The term "financial services industry" immediately brings banks to mind. While banking is vital for the economy to function, financial services include a broad basket of businesses ranging from insurance firms, FinTech companies, REITs brokerages, and asset managers, to those that provide services, such as stock exchanges or credit rating agencies.

Below we’ll take a deeper look at the fundamentals of the industry and a financial services ETF worth investigating:

A Highly Cyclical Sector

Bank and other financial services stocks were among the hardest-hit sectors when the COVID-19 pandemic sparked a global selloff in equity markets. While share prices of many of these companies have already rebounded off March lows, they are still considerably depressed.

Banks were also in the spotlight during the 2008/09 financial crisis, especially in the US, given their exposure to risky financial products. The financial stress turned into a full-blown global emergency when mammoth US investment bank Lehman Brothers went bust in September 2008, resulting in governments and central banks coordinating efforts to save many lenders by recapitalizing them.

In short, private debt held by many financial companies at the time was transferred to the state and became public debt. While the burden fell on taxpayers’ shoulders, the debate over the influence of financial institutions, the state's role, austerity policies and economic development followed. Most global economies eventually recovered, and stock markets boomed.

Still, every economic downturn is different. Unlike the crisis of 2008/09, the recent market declines did not stem from the banking industry or actions taken by financial firms.

Being a highly cyclical sector, financial services company prices are susceptible to changes in the economic climate, including interest rates, economic growth, housing market activity, global health, political and trade concerns.

For example, low interest rates can adversely affect banks' margins and profitability. After all, many commercial banks profit from the spread between deposit rates and loan rates.

In the US and other countries, interest rates are at historic lows. On June 25, the Federal Reserve announced the results of its annual stress tests and additional sensitivity analyses for banks. The Fed required 33 of the largest US-based banks to preserve capital by suspending stock repurchases and cap dividend payments in the third quarter.

In several other countries, financial institutions have also decreased or completely suspended their dividend payments. Now that the passive income element is gone, dividend investors may look for alternatives.

There will also likely be short-term price swings in these shares for the rest of 2020 as news headlines—especially regarding the health and economic effects of the pandemic change.

With all that in mind, here is an ETF that those interested in investing in the financial services industry may consider:

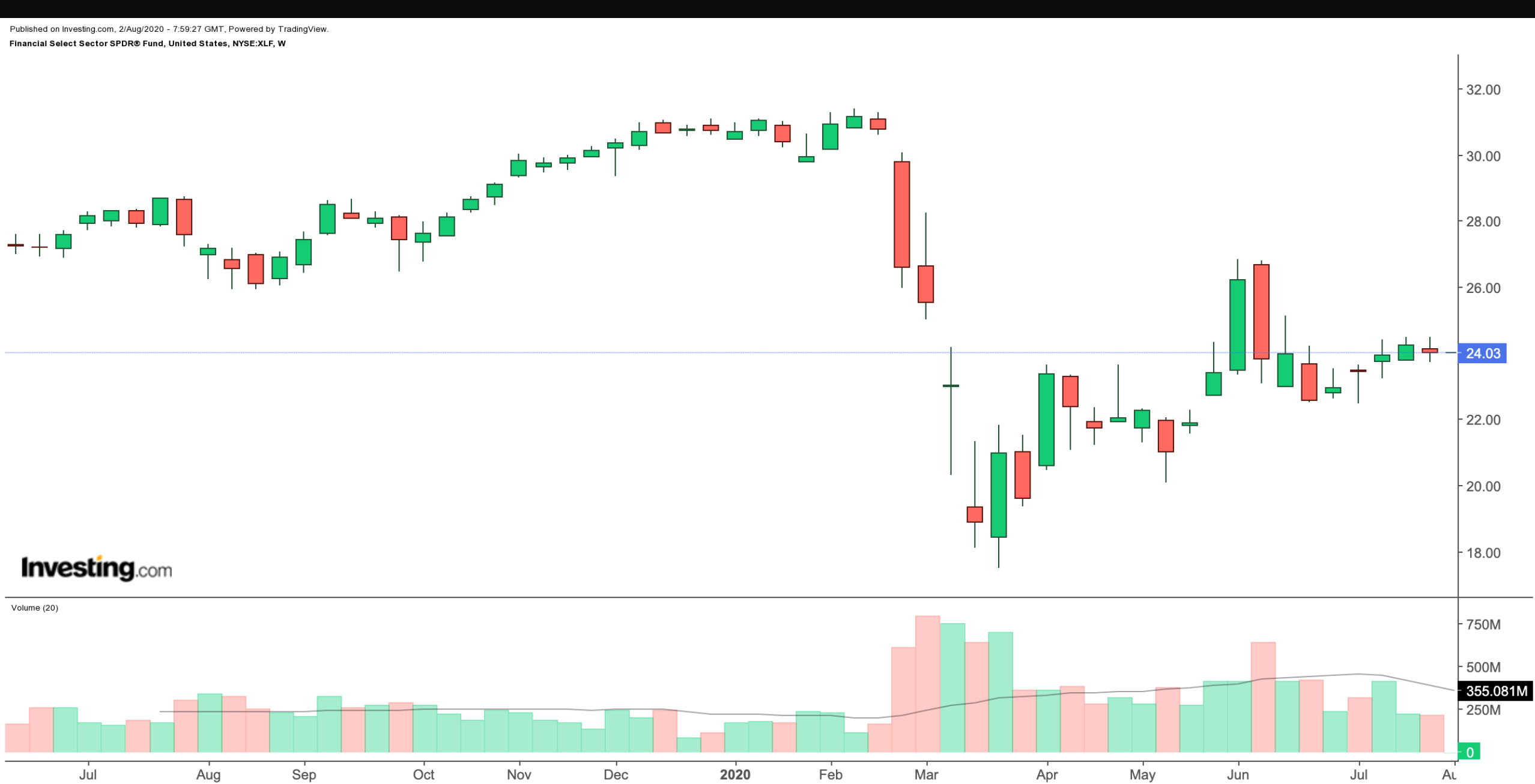

The Financial Select Sector SPDR Fund

- Current Price: $24.03

- 52-Week Range: $17.49 - $31.38

- Dividend Yield: 2.54%

- Expense Ratio: 0.13% per year, or $13 on a $10,000 investment

The Financial Select Sector SPDR® Fund (NYSE:XLF) has 66 holdings and follows the Financial Select Sector index. The top three sectors represented are banking, capital markets and insurance.

Over half of the total net assets consist of the top ten firms, standing close to $17.2 billion. XLF's largest three companies include Berkshire Hathaway Class B (NYSE:BRK.B), JPMorgan Chase (NYSE:JPM), and Bank of America (NYSE:BAC).

Since the late 1950s, legendary investor Warren Buffett and his long-time partner Charlie Munger have transformed Berkshire Hathaway (NYSE:BRK.A), (NYSE:BRK.B) from a struggling textile manufacturer to a holding company with a market capitalization greater than $475 billion.

In fact, BRK.A stock currently has the highest share price of any company in history. In 1964, each Class A share was just shy of $20. Now each share costs upwards of $293,000 (no, that's not a misprint, this version of the stock has simply never been split). Therefore, most ETFs would likely include shares of BRK.B, not BRK.A.

Berkshire Hathaway's regular 13F filings with the Securities and Exchange Commission (SEC) show the holdings in the company. Some of Warren Buffett's favorite companies: Large-cap stocks, consumer brands, stocks that pay dividends and Financials, including bank insurance companies and more recently FinTech businesses.

Buying into Berkshire Hathaway shares, either directly or indirectly through a fund, offers exposure to a wide range of businesses.

So far this year, XLF is down about 21%. However, that metric tells only part of the story. On March 23, the price hit a 52-week low of $17.49, so $1,000 invested in the fund at that time would now be worth about $1,370.

Bottom Line

There are various financial sector ETFs, ranging from US-based large companies to regional banks to global firms. As always, investors would need to conduct due diligence and inspect a given fund's holdings in light of their risk/return profiles.