- $1,800 was pivot point for gold in 2021

- Gold hit marginal new high in March 2022, then corrects

- Gold bull market more than two decades old

- Buying gold on weakness proven optimal approach

- 4 reasons to buy this dip

Gold is money, and the precious yellow metal has a long history as a means of exchange dating back thousands of years. Long before there were dollars, euros, yen, pounds, yuan, rubles and all currencies floating around in the global financial system, gold was the hard asset that held value and symbolized wealth.

Governments, central banks, monetary authorities, and supranational financial institutions hold gold as an integral part of their foreign exchange reserves. Moreover, they have been adding to reserves over the past decades, validating gold’s role in the global financial system. The last significant gold sale came in 1999-2001, when the United Kingdom parted with half its reserves at below $300 an ounce. Over the past two decades, the price path made the sale look foolish, as gold is not the barbarous relic of the past the British believed.

Aside from its monetary role, gold is a commodity and an ornamental metal that symbolizes love, wealth, and security. Unparalleled, gold’s brand remains the ultimate form of money.

Gold’s bull market began at the turn of this century as the British sold their last ounce. And it continues in May 2022. Gold supply and demand fundamentals support the price as it is a rare metal. Even though each ounce ever mined in history remains in the above-ground stocks, and the world adds more each year, the value has appreciated. Gold’s appreciation could be more about fiat currency depreciation than the metal. Over the past two decades, the precious metal has respected technical levels.

$1,800 Was Pivot Point For Gold In 2021

COMEX gold futures reached a new record high in August 2020 at $2,063 per ounce. After correcting to a low of $1,673.70, the price spent much of 2021 trading around the $1,800 level.

Source: Barchart

The chart highlights that $1,800 became a pivot point for the gold futures market from April 2021 through early 2022.

Gold Hits Marginal New High In March 2022, Then Corrects

When Russia invaded Ukraine in late February 2022, gold took off, rising to a new record peak of $2,072 per ounce. The precious metal experienced another correction that took the price to a low of $1,787 in mid-May 2022. Meanwhile, gold made another higher low, keeping the medium-term bullish trend intact.

On June 1, 2022, the nearby June COMEX futures contract was sitting at the $1,839 level, above the 2021 pivot point, as the price continued to consolidate and digest the latest move to over $2,000 and correction below the $1,800 pivot point.

