DXY is still consolidating:

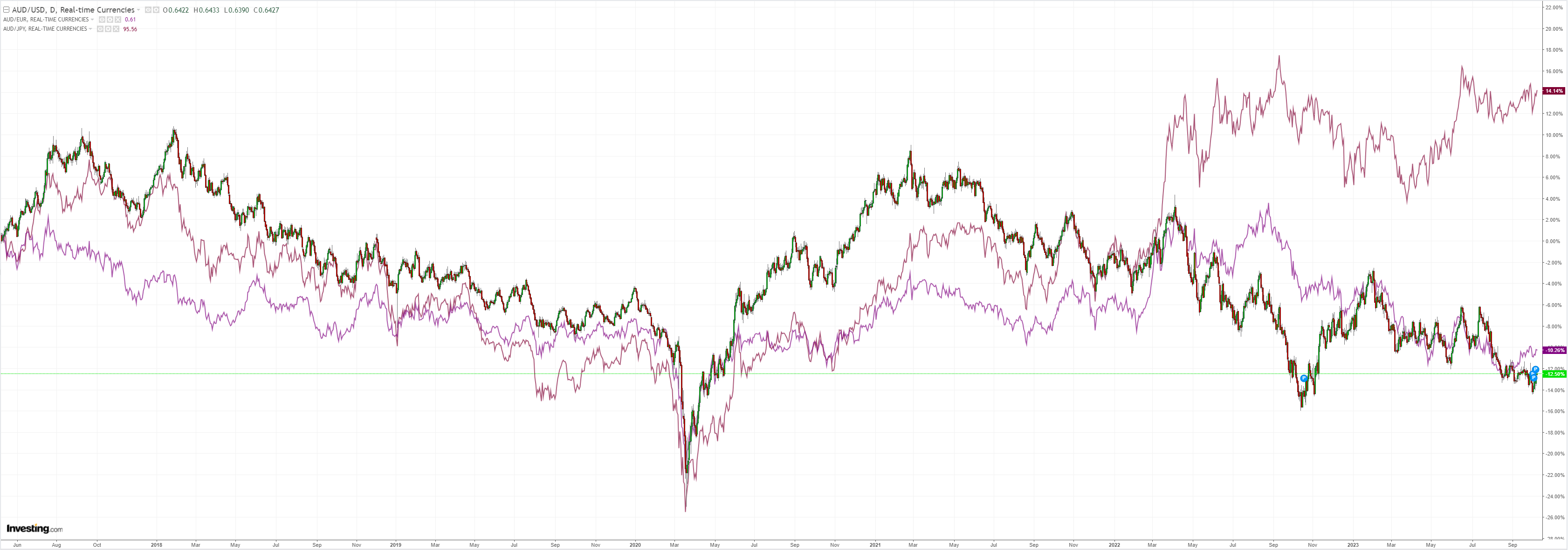

AUD bouncing:

CNY is finished:

