Over the holiday weekend, the number of coronavirus cases in the US hit new record highs, but Monday’s rally in currencies and equities suggest that investors are unfazed by the growing health crisis in the US. The Dow Jones Industrial Average rose more than 300 points as the euro closed above 1.13 against the US dollar for the first time in nearly 2 weeks. It is important to note that even though many currencies traded higher, the Japanese yen and Swiss franc also gained strength versus the dollar which is a sign that not everyone is convinced that the improvement in risk appetite is here to stay.

For now, the death rate remains low at less than 5% in the US. Testing is on the rise allowing for earlier intervention, there are more and better treatments and younger people who are less likely to die are accounting for a greater portion of new cases. Data, mostly from June, continues to improve and with companies working round the clock to develop a vaccine, the hope is that the virus will become more manageable, limiting the impact of tightened restrictions on the US economy.

According to the latest ISM non-manufacturing index, service sector activity accelerated last month as large states reopened activity. This improvement is consistent with Thursday’s better than expected nonfarm payrolls report. However the uncertainty lies in not what happened in June but how businesses and consumers behave in July, when virus cases are on the rise. Delays in hiring and investment are very likely.

Yet with no major US economic reports on this week’s calendar to threaten the rally, as long as the COVID-19 death rate in the US remains low and we do not see any alarming spikes in new cases, currencies and equities could hold onto their gains. At this stage, with investors shrugging off every piece of negative virus news, there needs to be some type of reality check for investors either in the form of a downtrend in data (which we may not see until next month) or some drastic turn in the US’ COVID-19 crisis for the optimism to fade. With that said, USDJPY and USDCHF traded heavily on Monday and could see further losses if investors are overweight currencies of countries that successfully flattened the curve.

On that note, euro was the best performing currency on Monday, thanks to ongoing signs of recovery. Eurozone retail sales jumped 17.8% in May, more than expected. Although the rebound in German factory orders was less than forecast, a double digit increase was still seen. Most importantly in contrast to the US, there’s a much better chance that these improvements in economic activity will be sustainable. Spain and Italy were the countries hit the hardest by the COVID-19 crisis in the Eurozone and there has been no major uptick or signs of a second wave in either country since the beginning of June. They have flattened the curve and eased most of their lockdown restrictions.

The UK is also doing a good job containing the virus but sterling lagged behind the euro as tensions between the UK and China grow. Last month, Britain said they would offer citizenship to almost 3 million people in Hong Kong who are looking to escape violations of freedom with the new security law. They are also accelerating their phase-out of Huawei gear from their 5G networks. China responded with threats of consequences. There are reports that the UK could be hit with tariffs—a trade war between the UK and China is the last thing the country needs. The EU and UK intensified Brexit negotiations but initial talks ended early amid major hurdles.

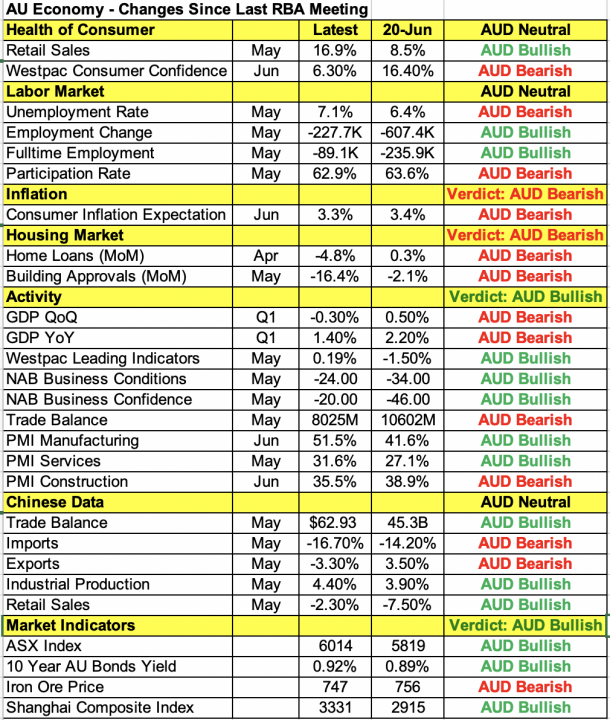

The Australian dollar is in focus tonight with a Reserve Bank of Australia monetary policy announcement on the calendar. The RBA is widely expected to leave policy unchanged and the question is whether their outlook for the economy and negative rates changed. As shown in the table below, there have been improvements and deterioration since the last policy meeting. Retail sales is up but the unemployment rate increased, housing market activity weakened and consumer inflation expectations declined. There’s no doubt that Australia is doing better today than in June, but with fresh outbreaks in the Melbourne suburbs, their decision to close the border between Victoria and New South Wales for the first time in a century, sealing off 6.6 million people in the process, will take a big toll on sentiment and possibly economic activity.

The Canadian dollar will also be in play with the IVEY PMI report scheduled for release—an improvement is expected.