Federal Reserve Chairman Jerome Powell on Friday spoke the words that investors have longed to hear: the rate-hiking cycle is ending. Except that maybe it isn’t.

Speaking at a conference last week, he explained that the credit crunch of late was doing some of the heavy lifting with taming inflation.

“The financial stability tools helped to calm conditions in the banking sector,” Powell noted. “Developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring and inflation.”

The bottom line:

“Our policy rate may not need to rise as much as it would have otherwise to achieve our goals. Of course, the extent of that is highly uncertain.”

Powell’s comments, for some observers, strengthened the view that the Fed is set to pause its rate hikes at the next policy meeting on June 14. The Fed funds futures market this morning is pricing in a moderately high 77% probability that the central bank will leave its target rate unchanged at a 5.0%-to-5.25% range. If correct, the pause will mark the first time that rates remained steady since the Fed began hiking in March 2022.

But don’t break out the risk-on celebrations just yet. Even if the forecast is accurate, it’s not clear that the current Fed funds rate will be the top for the cycle, advises Minneapolis Fed President Neel Kashkari.

If rates are left unchanged next month, “that does not mean we’re done with our tightening cycle. It means to me we’re getting more information,” he told CNBC on Monday.

St. Louis Fed President James Bullard didn’t help the doves’ case when he recommended yesterday that two more rate hikes are needed this year.

“I think we’re going to have to grind higher with the policy rate in order to put enough downward pressure on inflation,” he said yesterday. “I’m thinking two more moves this year, not exactly sure where those would be. But I’ve often advocated sooner rather than later.”

Forecasts are always dicey affairs and in the current environment, even for Fed heads. All the more so since there’s no shortage of reasons to remain humble about deciding what comes next. Debt-ceiling risk is one reason to stay cautious on divining the future. Although President Biden and House Speaker McCarthy had a “productive” meeting yesterday, there’s still no deal and analysts remind that the two sides remain far apart on policy.

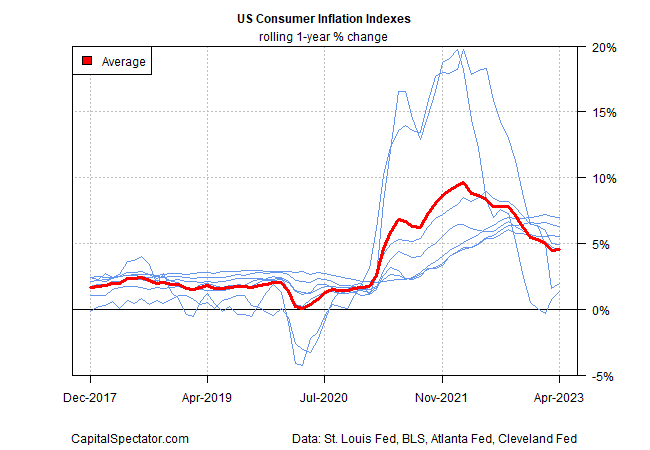

The case for pausing isn’t a slam dunk yet based on the slowing pace of inflation’s descent of late. As reported earlier this month in The US Inflation Trend Chartbook, the average one-year change for various measures of consumer prices was flat/fractionally higher in April at 4.5%. The steady pace marks the first time since last August that the year-over-year pace didn’t slide. It’s unclear if this is noise or a new phase of inflation remaining higher for longer than expected.

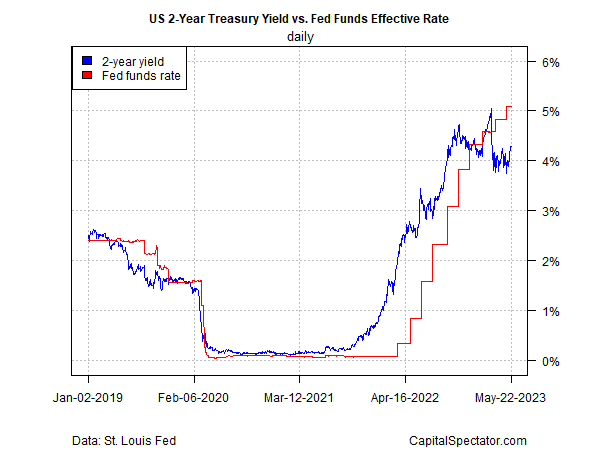

Nonetheless, the 2-year US Treasury yield is pricing in a pause and rate cuts. This policy-sensitive maturity is currently 4.29% (May 22), nearly a full percentage point below the current Fed funds target rate. The gap implies that the bond market estimates a high probability that the central bank will soon cut rates.

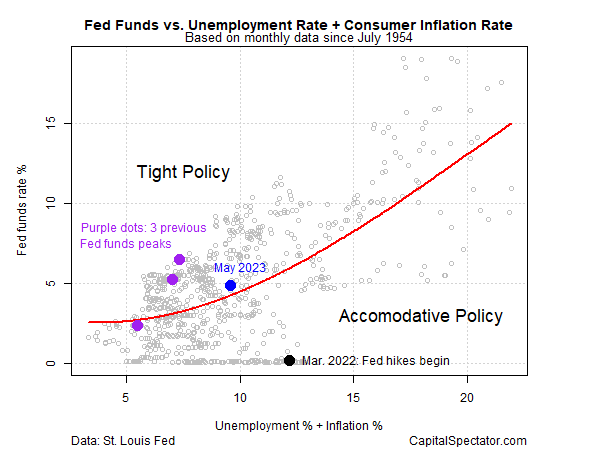

A simple model that uses inflation and unemployment to estimate a “fair value” for Fed funds indicates that a modestly tight policy prevails.

Is the current policy stance sufficient to keep inflation falling at a pace that satisfies the Fed?

Yes, predicts Mark Zandi, Moody’s chief economist.

“The banking system is still under a lot of stress, the economy is slowing, recession risks are high. If you add it all up, I don’t think there’s any need for a rate increase. Not now,” he told CNBC on Friday. “I feel very confident that inflation is going to be closer to 3% by the end of the year, and close to the Fed’s target by this time next year.”