Gold prices just higher ahead of Fed decision; silver near record highs

- Gold faced volatility last week but returned to Friday's lows amid a recovering US dollar and slightly higher bond yields

- Conflicting signals from Friday's job data and ISM report created uncertainty, potentially keeping gold in a holding pattern

- Despite that, the long-term outlook is bullish as central banks plan rate cuts in 2024, driven by global inflation, supporting gold's value

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Following the NFP-inspired volatility, gold returned near Friday's lows by early European trade, as the US dollar index recovered somewhat against the majority of G10 currencies and bond yields pushed a little higher.

The conflicting signals from the jobs data and the ISM services PMI report that were released on Friday has created a bit of uncertainty in the markets. The macro calendar is a bit subdued this week until the release of US CPI data on Thursday.

The yellow metal may therefore remain in a holding pattern for a bit longer, and there is the potential for further short-term weakness in gold as the slightly fragile risk environment could keep the dollar supported on the dips.

However, with the Fed seen cutting interest rates a few times this year, and other central banks also likely to loosen their policies, there’s no doubt in my mind about gold’s longer-term bullish outlook.

Gold Should Find Support From Central Bank Rate Cuts

As we proceed deeper into 2024, inflationary pressures are likely to continue to subside globally, initiating a cycle of interest rate cuts.

The European Central Bank, Bank of England, and the Federal Reserve are all expected to start this process potentially as early as the end of the first quarter, though more likely later in the year, considering the relatively less dovish stances maintained by the ECB and BoE in December.

In as far as the Fed is concerned, well it has outlined plans for three rate cuts in 2024, although the market is pricing in a couple of more rate cuts by the end of the year. The precise timing and extent of these cuts will hinge on incoming data.

Given that the boost in the price of gold in 2023 was driven in part by expectations of rate cuts in 2024, it is not unreasonable to expect the metal finding decent support once these central banks actually implement policy loosening and yields trend lower. Gold may even start a new bullish trend even before actual rate cuts, as markets tend to anticipate future developments.

There is undoubtedly significant pent-up demand for gold, given the heightened inflation experienced in recent years and the erosion of value in fiat currencies. Gold, often perceived as a true store of value, is expected to find support in the face of any substantial short-term weakness.

Shorter-Term Outlook Less Certain

Friday’s release of US activity figures added more concerns about data inconsistency than providing a clear direction for the markets. While the US labour market is certainly cooling, the slowdown is not rapid enough to prompt rate cuts in the first quarter.

This is especially true considering that wage growth remains resilient and the unemployment rate low. But those large revisions to the prior two months’ NFP data (-71K) and employment component of the ISM services report (showing a significant drop into contraction from 50.7 to 43.3) presented a contrasting narrative.

Given that the employment picture is not very clear, the dollar – and by extension, gold – should remain very sensitive to incoming data. The attention turns to the December CPI report, scheduled for release on Thursday, following a relatively quiet start to the week in terms of US data.