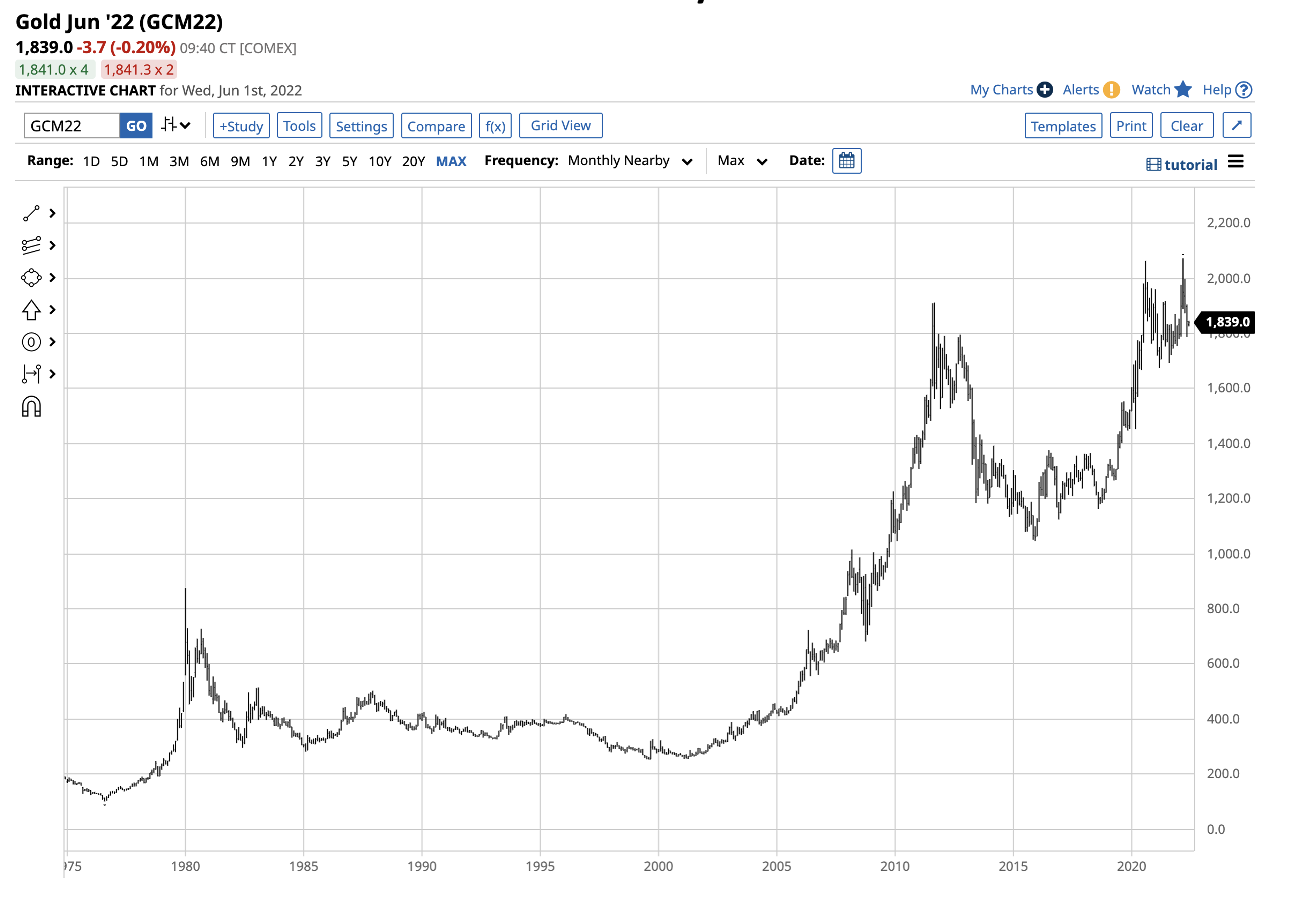

Gold Bull Market Over Two Decades Old

The gold bull is nothing new. Gold has been appreciating since the end of the last century.

Source: Barchart

The chart shows the rise in gold’s price to the $875 level in 1980 and nearly two decades of lower highs and lower lows that ended in 1999 at $252.50 per ounce. Since then, gold took off on the upside, making higher lows and higher highs. In June 2022, the bullish trend is nearly 23 years old, with no signs of ending any time soon.

Buying Gold On Weakness Proven Optimal Approach

Gold is an integral part of many investors’ savings. Gold is an asset that provides safety and is a store of value with thousands of years of performance history. Perhaps the most compelling reason to own gold is that governments hold the metal as part of their foreign currency reserves. Over the past years, central banks have added to reserves.

The United Kingdom’s sale at the turn of the century was an outlier, as other governments did not follow its lead. Ironically, London is the hub of the worldwide gold market. Meanwhile, governments and individuals that purchased gold steadily on price weakness over the past decades have increased the value of their holdings through accumulation and higher prices. At $1,840 per ounce, gold may be $232 below the March 2022 all-time high, but the price is more than seven times the level of the 1999 low.

4 Reasons To Buy This Dip

At least four compelling factors make gold a critical asset for all portfolios:

- History: Gold’s role as a means of exchange dates back thousands of years. It is a proven asset that is a store of value and a symbol of wealth.

- Inflation: Governments can expand the money supply to their heart’s content. The only way to increase the gold supply is to extract more from the Earth’s crust.

- Geopolitical turmoil: The hopes for globalism have evaporated with the bifurcation of nuclear powers. The Chinese/Russian “no-limits” cooperation threatens the US, Europe, and their allies. While the division between leading world countries could impact fiat currency values, all hold gold and respect its position in the global financial system.

- An emerging gold standard: Russia recently declared that 5,000 rubles could be exchanged for one gram of gold. The move lifted the Russian currency’s value against the US dollar despite the wide-ranging sanctions. If China follows and backs the yuan with gold, it would not only be a return of the gold standard for two leading countries, but would threaten the dollar’s position as the world’s reserve currency if the US does not follow and reinstitute an exchange rate versus the precious metal.

Gold has respected its technical support level at the March 2021 low. The pattern of higher lows and higher highs remains intact. Moreover, the geopolitical bifurcation could lift the precious metal’s role in the global financial system. Gold remains a metal that should be part of all portfolios. Buying on price weakness has been the optimal approach, which is likely to continue.