It is difficult to make much sense of the short-term price action in the foreign exchange market since so much is spurred by this or that headline about Greece. On the week, the euro lost about 0.6% against the dollar but outperformed the other major currencies save the yen. The yen gained nearly 1% against the dollar, the only major currency to do so.

Those currencies that under-performed last week had at least one thing in common. Monetary policy is now in play. New Zealand, Norway, and Sweden are in easing cycles, with the Riksbank move last week. The unexpected news that the Canadian economy contracted sparked speculation that Bank of Canada will have to cut rates again. The Reserve Bank of Australia meets this coming week. Most do not expect it to cut but instead signal a move in August.

The euro's range last week was set on Monday in reaction to news of the Greek referendum and bank holiday. It spent the rest of the week moving lower within the range, recording four days of lower highs. Given the polls seem to show a statistical dead heat, a short-run spike cannot be discounted. Last week's spike near $1.0955 was not revisited, but a break off it could signal another cent decline. Closer support is near $1.1030, with the 100-day average around $1.1045. On the longer-term charts, this is the lower end of the euro's broad trading range. The US jobs report is unlikely to convince many to bring their forecasts forward, which may help reinforce the range.

Last week's dollar recovery off the sub-JPY122 spike seen in the initial response to those Greek developments stalled near JPY123.75 to form the third point in the downtrend line from the multi-year high set in early June (~JPY125.85) and late June (~JPY124.40). That falling trend line comes in a little above JPY123 by the end of next week. A break of the JPY121.70-90 area would make many reconsider where the lower end of the range is to be found, in which case the JPY120 area would seem to be the risk.

Sterling lost a little more than one cent against the US dollar, and by about half as much against the euro. The price action disappointed many who had expected to benefit from haven flows as it were and the hawkish talk by some BOE members. However, much good news appears to have been priced into sterling and short-term rates. Last week the implied yield of the June 2016 short sterling futures contract fell 12 bp, even though both the manufacturing and service PMI were reported better than expected. The 10-Year gilt yield was flat on the week coming into Friday's session when it dropped almost nine basis points to slip back below 2.0%.

The technical tone for sterling has deteriorated. It finished the week with three successive closes below the 20-moving average, for which the five-day moving average has also crossed below. The potential trend line connects the multi-year, set in mid-April, and the early-June low near $1.5190 comes in at the start of the new week near $1.5510. It rises toward $1.5570 be the end of the week. This corresponds to the top of the near-term down channel, which begins the week near $1.5670, dropping about 20 pips a day. Sterling finished the week on its lows, setting the stage for a possible gap lower opening in Asia on Monday. A convincing break of the $1.5450-70 would leave little technical support ahead of the $1.5200 area.

There was a deterioration in sentiment toward the Canadian dollar, fueled by increased speculation that the Bank of Canada, which took out what it called an insurance policy when it surprised the market with a rate cut early this year, will have to cut interest rates again. Weak economic data, especially news that the Q1 contraction has carried into the start of Q2 spurred a 16 bp decline in the implied yields of the December 2015 Banker Acceptance futures contracts. The Canadian dollar fell 2% over the course of the week. This did a little more than offset its 1.3% gain over the past three months. The US dollar's first attempt to establish a foothold above CAD1.2600 was rebuffed. The rate cut speculation, and the drop in oil prices to the lowest level since mid-April will likely encourage another attempt. Above there, the next target is CAD1.28, which the greenback traded above earlier in the year but never on a closing basis.

The Australian dollar fell 1.4% before the weekend to almost $0.7500 to bring the week's loss against the US dollar to 1.8%. It finished the week at six-year lows. Renewed declines in commodity prices like copper and iron ore, some disappointing economic data from China, and expectations for a dovish central bank statement next week were the main considerations. Australia, like Canada, is struggling with a negative terms of trade shock. A rate cut later in Q3 seems likely, and we see scope for continued weakness over the medium-term. A break of $0.7450 would spur another near-term cent decline.

The price of crude oil broke down last week. News that the US rig count increased and force majeure was lifted in Libya took a toll. The possibility that some agreement with Iran will be reached soon may have also encouraged some long liquidation. The August contract finished at its lowest level since mid-April. That was also the last time that the contract finished below its 100-day moving average for two consecutive sessions. However, the fact that the contract finished the week (~$55.52) below its lower Bollinger® band (~$56.50) may be a caveat at the start of the new week. The $54.60 area is the next objective, with a break signaling potential toward $52.50.

The U.S. 10-Year Treasury yield fell eight bp last week; half before the June employment data and a half after. The 2.50% area attracts lenders (bond buyers). The lower end of the yield range is seen in the 2.25%-2.30% area. The technical indicators we look at appear to be pointing to a likely pullback in yields in the near-term.

The S&P 500 dropped more than we had anticipated last week. However, after Monday's breakdown, and a gradual recovery took place in the holiday-shortened week. The upticks stalled ahead of the 38.2% retracement of the leg down since June 22. This area 2084 needs to be overcome to lift the technical tone, but a move back above 2100. This seems unlikely as the Q2 earnings seasons formally begins on July 8 with Alcoa's (NYSE:AA) report. FactSet warns analysts are expected the first overall year-over-year decline since Q3 2012.

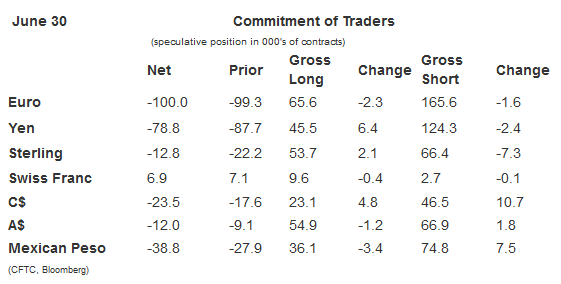

Observations based on the speculative positioning in the futures market:

1. There was only one significant gross currency position adjustment in the CFTC Commitment of Traders reporting week ending June 30 compared with seven the previous week. The gross short Canadian dollar position increased by 10.7k contracts to 46.5k. Of the remaining 13 gross currency futures position we track, only three changed by more than 5k contracts.

2. The under-performance of the dollar-bloc currencies in the spot market last week was partly reflected in the pattern in the futures market. The gross short euro, Swiss franc, yen and sterling positions were reduced, while they were extended for the Canadian and Australian dollar, and Mexican peso.

3. The net short sterling position fell to 12.8k contracts from 22.2k in the previous week. This is the smallest net short position since last November. The gross short position has been fairly stable. At 66.4k contracts, it essentially matches its 16-week average (67.1) and which is a little above the 8-week average of 63.8k contracts. It is new longs coming into the market that explains the movement in the net position. The gross long position has risen from 31k contracts in early June to 53.7k at the end of the month.

4. The net US 10-year Treasury futures position has almost moved neutral. There is a small 3.5k net short position still after 46.7k the prior week. The general pattern continued. New longs are coming into the market (31.2k contracts) and shorts have been pared (-12k contracts). Since early May, the gross long position has risen by 143k contracts to 451.6k. The gross short position has slipped by 38k contracts, leaving 455.1k.

5. The speculative position in the light sweet crude oil futures contract was little changed. The net long position increased by less than 1k contracts to stand at 328.2k. The bulls added 3k long contracts to increase their holding to 483k contracts. The bears added 2.3k contracts to their gross short position. Now it is at 154.8k contracts.