- Reports Q4 2020 results on Thursday, Jan. 21, after the market close

- Revenue Expectation: $20.64 billion

- EPS Expectation: $1.81

When International Business Machines (NYSE:IBM) reports fourth-quarter earnings later today, investors will be keen to know whether the company’s cloud-computing unit is producing enough growth to balance the pandemic-driven slowdown hitting the tech company's other businesses.

It’s a tough balancing act for the 109-year-old giant that has been slow to restructure its business at a time when demand for its big-frame servers and other hardware plunged and its clients began storing their data on cloud services provided by rivals, like Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT).

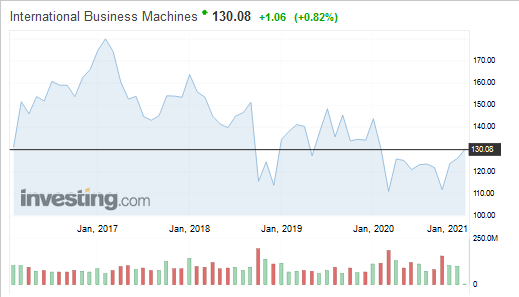

IBM stock’s five-year chart clearly tells this story.

During that period, shares hardly moved, while the tech-heavy NASDAQ surged 187% over the same time frame.

IBM closed yesterday at $130.08.

To reverse its fortunes, IBM’s new CEO Arvind Krishna is betting big on hybrid cloud software and services, which refers to companies using a combination of their own servers and renting storage and computing power from large providers. In 2018, IBM spent $34 billion to buy Red Hat to become a leader in this field.

In a conference call with analysts in October, as reported by Bloomberg, Krishna said:

“As we look forward, the case for hybrid cloud is clear. It’s a tremendous opportunity valued at $1 trillion, with most of the enterprise opportunity ahead of us.”

Attractive Valuations

To get his focus right, he has restructured his team, laid off workers and announced in the previous quarter that the Armonk, New York-based company will spin off a slower-growth business that manages corporate computer systems, essentially dividing IBM into legacy IT-management and a newer cloud unit.

These impressive changes, however, have failed to sway investors who continue to see the company struggling amid intense competition in the cloud market. For Q3, IBM reported its ninth consecutive quarter of declining or flat sales and provided no forecast, citing pandemic-related uncertainty.

IBM, in our view, is becoming an attractive stock to bet on, especially after the new management’s clear shift to cloud computing. These steps are encouraging and could unlock the value of IBM stock.

IBM shares now trade at a valuation far below its peers. Its 10.96 times forward price-to-earnings ratio is cheaper than the Technology Select Sector SPDR® ETF's (NYSE:XLK) 25-times multiple and the First Trust Cloud Computing ETF's (NASDAQ:SKYY) 35-times multiple. But, at the same time, IBM is in a tough market in which Microsoft and Amazon have already taken a significant lead.

Bottom Line

After the Red Hat acquisition, and with new management in place, we see IBM slowly getting back to a growth path. IBM’s healthy balance sheet, manageable debt and a more than 5% dividend yield make its stock a bet worth considering, especially when its turnaround is gaining pace.