If you’ve attended a barbeque, dinner party, or even a workplace watercooler in recent times, it's likely you’ve had or heard conversations about interest rates. How high rates are right now, how low a rate a mate managed to find, and what rates might do next have all been major talking points since the Reserve Bank of Australia (RBA) began its hiking spree in May 2022.

Since then, rising mortgage interest rates have placed many Australian homeowners under financial strain. But what about those who owe money on a car loan, or are considering taking out finance for a new set of wheels?

Have car loan interest rates increased at a similar rate as home loans? And if not, why not?

Let’s dive into the relationship between the RBA cash rate and car loan interest rates, beginning with the basics.

Why does the RBA cash rate impact interest rates?

Prior to 2022, you’d be forgiven for not having heard of the RBA cash rate. It's the central bank’s only tool against inflation, which had arguably been too low in the years leading up to 2022. Low inflation led the cash rate on a generally downwards trajectory in the decade to 2020, reaching a record low 0.1% that year.

But how does the cash rate influence inflation and interest rates? Well, the cash rate determines, among other things, how much banks have to pay to borrow the money they provide to consumers through the likes of home loans and car loans. Thus, when the cash rate is high, banks have to pay more to upkeep their business, and they tend to charge borrowers more, in the form of higher interest rates, to cover their higher costs.

The RBA aims to keep inflation in the realms of 2% to 3% on an annual basis. However, on the back of the pandemic and record household savings, inflation took off in 2021 and 2022, forcing the RBA to increase the cash rate 13 times to 4.35% by November 2023.

And while home loan interest rates have been widely reported and discussed in the months and years since, those on car loans appear to have been largely left out of the conversation.

Have car loan interest rates increased since the RBA’s first hike?

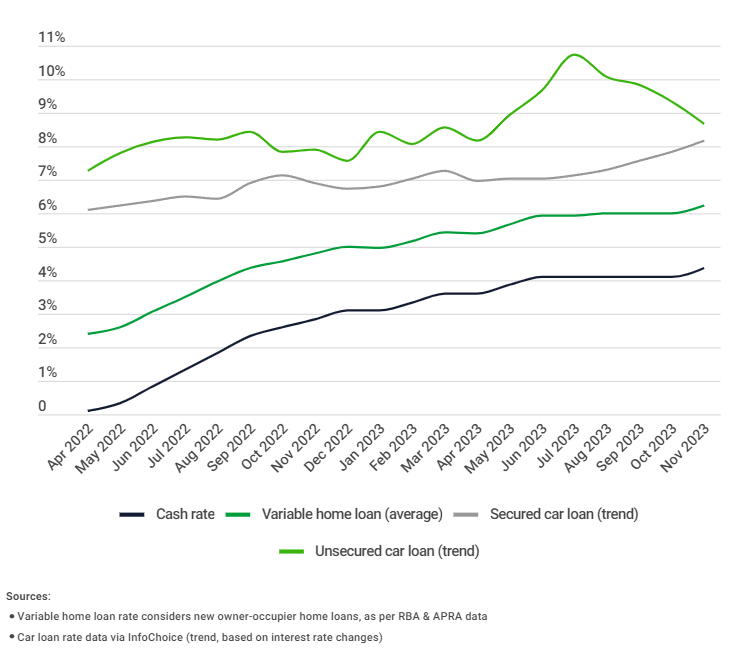

Take a look at the chart below, depicting both the cash rate and movement in interest rates on new loans from April 2022 to November 2023.

As the chart shows, though it might be hard to notice, the increase in interest rates on new home loans have far outpaced those of car loans.

The typical interest rate on a new owner-occupier, variable rate home loan rose 158% between April 2022 (one month prior to the RBA’s first hike) and November 2023, reaching 6.23% p.a.

On the other hand, new fixed rates on a secured car loan jumped 33% to 8.15% p.a., according to InfoChoice data adjusted to identify trend. For a new unsecured car loan, it climbed 19% to 8.67% p.a.

But there might be more to it than meets the eye. Particularly, as lenders tend to vary car loan rates greatly from their lowest advertised rate – more on that below.

A quick guide: Secured vs unsecured car loans

Before we go further, it's important to note the difference between secured and unsecured car loans, and why they generally offer different interest rates.

A secured car loan is one that has collateral attached. This collateral is generally the car itself. It means that, if a borrower defaults on their loan, their lender can take the collateral in order to recoup its losses.

On the other hand, if a borrower defaults on an unsecured car loan, their lender may have to cop the loss. Though, the default would be reflected on the borrower’s credit history and, in some cases, their lender might take them to court over the debt.

Some of the market’s best car loan interest rates revealed

In the market for a new car? The table below features car loans with some of the lowest interest rates on the market.

"How have RBA cash rate rises affected car loan rates?" was originally published on Savings.com.au and was republished with permission.