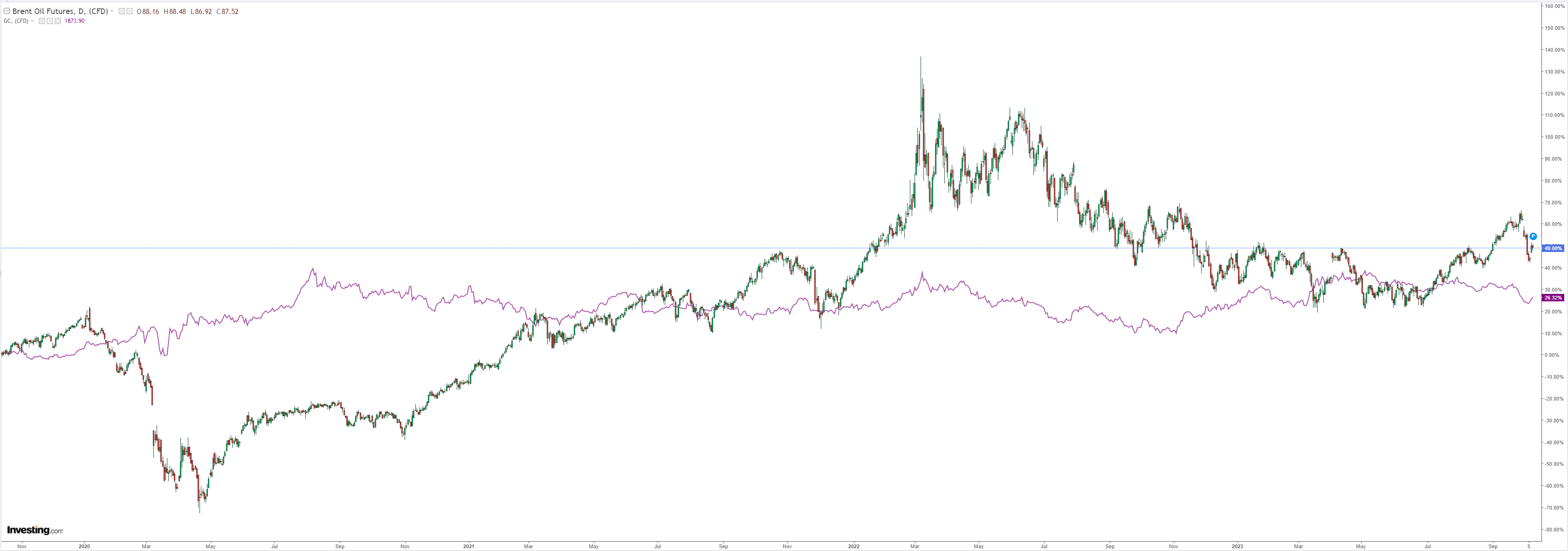

Oil and gold marking time:

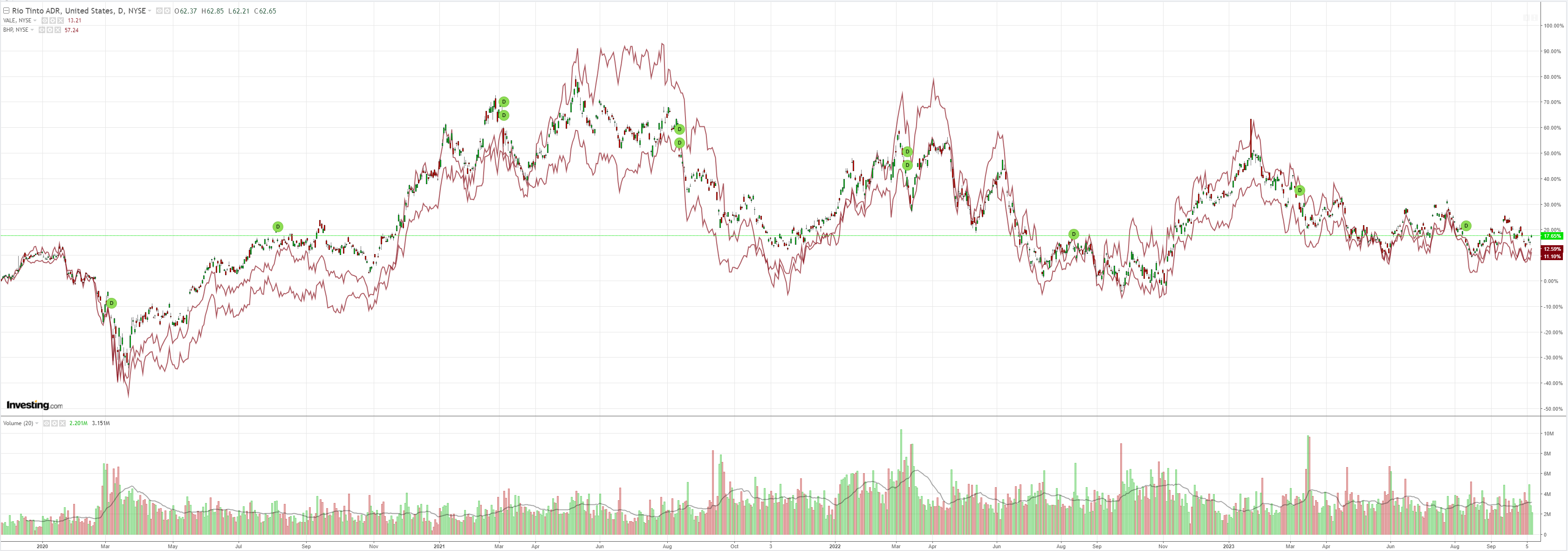

Dirt fell:

Miners popped:

