Calling tops and bottoms in the stock market is the Holy Grail for investing analytics. Alas, success on this front is nearly impossible, at least in terms of timely precision. Yet some of us still venture down this path.

Why? Developing perspective helps, even if it’s less than perfect perspective and it’s used judiciously and the caveats are recognized.

The main caveat is summed up in the warning that the market can stay irrational for longer than you can remain liquid. History, after all, is replete with examples of markets that appeared “over-valued” and continued to set new highs, sometimes for years.

Why, then, make the effort to evaluate market conditions in search of clues about future returns?

One reason, and one that I find compelling: tracking what appears to be the market cycle is a useful reminder that risk is non-stationary. Another aspect of engaging in this type of analysis is that it forces you to consider your risk tolerance and decisions related to your investment choices, asset allocation, etc.

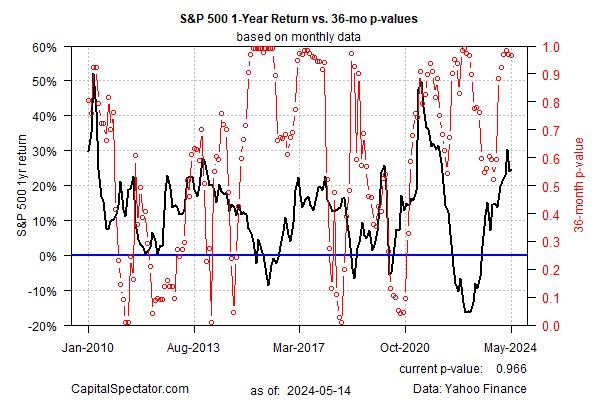

With that in mind, let’s check in on an effort to quantify so-called bubble risk for the S&P 500 (for details, see this post). There are many ways to approach this task and the chart below is but one flavor. The current reading suggests the S&P 500 is overextended.

In fact, that was also the message in early March, when I ran the same analytics. How did that signaling fare? Results are mixed, at best. The following month the market corrected sharply, but has since resumed an upward run and is now close to reaching a new high.

The frothy picture noted in the chart above finds corroboration in other metrics, such as the CAPE ratio. The question is what, if anything, investors should do in light of the general view that the market seems to be fully valued, if not overvalued?

One answer is to pair longer-term valuation estimates with shorter-term trend profiles. Each is valuable for different reasons for different time horizons. It’s not unusual that one contradicts the other, which applies to current conditions. Indeed, as the chart below indicates, the S&P 500 trend remains bullish. After a brief correction last month, animal spirits have rebounded.

The value of monitoring valuation/bubble risk and trend is that when the two are in agreement, the related risk analysis is arguably more persuasive. On that assumption, which is backed up by the historical record to a degree, the current state of market conditions leave room for debate about the near-term outlook.

When trend deteriorates, at a time when value/bubble risk appears elevated, that would be a much stronger case in favor of risk-off. But for the moment, we’re not there yet, and no one knows the timing of when that will change.

From a calculated risk perspective, the bulls still have an edge. The longer-run analytics suggest the margin for error is fading, but trend analytics suggest this isn’t yet an acute headwind.