Daily FX Market Roundup 02.11.20

By Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Most of the major currencies rebounded against the U.S. dollar on Tuesday thanks in part to an earlier pullback in Treasury yields and new record highs for U.S. equities. Although stocks came off their highs to end the day unchanged, currencies held onto their gains. Federal Reserve Chairman Jerome Powell’s semi-annual testimony on the economy and monetary policy is this week’s biggest event. Judging from the reaction in the dollar and the Dow, investors liked what he had to say. Powell feels that the economy is in a good place, fundamentals supporting household spending are strong and while the coronavirus-driven slowdown in China is likely to have some effects on the U.S., it is too early to say what the impact will be. The central bank is monitoring risks to their outlook closely but for now, monetary policy remains appropriate.

Going into this week’s testimony, investors were looking for answers to 3 key questions:

- How will coronavirus impact the U.S.?

- When will the repo operations end?

- Is a rate cut on the table?

Chairman Powell downplayed the impact of coronavirus. Based on his comments, it is clear that the Fed is unfazed because China has taken strong measures to contain the virus and provide liquidity. There are very few cases in the U.S. and so far, the impact on the U.S. economy is limited. However we’d like to remind our readers that many factories supplying U.S. business in China remain shut and flights to China remain canceled. Still, investors responded to Powell’s optimistic outlook by driving equities and high-beta currencies higher.

On repos, the Fed expects to continue their operations into April. Money markets seem to be functioning well and if that continues, they will gradually transition away from repo operations to supply reserves. However considering the demand for their latest operation, which was a third oversubscribed, liquidity is still an issue. Many view these operations as akin to QE and with no set date for ending repo, investors saw this as a greenlight to keep equities bid. While Fed fund futures are pricing in a 30% chance of easing this year, Powell gave us very little reason to believe that a rate cut is on the table. All of this is positive for U.S. assets including the dollar and explains the resilience of USD/JPY. Powell will be testifying again before the Senate on Wednesday and we do not anticipate any surprises as anything worth trading would have been revealed today.

Bank of England Governor Carney also spoke on Tuesday but his comments were far more cautious than Powell’s. Carney said the economic impact of coronavirus is already bigger than SARs. At the same time, Brexit uncertainty has held back productivity growth so some stimulus may be needed to return to trend growth. More specifically he said they could cut rates if there is no post-election bounce. Sterling has been surprisingly resilient in spite of these comments and muted GDP growth, holding above the 100-day SMA. Q4 data confirmed that the UK economy stagnated in the fourth quarter, but on an annualized basis, growth held at 1.1% instead of slowing to 0.8%. Industrial production rose less than expected but the UK turned an unexpected trade surplus in December on a jump in metal exports. Exports excluding precious metals were weak.

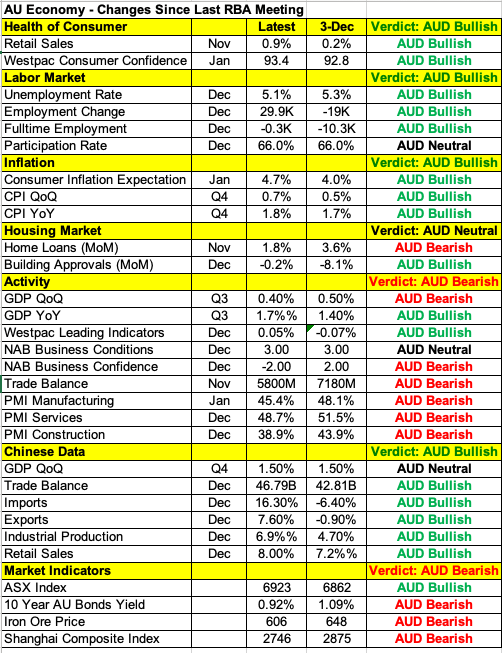

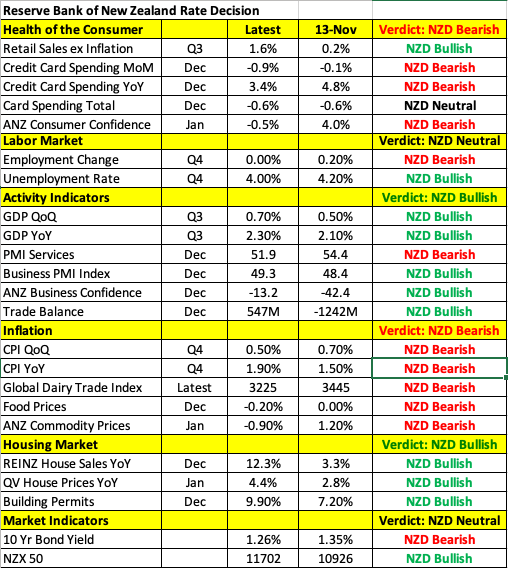

The next major event will be tonight’s Reserve Bank of New Zealand monetary policy announcement. No changes are expected. However in light of the Reserve Bank of Australia’s GDP downgrades and the coronavirus that hit in January, the RBNZ could be more cautious. The last time the RBNZ met was in November and the decision kicked off a 400-point rally in NZD/USD. At the time, Orr sounded upbeat when he said there’s no urgency to act. Last month, RBNZ Assistant Governor Hawkesby said they are monitoring the impact of coronavirus and the lower currency is helping to insulate the economy. Data hasn’t been terrible since the last meeting with housing, manufacturing activity and business confidence improving (see table below). However nearly all of these reports were taken before coronavirus and we suspect the outlook has changed. Fresh concerns from the RBNZ could drive NZD/USD to 4-month lows. Ambivalence like the Fed will mark a near-term bottom for the currency.