The GBP/USD was a touch higher on Tuesday after it managed to rebound on the back of a firmer risk tone on Monday. That followed Israel’s limited response in Iran at the weekend, raising hopes that the conflict will not escalate further. But this could be the quiet before the storm, for the cable faces a rather busy couple of weeks or so.

On Wednesday, we will have the UK’s budget announcement, which will be sandwiched between key US data releases throughout the week, including JOLTS Job Openings later today and Nonfarm Payrolls on Friday. Then, next week, the US Presidential Election will take place on Tuesday, followed by interest rate decisions from both the UK and US central banks on Thursday.

Ahead of all these events, the GBP/USD has bounced back but the outlook remains modestly bearish as rates trade near the 1.30 handle.

GBP: UK Budget in Focus for UK Investors

Last week’s UK PMIs didn’t quite meet expectations and will likely nudge the Bank of England to rethink its cautious approach. However, with no major UK data this week, all eyes in the gilt market—and on the pound—are now set firmly on this Wednesday’s UK budget announcement. Chancellor Rachel Reeves has confirmed a shift in the fiscal rule to boost investment, effectively opening the door for potentially billions in new borrowing.

Since the announcement, gilts have lagged behind other developed market bonds, and there is a risk of further yield rises on budget day. The key question as far as the pound is concerned is whether gilt underperformance will bring about excessive volatility. If so, it could increase turbulence and amplify downside risks for the currency.

As a result, GBP/USD might see cautious trading in the lead-up to both the UK budget and upcoming US election uncertainties, and for that reason, I don’t envisage it moving materially north of $1.30, if at all, in the next few days.

US Economic Data Could Reinforce Path to Slower Rate Cuts

Last week’s stronger economic indicators have reinforced expectations that the Federal Reserve may take a measured approach to future rate cuts, but will that change this week with some top-tier data scheduled on the US economic calendar? These include JOLTS, non-farm payrolls, and ISM surveys among others.

Last week’s data releases—such as jobless claims, services PMI, and durable goods orders— all surpassed forecasts, suggesting economic resilience. If we see a similar outcome from most of this week’s data releases, then that could even raise question marks over further rate cuts beyond the two more priced in for this year, as the Fed may be more inclined to wait and see before easing policy further.

As a result, traders and investors are closely watching incoming data to gauge whether the Fed will indeed adopt a more gradual approach to rate reductions. In particular, there are three important US data releases to watch this week that could significantly impact the US dollar and the GBP/USD forecast.

1. JOLTS Job Openings (Tuesday)

With the Fed’s focus turning to employment, we will give preference to any labor market indicators over other data releases in the next couple of months. Though this data release is not very up-to-date (with this one covering August), it can still impact the market because job openings are a leading indicator of overall employment, and they usually take a few months to be filled.

Last time, we saw a surprisingly strong print of 8.04 million, aiding the dollar’s rally. Any further strength could boost expectations that the NFP data on Friday would also beat expectations.

2. US Advance GDP estimate (Wednesday)

This will be the initial estimate of economic performance in Q3. Last quarter saw a growth of 3.0% in an annualized format, which was revised higher from the initial 2.8% reported initially. This time, growth is expected to come in at 3.0% again, which would represent a decent performance for the world’s largest economy.

Let’s see if the actual data will match expectations, or whether there is a significant deviation.

3. US nonfarm payrolls (Friday)

Last month’s surprisingly good nonfarm payrolls data helped to fuel a big rally in the dollar as the market was forced to drop its calls for further outsized rate cuts from the Fed.

Let’s see if those numbers will be revised and whether the strength in the labor market will continue for another month. Any further strength in employment data could even call into question the now lower expectations of 50 basis points worth of more rate cuts in the next two FOMC meetings in 2024. This will undoubtedly move the US dollar.

US Election Adds Another Layer of Uncertainty

The US presidential election is also in focus, with polls and odds markets showing a close race. Some betting markets are now leaning toward a Trump victory, and this has led to a big rally in the Trump stock. A Trump win could have inflationary implications, potentially impacting the Federal Reserve’s approach to rate policy.

Given Trump’s policies, investors may anticipate a more aggressive Fed response to manage potential inflation. This outcome could well drive the dollar even higher, given that this is proving to be a rather close race.

The uncertain outcome has led investors to adopt a cautious stance, with many waiting to see how the election results may influence the Fed's future policy decisions and overall market sentiment. This has been evident in stock not moving much last week, VIX rising and gold hitting new record highs.