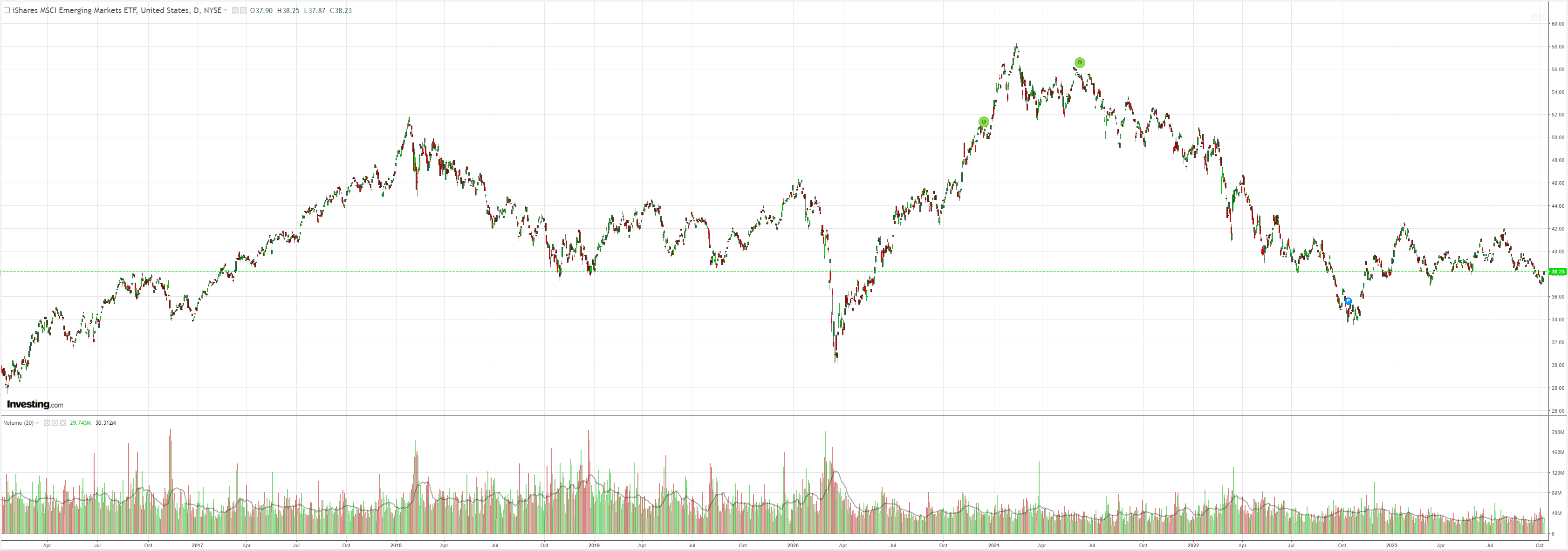

With EM:

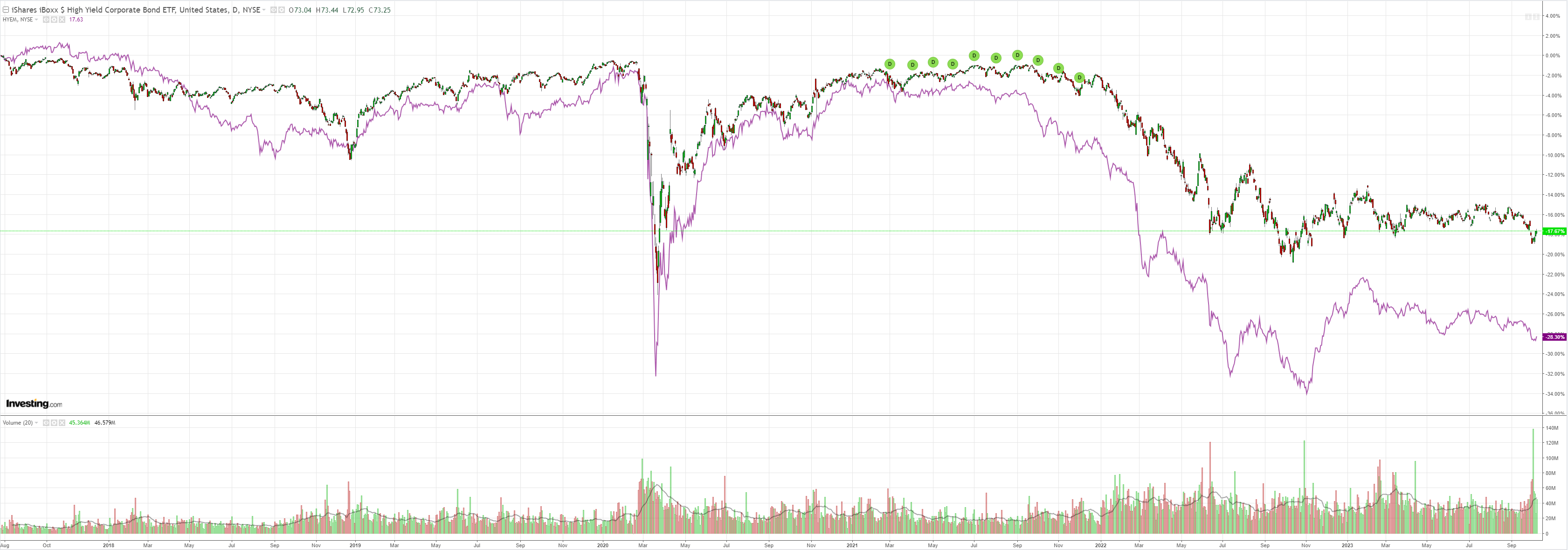

And junk:

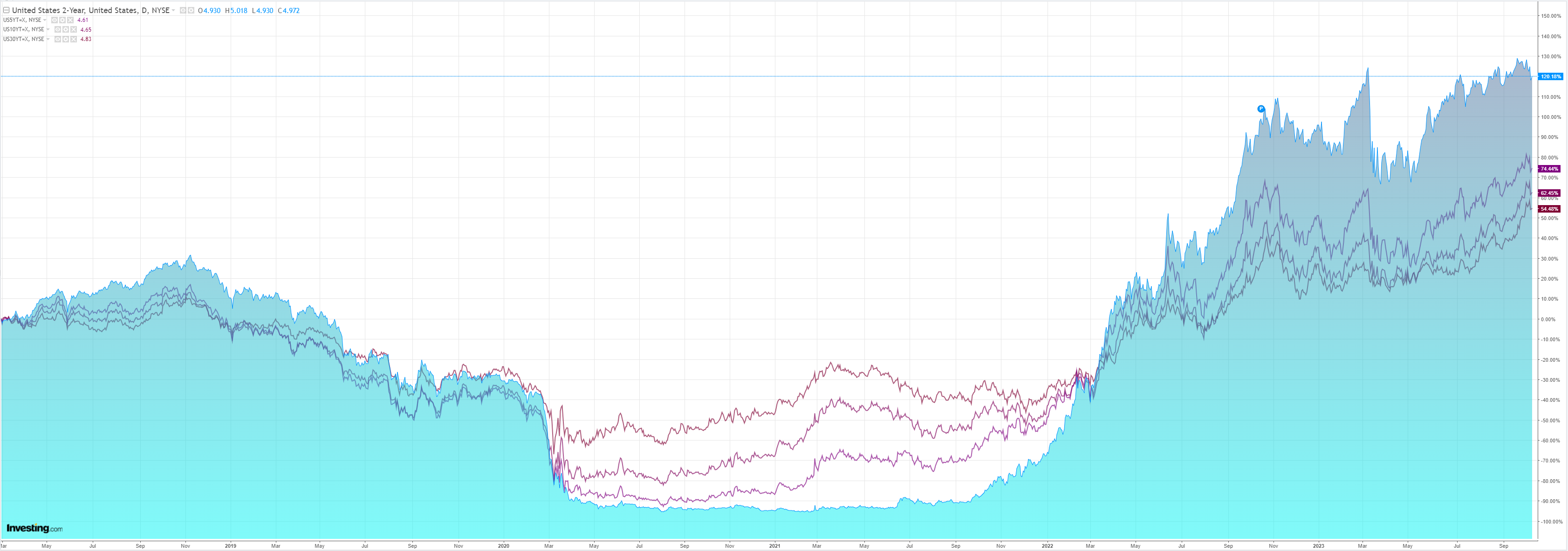

Yields firmed:

Stocks marched higher:

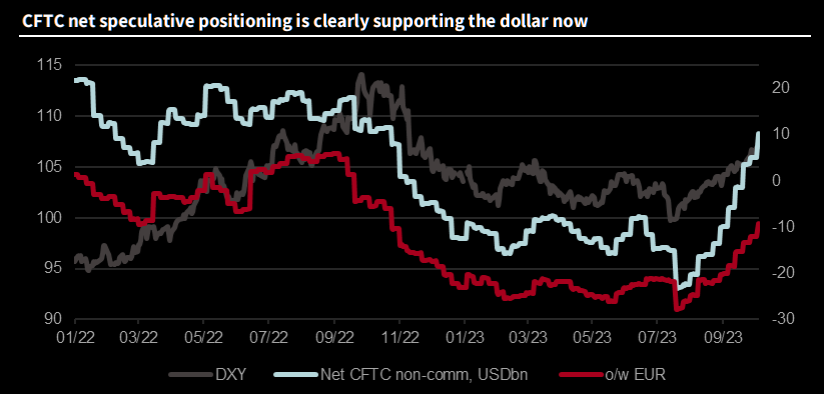

Once again, positioning has taken priority over fundamentals. DXY is overbought. Treasuries and stocks oversold. Now we see the snapback.

