- The growing season in the Northern Hemisphere is under way

- Soybean prices are at highest level in years, crush spread indicates robust demand

- Corn close to all-time high

- Wheat experiencing geopolitical nightmare

- Buying Dips Via JJG ETN

- For tools, data and content to help you make better investing decisions, try InvestingPro+

The agricultural products that feed the world have been on quite a run to the upside in 2021 and 2022. Soybean and corn futures came within a stone’s throw of the 2012 all-time highs, with prices rising to more than $17 and $8 per bushel, respectively. The world’s most political commodity – wheat – moved to a record peak, eclipsing the previous all-time high seen in 2008.

Each year is an adventure in the agricultural markets. As the global population grows, the world requires more beans, corn and wheat to satisfy requirements. In 2022, it will take more bushels to feed the world than in 2021. And it will take even more again in 2023. The weather is typically the primary factor for prices. Drought, floods or other adverse weather events that reduce crop sizes cause prices to rise, while bumper crops are bearish. Meanwhile, 2022 is anything but an ordinary year in the agricultural markets as supply-chain issues, inflation, the potential for a recession, the war in Ukraine and other factors make Mother Nature an afterthought for prices.

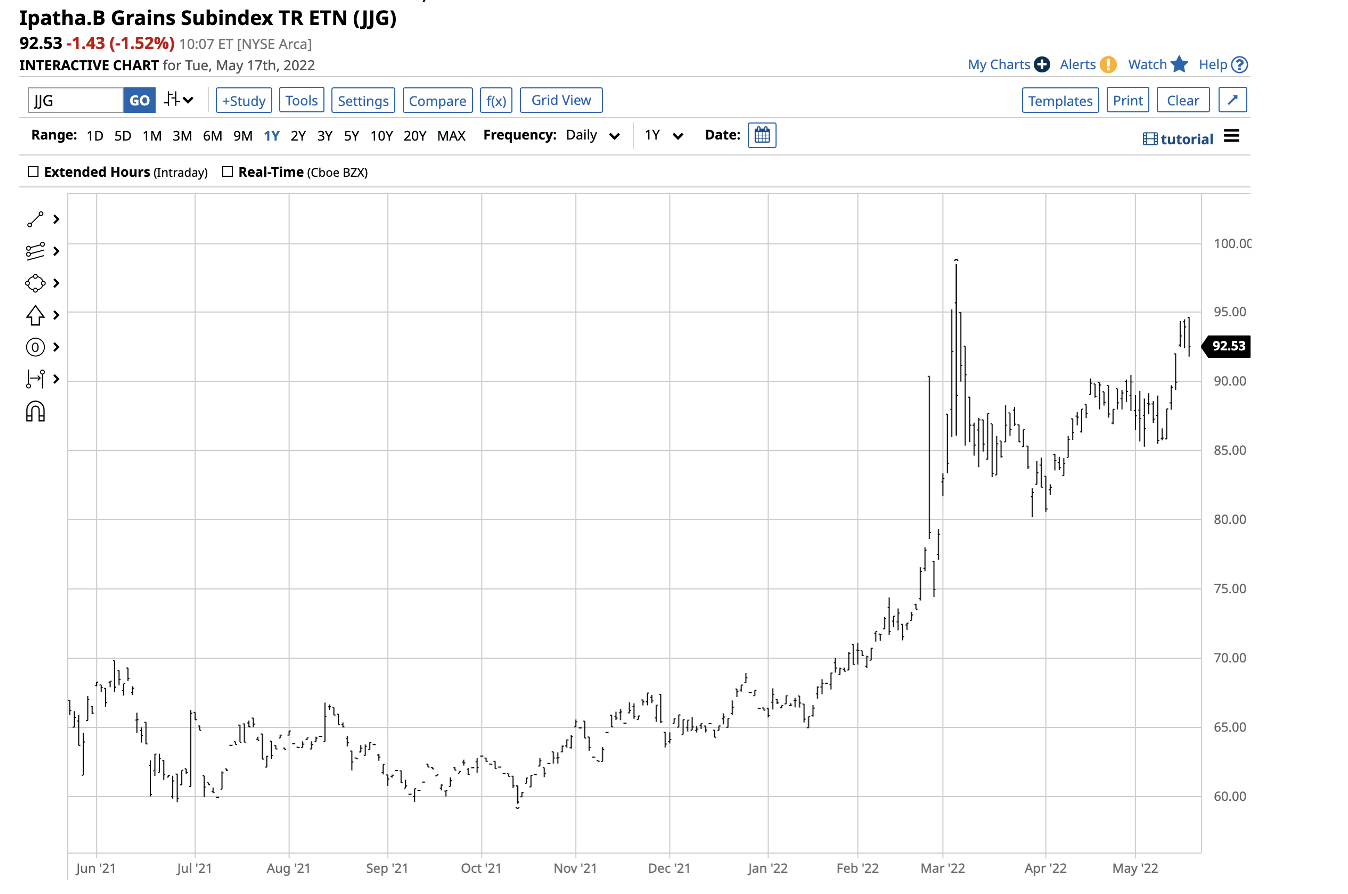

Grain and oilseed futures have pulled back from the recent highs, which could be the perfect opportunity to hop on board a very bullish trend with fundamental winds behind their sails. The iPath® Bloomberg Grains Subindex Total Return ETN (OTC:JJGTF)) moves higher and lower with grain and oilseed prices.

Growing Season In Northern Hemisphere Under Way

The seeds for the 2022 North American crops are now in the ground. On May 12, the U.S. Department of Agriculture released its May World Agricultural Supply and Demand Estimate report. The monthly WASDE is the gold standard for fundamental data on the commodities that feed the world.

I reached out to Sal Gilberte, the founder of the Teucrium family of grain and oilseed ETF products, including the Teucrium Corn Fund (NYSE:CORN), Teucrium Wheat (NYSE:WEAT) and Teucrium Soybean (NYSE:SOYB) ETFs.