Gold Technical Analysis

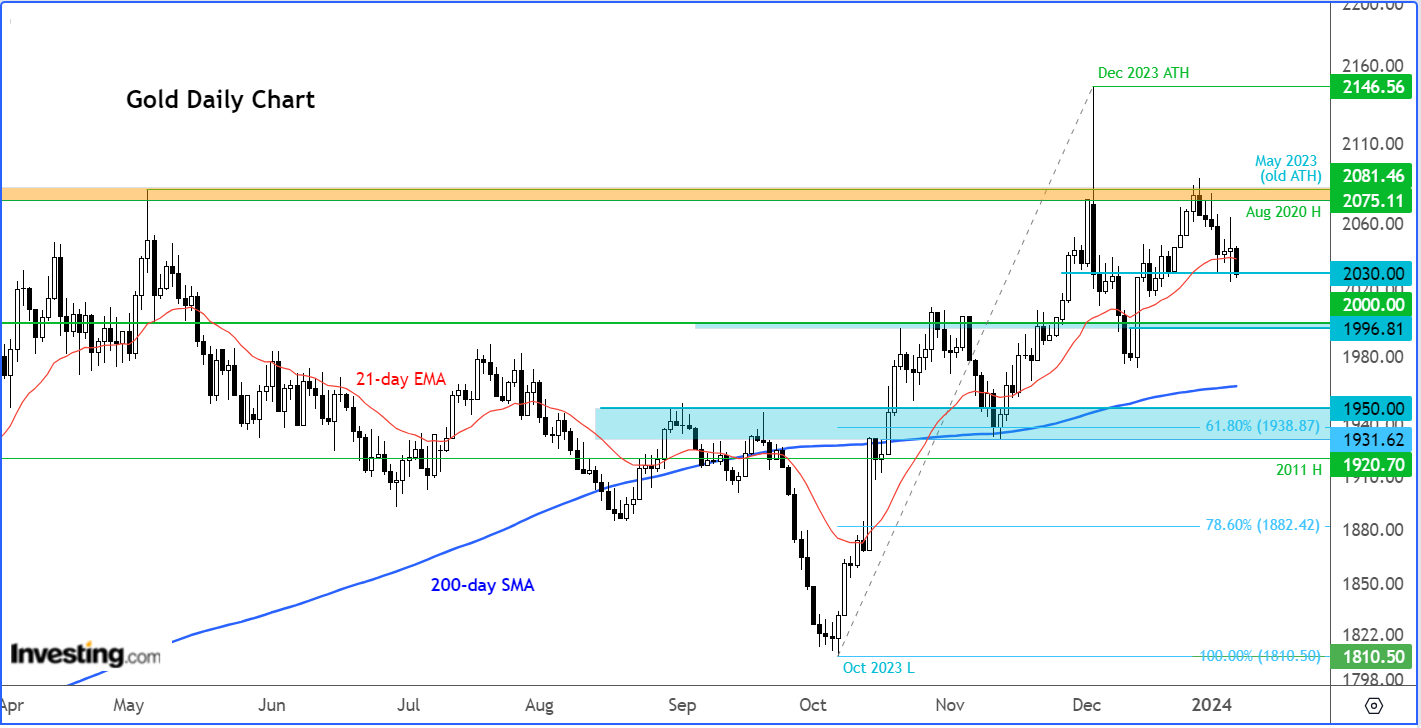

The short-term direction of gold remains unclear, and a clear bullish signal is needed to confirm a low has been made. But the long-term technical outlook is still looking pretty much bullish.

The short-term direction of gold remains unclear, and a clear bullish signal is needed to confirm a low has been made. But the long-term technical outlook is still looking pretty much bullish.

If shot-term support around $2030 breaks down, then the next big level to watch is around $2000, followed by around $1950, roughly corresponding with the rising 200-day average and prior support. With the slope of the 200-week MA pointing higher, this is objectively telling us that the long-term trend is indeed bullish.

As far as resistance levels are concerned, the post-covid high of $2075 that was hit in August 2020 is going to remain a pivotal zone for gold. The metal has not been able to post a weekly close above this level. If and when it does, then the December 2023 high of $2146 will come into focus next.

***

Beating the market has now become a lot easier with our Flagship AI-Powered ProPicks

Oftentimes, investors will miss incredible market opportunities simply by not knowing which companies to bet on.

Luckily, those times are long gone for InvestingPro users. With our six cutting-edge AI-powered strategies, including the flagship "Beat the S&P 500," which outperformed the market by 829% over the last decade, investors now have the best selection of stocks in the market at the tip of their fingers every month.

Strategies are rebalanced monthly, guaranteeing that our users stay ahead of the curve amid shifting market dynamics and an ever-changing macroeconomic environment.

Subscribe here for up to 50% off as part of our year-end sale and never miss another bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.