Has the global economy deflated enough for rates to peak and deliver soft landing? The war is offering new hope of such as it bids safe-haven Treasuries.

But, before long, stocks will again deliver their own economic recovery via the wealth effect. Oil remains wild and at high risk of going higher as it works off its overbought state.

We get US inflation tomorrow so that will determine the immediate course of markets. My guess is it will rebound but market will probably look through as they work off the extremes.

I am still bearish. Europe’s recession is interminable. China’s failing economy is mulling more stimulus, but that is throwing money into a bottomless pit. The US yield shock is either enough for recession or it will repeat.

Societe General has more.

The Fed’s ‘high for longer’ message and continued economic outperformance will support the dollar, despite a dysfunctional political system, until either the US economy slows or the rest of us pull our socks up. Market positioning is no longer going to provide a headwind for the euro or sterling, and sentiment regarding the economic outlook is already dire, but that may just make it hard to break EUR/USD parity. The yen is hostage to US yields (and BOJ inaction), AUD and NZD are hostage to Chinese market sentiment as the economy settles into slower growth (but not crisis), but the peak in ECB rates (and Riksbank and Norges bank policies) can support the Scandinavian currencies. CAD is helped by decent data, higher oil prices and a bearish mood.

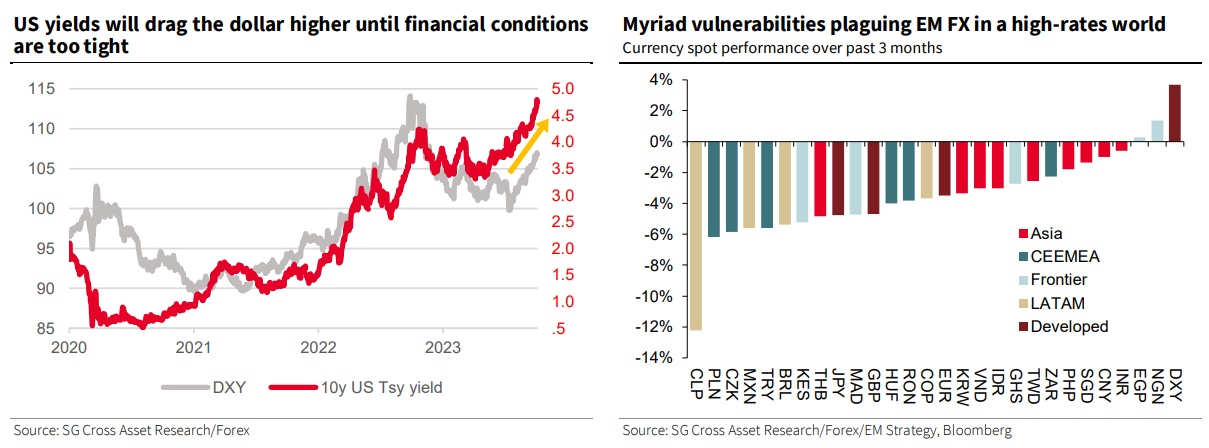

The Treasury market still sets the pace (and direction). As central banks move from raising rates to seeking as many ways as possible to say ‘higher for longer’, growth expectations have more room to adjust than policy expectations. And as long as US economic data continue to outshine those in Europe (and elsewhere) the dollar will remain strong. It is likely to be weaker next year but picking peaks is a fool’s game in a market renowned for overshoots.

Emerging markets: Where are EM FX vulnerabilities to US rates and oil prices? In the context of the new war unfolding in the Middle East, how will EM FX perform if US rates continue to climb? We believe that in addition to 1). the recent relationship between currency performance and US Treasuries and 2). the currency beta to DXY, some of the most important factors to consider impacting future currency performance include: 3). the tightness of the current monetary policy stance, 4). market expectations for the future shift in monetary policy stance, 5). central banks’ appetite for FX interventions, 6). potential for profit-taking, and 7). the relationship between currencies and oil prices.

The AUD is still being protected by its immense short. But that should get worked off somewhat in this great market consolidation as well.

The base case is still another leg lower.