Gilberte’s take on the latest WASDE report:

“The May WASDE is important because it gives the first official look at next year’s crop estimates. Attention to this year’s report is heightened due to the uncertainties injected into global grain markets by Russia’s invasion of Ukraine. That said, the USDA did the expected regarding Ukraine and issued estimates in line with what has generally been reported as official Ukraine estimates concerning their own farming sector.

“It looks like the USDA may have underestimated Russian wheat production and is still overestimating Brazilian soybean production for the current crop year. Most significant in this entire report, in terms of specific estimates, is the yield reduction for U.S. corn of nearly four bushels an acre below trend line; even with current weather issues it is probably too early to call for such a substantial reduction in yield, especially given the large number of estimated planted corn acres – any revisions in yields from this point forward will have major impacts to market expectations and price volatility.

“The report is overall supportive to the grain sector because it again confirms tightening global grain balance sheets relative to five- and 10-year historical norms, but we are in a seasonal time period when grain market prices often plateau, which could limit upside potential from here, barring substantial weather issues as the growing season progresses. Expect the elevated level of price volatility in grain markets to continue for the remainder of the year as weather and geopolitical events continue to unfold.”

Gilberte cautioned that the uncertainty over the weather and crop is peaking in May, and we could see price corrections. However, 2022 is far from an ordinary year for agricultural products, as inflation, supply-chain issues and the war in Europe have pushed prices to multi-year or all-time highs over the past weeks and months. The trends in the soybean, corn and wheat markets remain bullish. The full text of the May WASDE report is available via this link.

Soybean Prices At Highest Level In Years, Crush Spread Indicates Robust Demand

Soybeans are critical ingredients in many human foods and animal feeds. Aside from cooking oil, soybean oil is also required for biodiesel fuel production.

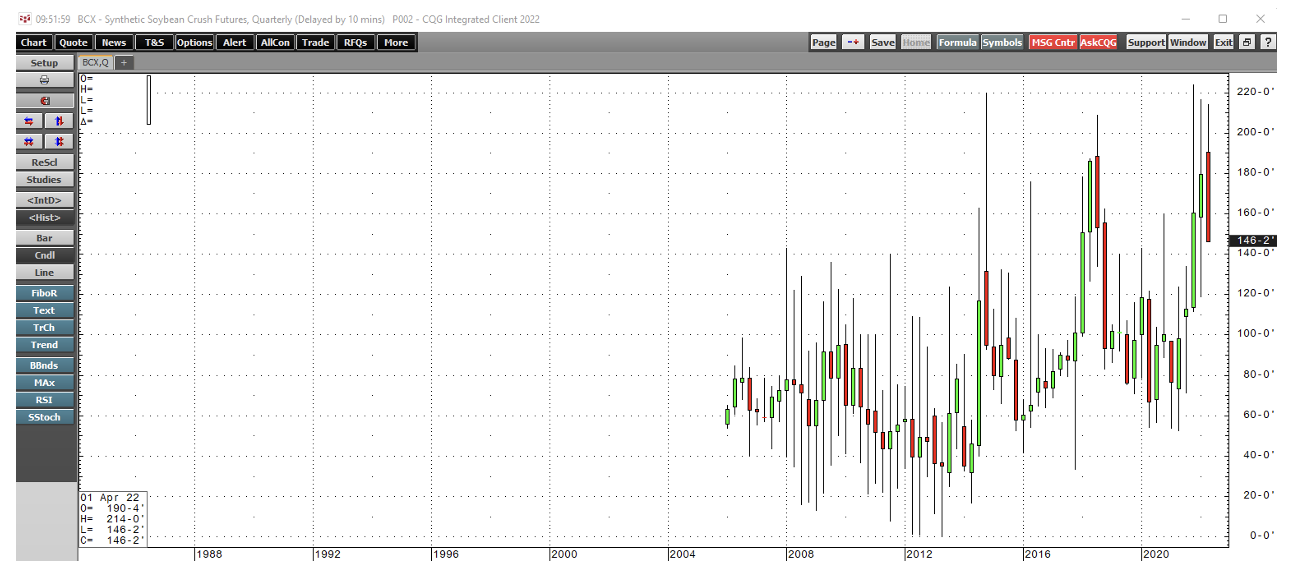

Source: Barchart

The chart highlights at $16.7200 per bushel on May 18, nearby July soybean futures are not far from the February 2022 high of $17.65 and the record peak of $17.9475 seen in 2012.

Processors crush raw soybeans into oil and meal. The crush spread reflects the economics of refining soybeans and is a real-time indicator of the demand for the products.

Source: CQG.

The quarterly chart of the soybean crush spread shows the long-term average is around 80 cents to $1 per bushel. At more than $1.46 on May 18, the processing margin reflects high prices and robust demand for soybean oil and meal, supporting the price of the raw oilseed. Soybean futures could trade at a new all-time high over the coming weeks and months. Any weather event that disrupts the growing season could push prices to $20 per bushel or higher.

