- The Bank of England's hawkish stance has driven GBP/USD above 1.33.

- Traders should watch upcoming GDP figures for their potential impact on BOE decisions.

- As bulls target 1.41, the momentum could continue carrying the pair higher.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

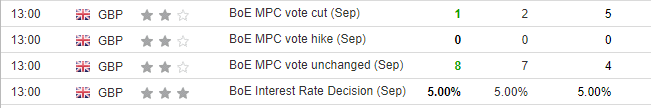

In the wake of the Fed's unexpected 50 bp rate cut last week, the Bank of England quietly made a significant move of its own: it paused the interest rate cuts that began in August.

This decision, accompanied by a notably hawkish tone, has energized the British pound, driving the GBP/USD currency pair to new heights.

With inflation data revealing a slowdown in the disinflationary process, the Bank is treading carefully, indicating that further interest rate cuts may not be on the immediate horizon.

As a result, the GBP/USD has confidently broken above the 1.33 mark. Traders should watch closely for potential upward momentum in the days ahead

Why Didn’t the Bank of England Proceed with Cuts?

After the Bank of England cut interest rates earlier last month, many anticipated a continuation of this trend in future meetings. Yet, the nearly unanimous decision to keep rates unchanged reinforced the hawkish stance among policymakers.

It's also important to highlight that the board decided on quantitative tightening, planning to reduce reserves by $100 billion over the next year. This move further contributed to the overall hawkish tone of the meeting.

As for the upcoming meeting in November, the bank's decision will hinge on economic data, particularly inflation trends and the overall condition of the local economy.

Next Monday, key GDP figures will be released, and if they fall below expectations, the BOE may reconsider its position on rate cuts.

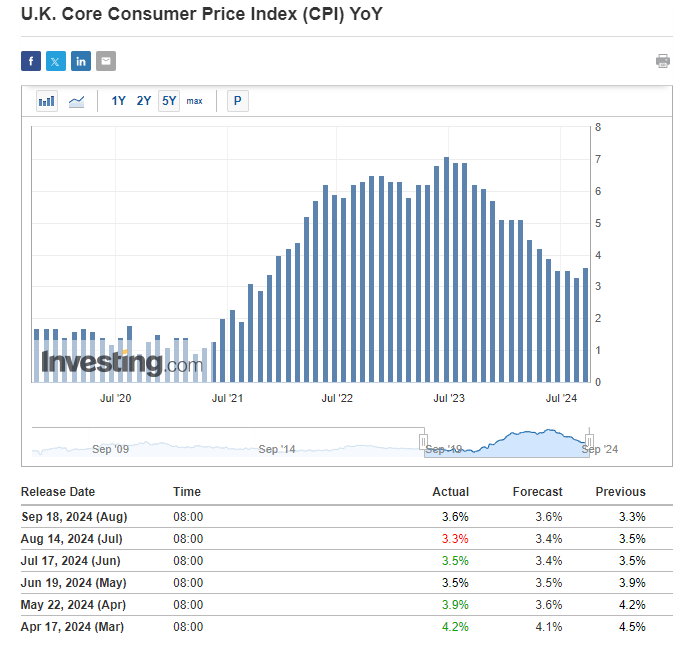

Core Inflation in the UK Raises Concerns

The inflation data released last week has caught the attention of the Bank of England, whose top priority remains achieving a sustainable inflation target.

While keeping consumer inflation steady at 2.2% year-over-year isn’t alarming, the rise in core inflation from 3.3% to 3.6% signals a potential concern for Andrew Bailey and his team.

In theory, recent industrial production data, which fell short of forecasts, might support the case for rate cuts.

However, when viewed in context, this indicator shows an upward trend and one reading alone is insufficient to alter the overall trajectory.

GBP/USD: Aiming for 1.41

Currently, the GBP/USD pair is experiencing a dynamic demand impulse, reaching its highest levels since early 2022. Buyers are unlikely to lose momentum, with the next short-term target appearing to be around 1.34.

Looking at higher time frames, the main supply zones are found at 1.36 and just above 1.40, near the 2021 highs. A key factor for realizing this scenario will be continued interest rate cuts in the US, which seem to remain unthreatened for now.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.