks to track the performance of the NASDAQ US Dividend Achievers Select Index, which was established in March 2006. As one cannot directly invest in an index, an ETF such as VIG enables investors to gain exposure to companies in that fund.

Comprised of businesses with at least ten consecutive years of increasing annual, regular dividend payments, the VIG index may be suitable for those seeking a steady diet of reliable payout growth.

The fund consists of 214 US-headquartered companies covering a range of sectors, including consumer services, industrials, health care, technology, consumer goods, financials, utilities, and basic materials. The ETF's top 3 holdings are Microsoft (NASDAQ:MSFT), Walmart (NYSE:WMT), and Johnson & Johnson (NYSE:JNJ). The top ten holdings make up over 35% of the index.

VIG is one of the lowest-cost ETFs to buy on the market, creating almost zero drag on returns. Year-to-date, the price is down 1.6%, which does not take into consideration the dividend yield.

Over the coming days, many companies in the index will be reporting quarterly earnings. Given the recent increases in prices of individual shares, there may be some short-term profit-taking around the corner, with a decline toward the $118 level or below likely. This could provide potential VIG investors with a better entry point.

Bottom Line

Academic research highlights that dividends have played an essential role in the returns in the US in the past 50 years. Since the 1970s, over 75% of the total performance of the S&P 500 Index is from reinvested dividends and the power of compounding.

Therefore, investors may want to do further due diligence on the suitability of dividend stocks and ETFs for their portfolios.

Other funds to consider:

- Fidelity® Dividend ETF for Rising Rates (NYSE:FDRR)

- O’Shares FTSE Russell Small Cap Quality Dividend ETF (NYSEARCA:OUSM)

- ProShares MSCI Europe Dividend Growers ETF (NYSE:EUDV)

- ProShares S&P Technology Dividend Aristocrats ETF (BATS:TDV)

- SPDR® S&P Dividend ETF (NYSE:SDY)

- SPDR® S&P Global Dividend ETF (NYSE:WDIV)

- WisdomTree U.S. MidCap Dividend Fund (NYSE:DON).

We plan to cover these ETFs in the coming months.