The 2023 holiday season is officially upon us, and already, records are being shattered. Black Friday deal-hunters in the U.S. shelled out $9.8 billion online, a 7.5% over last year, according to Adobe (NASDAQ:ADBE) Analytics. Consumers may have spent an additional $10 billion over the weekend and could spend a massive $12 billion on Cyber Monday, which would also be a new record, Adobe says.

Indeed, this year appears to be one of contractions. I see a resilient consumer, with U.S. retail sales well above the five-year average, but I also see a looming sense of economic uncertainty. According to a recent Bankrate survey, around half of American adults say they’re worse off economically today than when President Joe Biden took office, with nearly 70% citing an increase in the cost of living.

The 2023 narrative, then, isn’t just about holiday cheer and shopping sprees. It’s about how consumers are hedging their bets against economic unpredictability, turning to real assets like gold, Silver and Bitcoin as stores of value.

Consumer Spending and Retail Realities

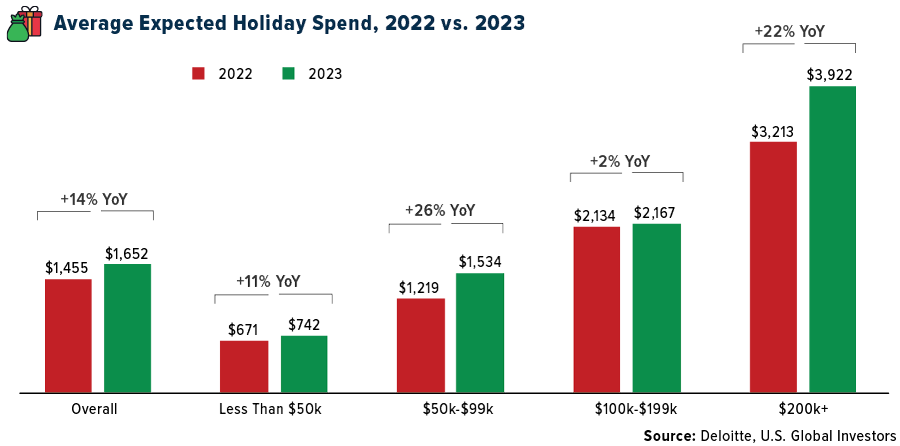

First, let’s examine the outlook for holiday spending. According to Deloitte’s Holiday Retail Survey, consumers are poised to spend an average of $1,652 this holiday season, a 14% increase compared to last year. Those making $200,000 or more plan to spend almost $4,000, up from an average of around $3,200 last year. These figures eclipse pre-pandemic spending levels, suggesting a return to normalcy.

But this is only one side of the coin. A closer look reveals a more nuanced story. While 95% of consumers plan to purchase during the holiday season, there’s a marked shift in priorities. Non-gift purchases, such as holiday decorations, are also on the rise, and self-gifting is becoming increasingly popular, with 75% of consumers expected to buy gifts for themselves.

Not all retailers are brimming with confidence. A Reuters report highlights a mixed bag of expectations among U.S. retailers, with major players in apparel, electronics, and home improvement sectors bracing for a challenging season. Sales in recent quarters have been tepid, and forecasts for the year have been revised downwards.

The dichotomy between consumer spending and retail sentiment underscores the complexity of this year’s holiday shopping landscape, in which gold, silver, and Bitcoin have emerged as stars.

Gold and Silver’s Dominance

Gold prices have been on an upward trajectory, surpassing $2,018 an ounce in early Monday trading. This rise is attributed to a weaker dollar and a Federal Reserve that appears hesitant to continue its aggressive rate hikes. The U.S. Dollar Index, a measure of the greenback’s value against a basket of other major currencies, has seen a notable decline, cooling over 3% since early October. Geopolitical tensions in the Middle East are also contributing to gold’s rising value.

Further, the World Gold Council (WGC) reports a robust demand for the yellow metal, particularly from central banks, which purchased a record-breaking 800 tons in the first nine months of the year, representing a significant portion of the total demand.

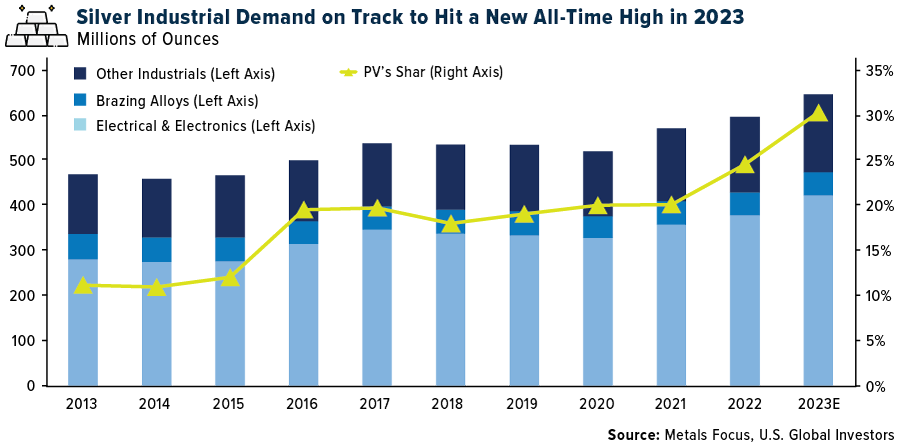

Silver, often in gold’s shadow, is carving out its own niche. According to Metals Focus’s weekly update, industrial demand for the white metal is expected to hit an all-time high this year. Despite economic headwinds, demand in sectors like photovoltaics (PV) remains robust. This strong industrial offtake keeps silver’s demand at historically high levels, even as the market remains in a deficit.

Bitcoin at a 52-Week High

Bitcoin, gold’s digital cousin, has not been left behind. CNBC reports a significant rally in the world’s leading cryptocurrency, reaching highs not seen since May 2022. Bitcoin’s resurgence, climbing above the $38,000 mark on Friday, signals a growing investor appetite for alternative assets.

This shift is partly attributed to the resolution of legal issues in major crypto exchanges, not to mention the imminent approval of a U.S.-based spot Bitcoin ETF, hinting at a maturing market that is increasingly being viewed as a legitimate investment option.

Cautious Optimism in Holiday Spending

What does this preference for real assets tell us? Simply put, it’s a barometer of economic sentiment. The rise in gold, silver, and Bitcoin prices isn’t just a market trend, but a reflection of investors’ search for financial safe havens this holiday season. In a world rattled by inflation fears, interest rate hikes, and geopolitical uncertainties, these assets offer a semblance of stability.

As we dive into the 2023 holiday season, the narrative, I believe, is one of cautious optimism. Consumers, while ready to spend, appear also to be seeking refuge in real assets. This year’s holiday shopping, then, isn’t just about finding the perfect gift. It’s about balancing the joy of the season with the prudence of financial preparedness.

In the end, the 2023 holiday season will likely be remembered as a time when consumers celebrated with an eye on the future, investing in assets that offer not just physical but also economic reassurance.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate for every investor.

The U.S. Dollar Index indicates the general international value of the USD by averaging the exchange rates between the USD and major world currencies.