Originally published by guppytraders.com

The Hang Seng has broken two significant support features. This suggests a continuation of the downtrend with a downside target near 25,200. The Hang Seng has the appearance of a head and shoulders pattern, but this pattern is not valid. The right shoulder of the pattern is created by just two days of activity. The reversal is too small and too brief to be considered as a left shoulder development.

The first significant support feature to be broken is the historical support resistance level near 28,000. This is the upper edge of a trading band projection. The lower edge of this trading and is the current downside target level.

The price fall below 28,000 was not a clear fall. There was consolidation around this level,. And the potential for a rally rebound to develop. However the fall below the second support feature has confirmed this downtrend.

The second support feature is the uptrend line that is projected from the anchor points in 2016 February, and July and again in December. This is a long projection of this trend line, but this can at times provide a future support level.

The current move is a fall below this line, followed by a small rebound and retest of this line as a resistance level. The second retreat from this line confirms the continuation of the downtrend.

It is significant that the value of the trend line matches the value of the support level and this increases the significance of the fall below these two features.

The downside target is set using the width of the trading bands. The 25,200 level has acted as a strong resistance level in 2014, 2015 and in 2017. Traders will watch for consolidation to develop near the 25,200 level.

We use the ANTSYSS trade method to extract good returns from the potentially fast fall as the retreat develops. Traders will cover shorts near 25,200. A move above resistance near 28,00 shows consolidation near this level, but it is not a signal for a new rally uptrend.

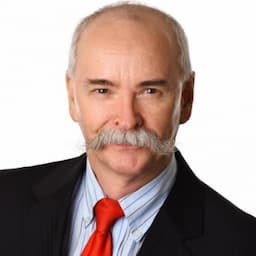

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational