It’s done it AGAIN: Yet another AI-picked stock for November is up 37%+

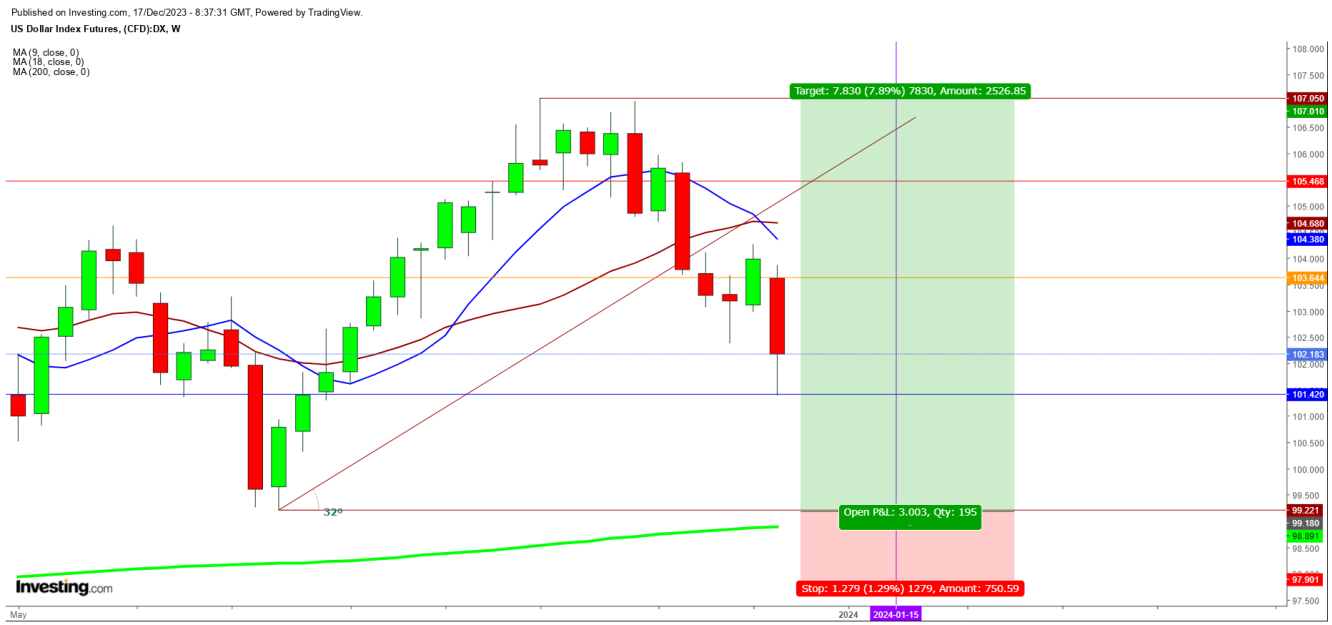

On analysis of the movements of the US Dollar Index futures, I find that the US Dollar is likely to regain a strong reversal from the first trading session of the upcoming week as the current sell-off has thrown the dollar at 4-month- Low amid dovish Fed on rate hike while the hopes for rate cut griming around in the upcoming meeting of the Federal Reserve on January 31/February 1, 2024.

Undoubtedly, these sentiments could continue to exert pressure on the yellow metal during the weeks ahead as the US dollar Index futures are likely to regain a strong reversal, and the strong dollar would extend selling pressure on gold in the days ahead.

Let us start to analyze the movements of god futures to know their expected directional moves and limits.

In a 15-minute chart, you can see how the god futures could move downward as the 9 DMA and 18 DMA have moved downward, even below the 200 DMA, formed a bearish crossover that confirms exhaustion likely to continue during the upcoming week.

In an hourly chart, the gold futures have found support at the 200 DMA but still below the bearish crossover formation, as the 9 DMA has tilted downward below the 18 DMA, confirming bearishness to continue despite wobbly moves if the gold futures find a breakdown below the 200 DMA and sustain there during the early hours after weekly opening. Wait and watch for an hour or two before taking a position according to my expected trading range with a defined Stop Loss.

In a 4-hour chart, gold futures found stiff resistance at $2058 on Dec.15, 2023, before a steep fall during the last trading hours, even moved below the 18 DMA before closing the week at $2033.70, indicating bearishness likely to continue during the upcoming week. Immediate support will be at $2004, where the 200 DMA could provide a strong buying support.

Undoubtedly, some reversal could be there, but a breakdown below immediate support, will keep the selling spree intact during the upcoming week.

In a daily chart, the gold futures found support at 18 DMA last Friday, but the formation of a bearish crossover below this with a downward move by the 9 DMA.

Secondly, the formation of an ‘Exhaustive Hammer’ on Dec.14, followed by a ‘Bearish Candle’ on Dec.15, confirms a gap-down opening is likely as the rate cut hopes have extended with the dovish Fed’s statement after its last meeting.

The trading strategy will be bearish amid my expected trading zone in the daily chart.

In a weekly chart, gold futures look indecisive as the weekly candle, formed during the week ended on Dec.15, looks evident enough for extended volatility during the upcoming week with a bearish bias.

Like the weekly closing level, the weekly opening level matters a lot in defining the further directional move by the gold futures for the upcoming weeks.

I suggest traders keep vigil over the follow-up moves after the weekly opening before creating any position.

On analysis of the current weekly movements by the gold futures, I expect them to hit the 200 DMA in a weekly chart, which is at $1640, before March 31, 2024.

In a monthly chart, if the gold futures not sustain above the immediate resistance at $2058 during this month and find a breakdown below the next support at $1986, the next target could be $1918 in January 2024.

Secondly, the Fed’s next meeting on Jan.31/Feb.1, 2024, will impact the direction of the gold futures during February.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. Readers can take any long or short trading position at their own risk.

Which stocks should you consider in your very next trade?

Successful investors know to check multiple angles before making their move. InvestingPro's three powerful features work together to give you that edge:

ProPicks AI runs 80+ stock-picking strategies, including Tech Titans, which doubled the S&P 500's performance in just 18 months!

Fair Value combines 17 proven valuation models to help you spot overpriced stocks and undervalued gems.

And WarrenAI delivers instant insights on any stock. Ask questions, get vetted answers backed by real-time data (unlike ChatGPT).

Our subscribers use all three to identify stocks before double-digit gains and avoid costly mistakes.

But with 55% during our early bird Black Friday Sale, even if you only use one of these features the value pays for itself.