Our GBP/USD forecast will remain bearish until at least after the US election, regardless of what it does in the interim.

GBP/USD Technical Analysis and Trade Ideas

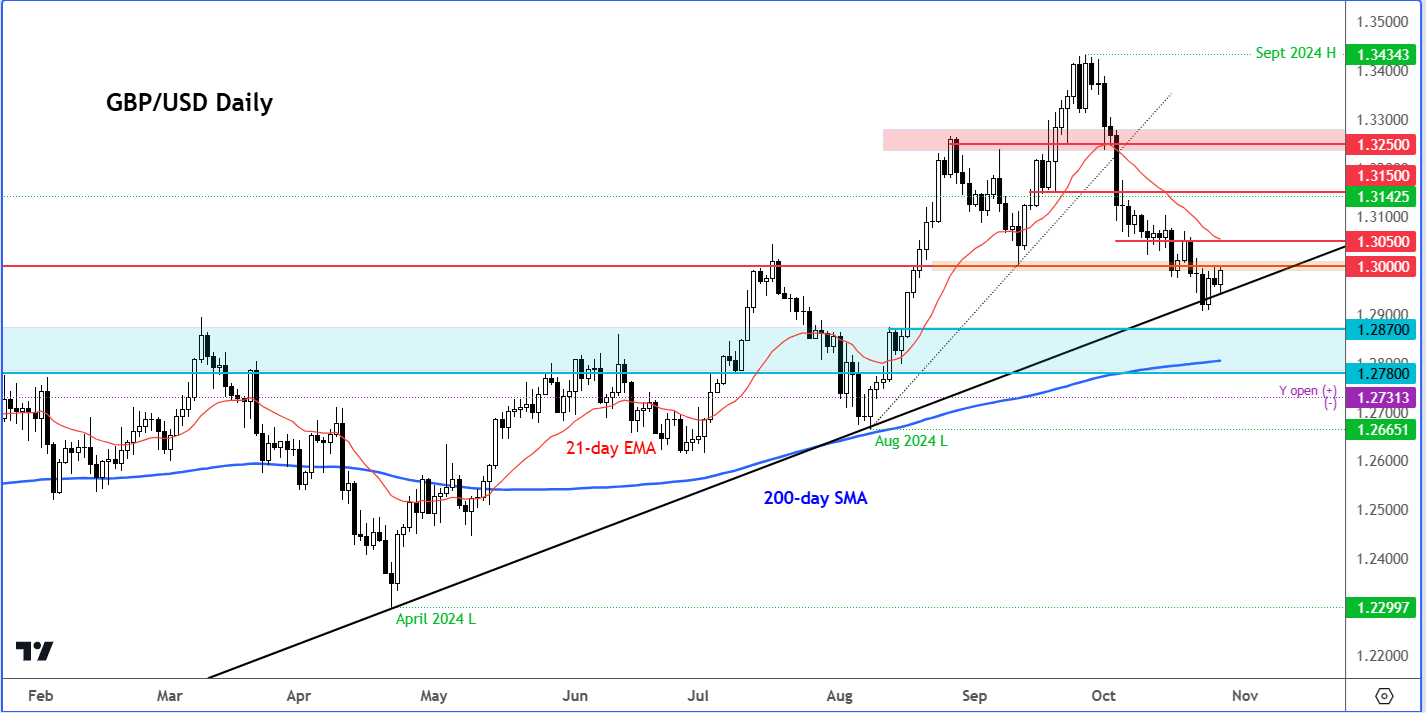

Source: TradingView.com

Twice now, the GBP/USD has bounced right where it needed to: at just over the 1.2900 handle, where the long-term bullish trend line going back to September 2022 comes into play.

However, the cable continues to find resistance around the 1.2980-1.3000 area, which must be reclaimed to boost the appeal of the cable for the bulls. If reclaimed, we could see the price squeeze higher towards 1.3050 initially and then potentially climb to the next area of resistance around 1.3150.

However, if resistance holds here, then the bears will likely have another crack at the bullish trend line later this week. A breakdown looks to be on the cards. Potential supports below the trend will come in around 1.2870, followed by 1.2800 area where the 200-day MA converges.

All told, the technical forecast still remains bearish despite today’s recovery. We are yet to see a clear bullish reversal pattern on the chart of the cable. Until that happens, there is no reason to call the bottom.