- U.S. dollar strength and geopolitical tensions are causing fluctuations in the gold market.

- Gold demand has reached historic highs, driven by increased bullion demand and ETF inflows.

- Gold prices are above $2,600 per ounce, with further gains possible if resistance levels are broken.

- Get ready for massive savings on InvestingPro this Black Friday! Access premium market data and supercharge your research at a discount. Don't miss out - click here to save 55%!

The US dollar's strength, bolstered by the results of the U.S. presidential election, has recently affected the gold market, triggering a dynamic correction.

The primary factor behind this trend is that the market, while still expecting another 25 basis point cut by the Fed in December, now anticipates a reduction in the scale of easing next year due to President-elect Trump's policies.

Despite this longer-term outlook, the yellow metal has rebounded in recent days on the back of increasing geopolitical uncertainty. Over the weekend, reports emerged that the U.S. administration agreed to let Ukraine use U.S. long-range missiles against targets in Russia. This clearly escalatory move has driven investors back to so-called safe havens, as evidenced by a noticeable rebound in gold prices.

Let's take a look at the perspectives for the metal now.

Q3 Sees High Global Demand for Gold

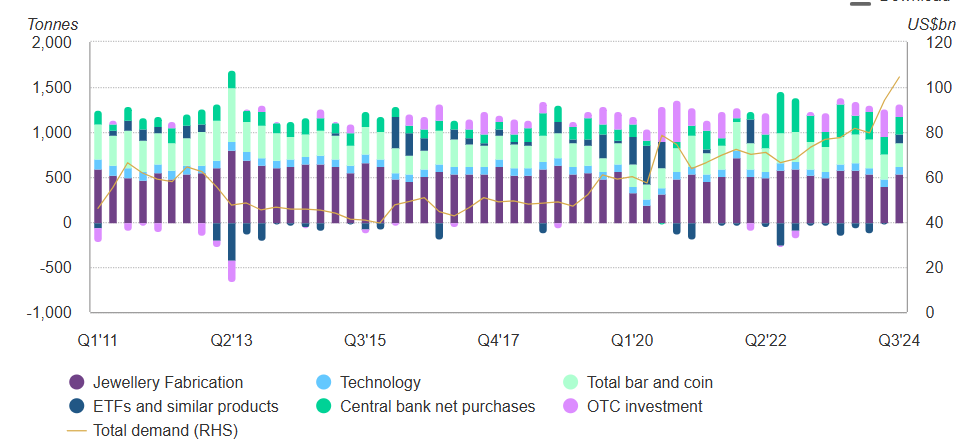

According to the World Gold Council, demand for bullion in the third quarter of this year rose by 5% year-over-year, translating to 1,313 tons. In nominal terms, there was a 35% year-over-year increase, crossing the $100 billion mark for the first time in history, primarily due to the rising prices of this royal metal.

Figure 1: Gold demand structure. Source: World Gold Council

Flows into ETF-type funds are also progressing positively from a demand standpoint. In October, we observed a continuation of the positive trend, with inflows amounting to $4.3 billion in the previous month. This influx has pushed the level of funds under management to a new historical high of $286 billion. Currently, there are no signs indicating a slowdown in this trend, which may continue to be supported by major central banks.

When analyzing the gold market, it is impossible to ignore geopolitical events. In recent years, we have seen numerous instances where the escalation or de-escalation of tensions in particular regions has influenced gold prices.

Key examples include the ongoing conflicts in Ukraine and the Middle East, which continue to capture investor attention. Recently, Ukraine made headlines again after the U.S. administration agreed to allow the use of their long-range missiles against targets within Russia. Investors reacted as expected, leading to a corresponding rebound in gold prices. In the coming days, the focus will be on Russia's response, with any further escalation likely to bolster demand.

Technical View: Gold prices have surged back above the $2,600 per ounce mark

Following a strong rebound, gold is returning to an upward trajectory after successfully defending the support area around $2,550 per ounce. If buyers can overcome and surpass the two local resistance levels, capped at $2,700 per ounce, the demand side will have a clear path to target new historical highs.

Figure 2 Technical analysis of gold

Conversely, a signal for an extended downward movement would be a drop below the upward trend line and support at $2,500. This could pave the way for the largest correction in recent years. However, given the current conditions, such a scenario is considered less likely.

Be sure to subscribe to InvestingPro now for up to 55% off as part of our Early Bird Black Friday sale!

***

Disclaimer: This article is for informational purposes only. It is not intended as a solicitation, offer, advice, or recommendation to purchase any asset. All investments should be evaluated from multiple perspectives, and it is important to remember that any investment decision and the associated risks are the sole responsibility of the investor. Additionally, no investment advisory services are provided.