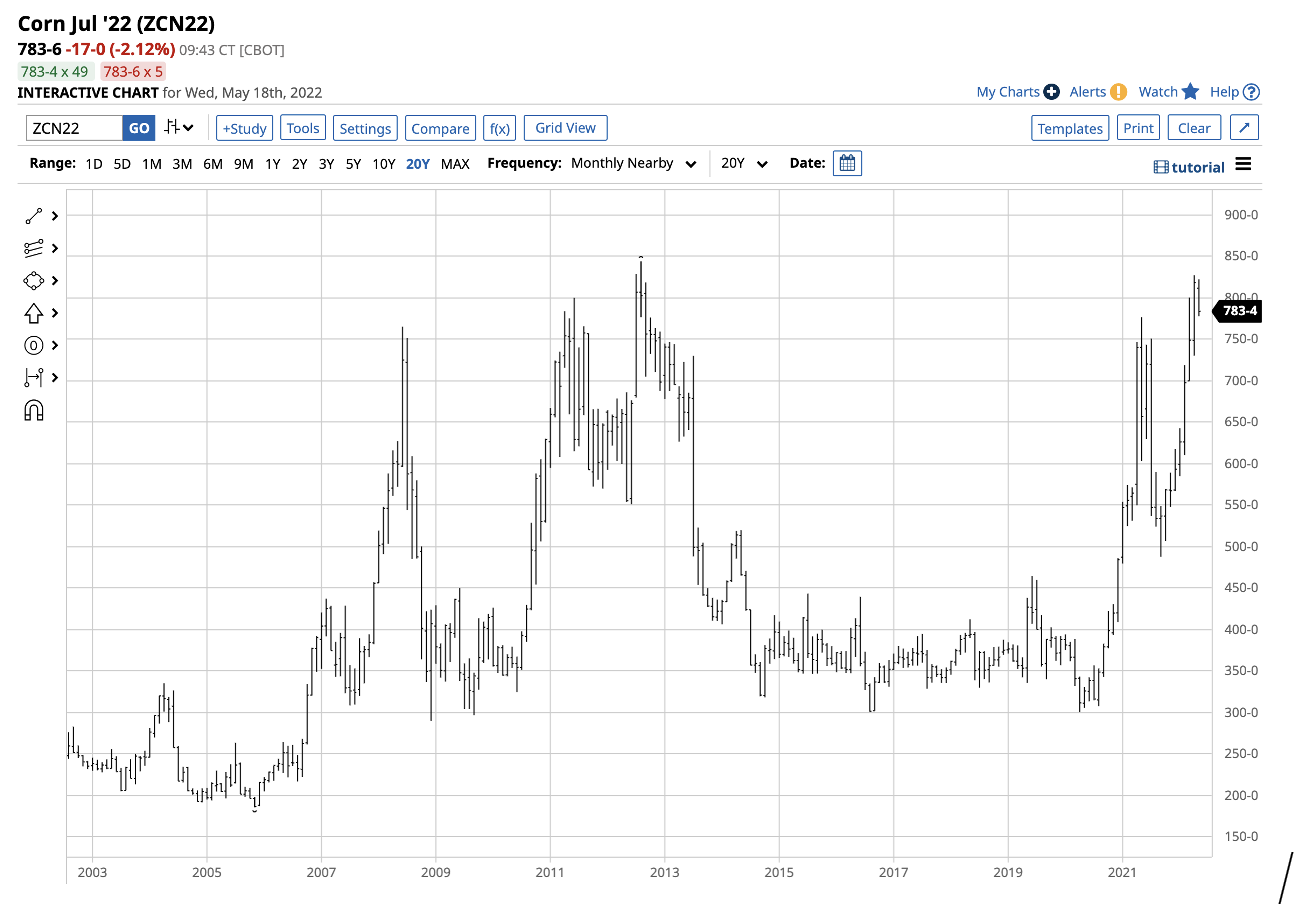

Corn Close To All-Time High

Corn is another agricultural commodity that provides nutrition and energy. In the U.S., the world’s leading producer and exporter of corn and soybeans, corn is the primary ingredient in ethanol, the biofuel that blends with gasoline to power most automobiles.

Source: Barchart

The chart highlights at $7.8375 per bushel on May 18, nearby July corn futures are not far from the April 2022 high of $8.27 and the 2012 record peak of $8.4375.

The ethanol price has increased with oil and gasoline prices since the April 2020 low.

Source: Barchart

The chart shows the move from 80.50 cents per gallon wholesale in April 2020 to a record $3.45 in November 2021. At $2.7950 per gallon on May 18, ethanol prices are closer to the high and support higher corn prices.

Corn is on a path toward a new record high above the $8.4375 level, and $10 per bushel corn is not out of the question in 2022 and the coming years.

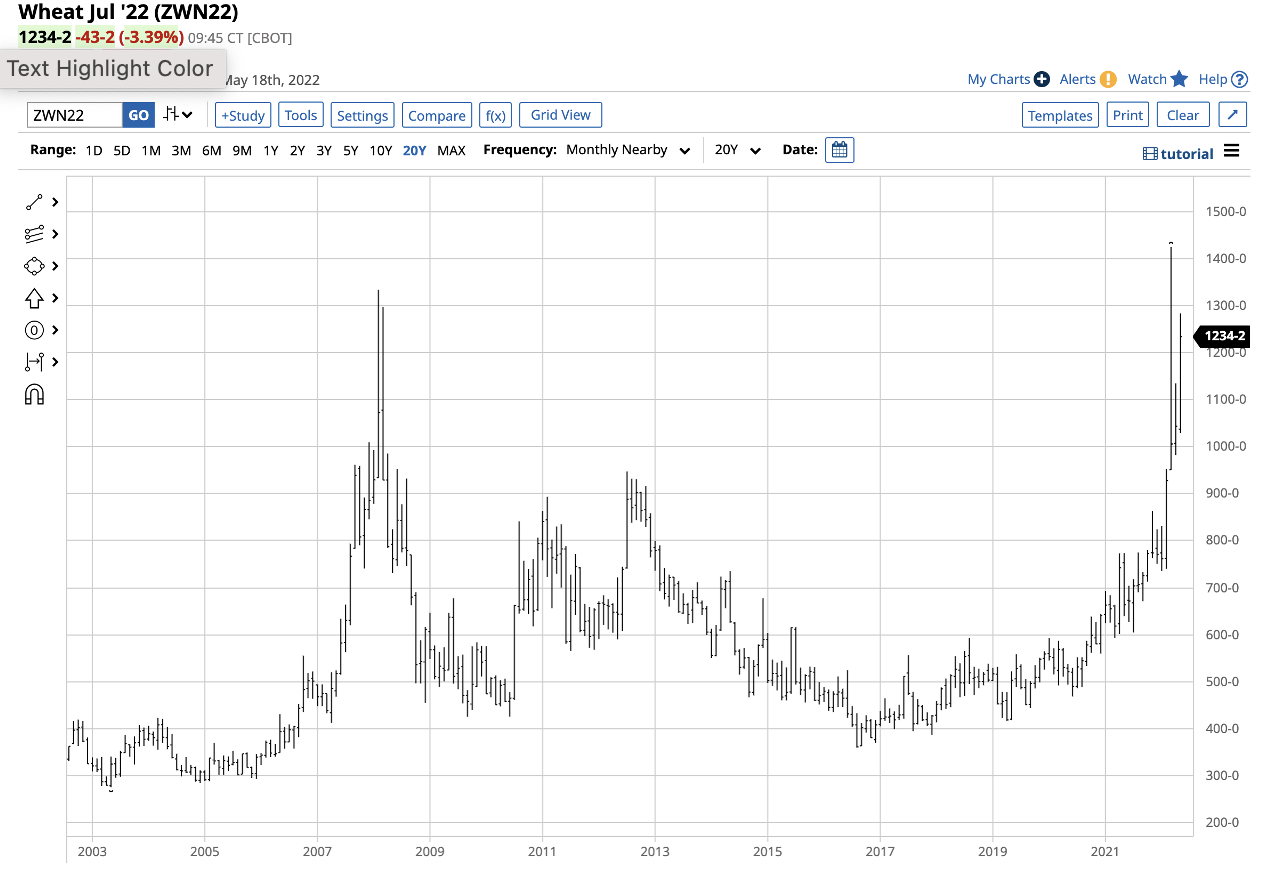

Wheat Experiencing Geopolitical Nightmare

Fundamental supply and demand factors and technical trends point to higher soybean and corn prices. However, wheat is another story, as Russia and Ukraine are Europe’s breadbasket, supplying one-third of the world’s annual wheat supplies.

Recently, India banned wheat exports because of its heatwave and its support for Russia. India is a leading wheat-producing country. Wheat prices exploded higher from an already elevated level after the export ban.

Source: Barchart

The chart of CBOT Soft Red Winter wheat futures, the grain’s global benchmark, shows the rise to a record $14.25 per bushel high in March 2022, just after Russia’s invasion of Ukraine. The price moved above the previous all-time high of $13.3450 set in 2008. July CBOT wheat futures were trading at the $12.3425-per-bushel level on May 18, with the potential of much higher prices over the coming weeks and months as Ukraine’s fertile breadbasket is a mine and battlefield. Moreover, the critical logistical hub at the Black Sea ports is a war zone, making exporting wheat challenging in 2022.

Wheat is also a political tool for Russia regarding exports to countries that support Ukraine in the war. Wheat futures remain explosive at the $12.3425-per-bushel level.

Buying Dips Via JJG ETN

While the weather is always critical for annual supplies, 2022 is no ordinary year in the soybean, corn and wheat markets. Rising inflation has caused farmers’ input costs to soar, and Russian dominance in the worldwide fertilizer market threatens crucial supplies. Moreover, the war in Europe’s breadbasket could cause shortages and famine over the coming months and years. The path of least resistance of grain and oilseed prices remains higher, and the potential for explosive upside spikes is a clear and present danger in the current geopolitical environment. India’s heatwave only exacerbates the supply issues.

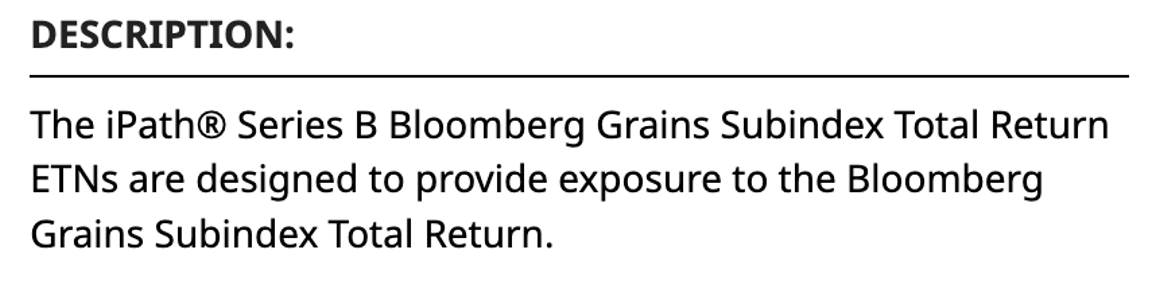

The fund summary for the iPath® Bloomberg Grains Subindex Total Return ETN (OTC:JJGTF) states:

Source: Barchart

At $92.53 per share, JJG had $67.94 million in assets under management. The ETN trades an average of 10,054 shares each day and charges a 0.45% management fee.

Source: Barchart

The JJG ETN closed at $66.25 on Dec. 31. At the $92.53-per-share level on May 18, JJG is 39.7% higher in 2022, with more gains could be on the horizon.

Grain and oilseed prices have experienced a nearly perfect bullish storm in 2022, and the bullish trend looks set to continue to push prices higher.

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »