Street Calls of the Week

DXY sagged last night as EUR bounced:

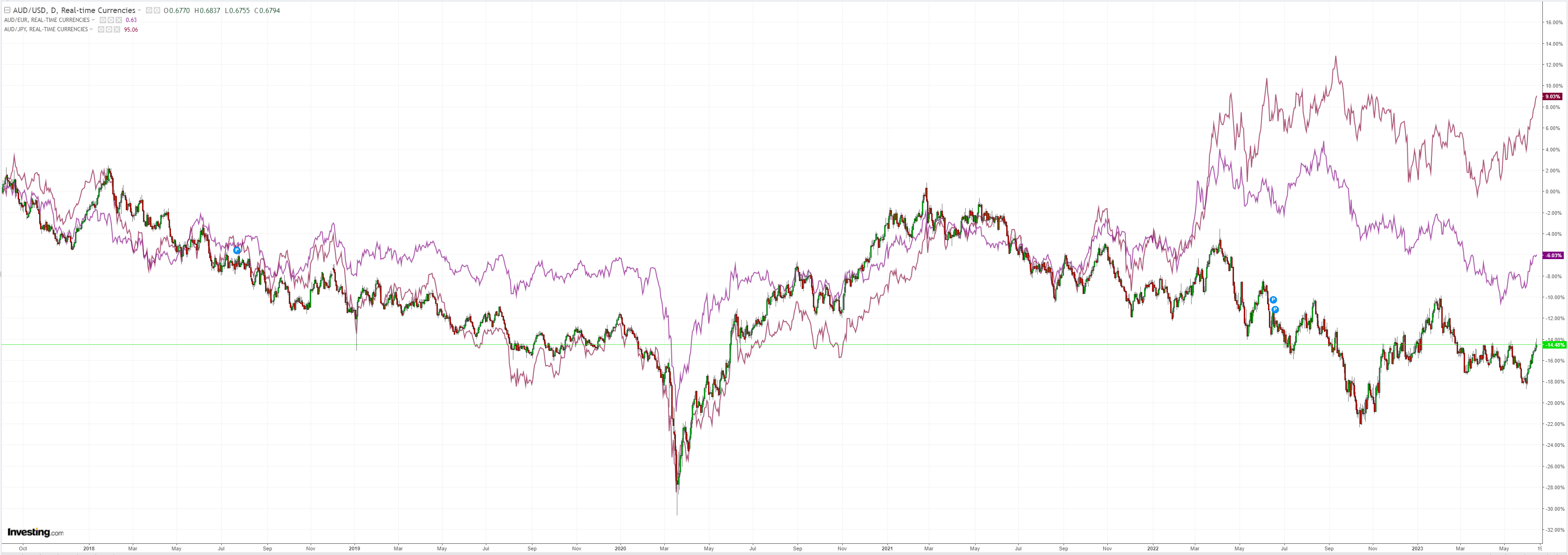

Australian dollar popped and dropped:

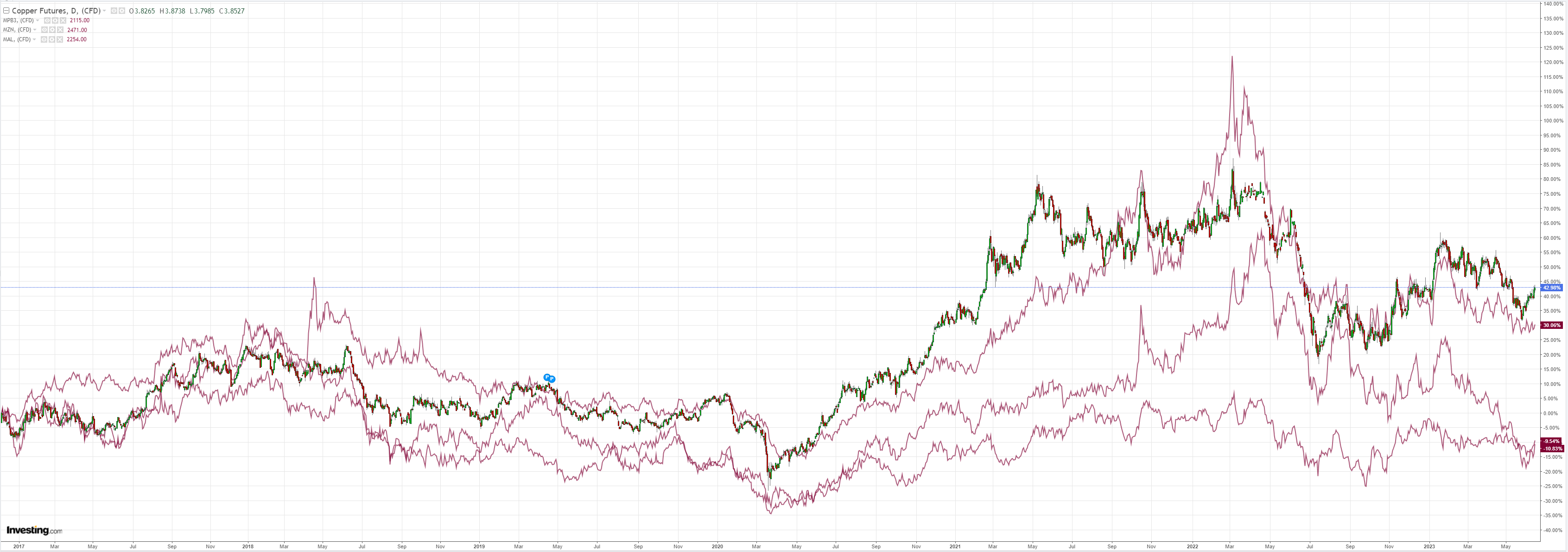

Base metals are hoping for China stimulus:

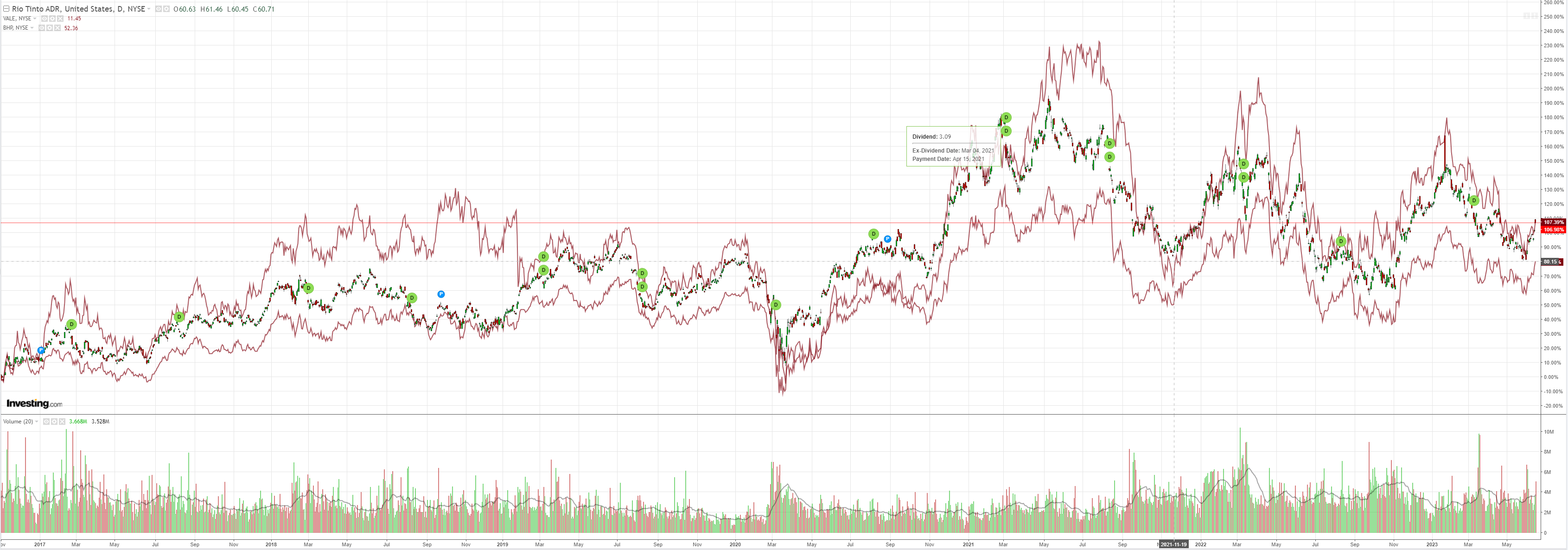

Big miners (NYSE:RIO) too:

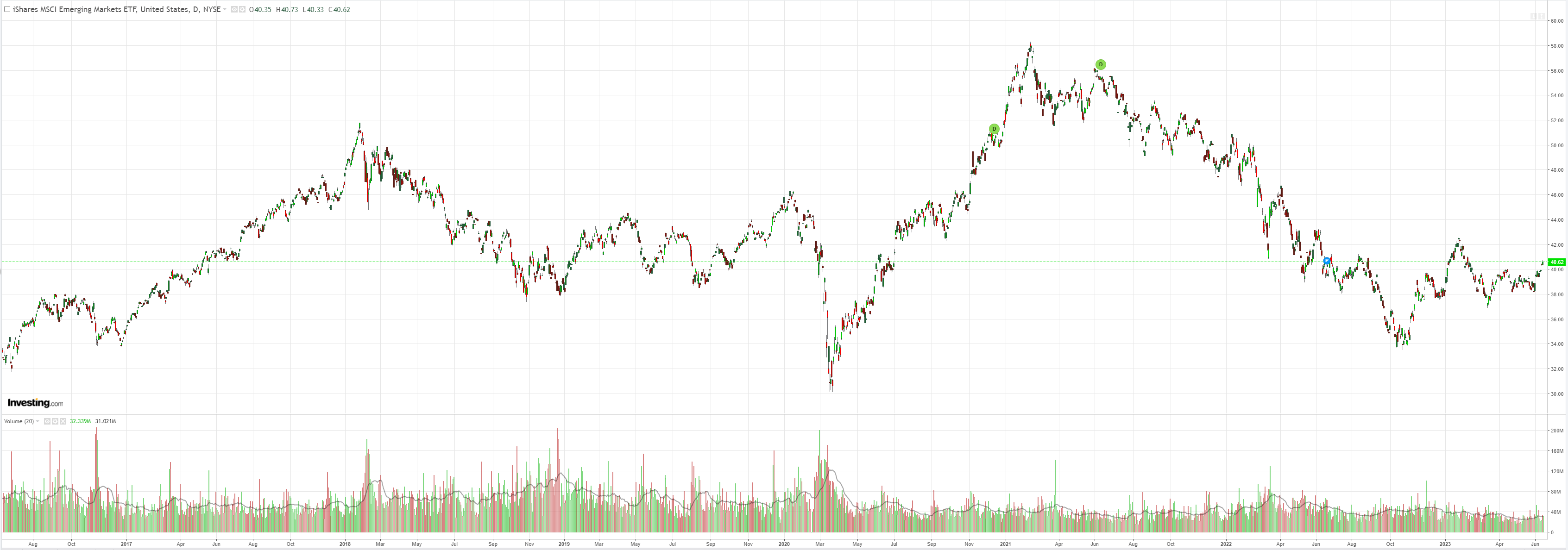

EM stocks having a crack:

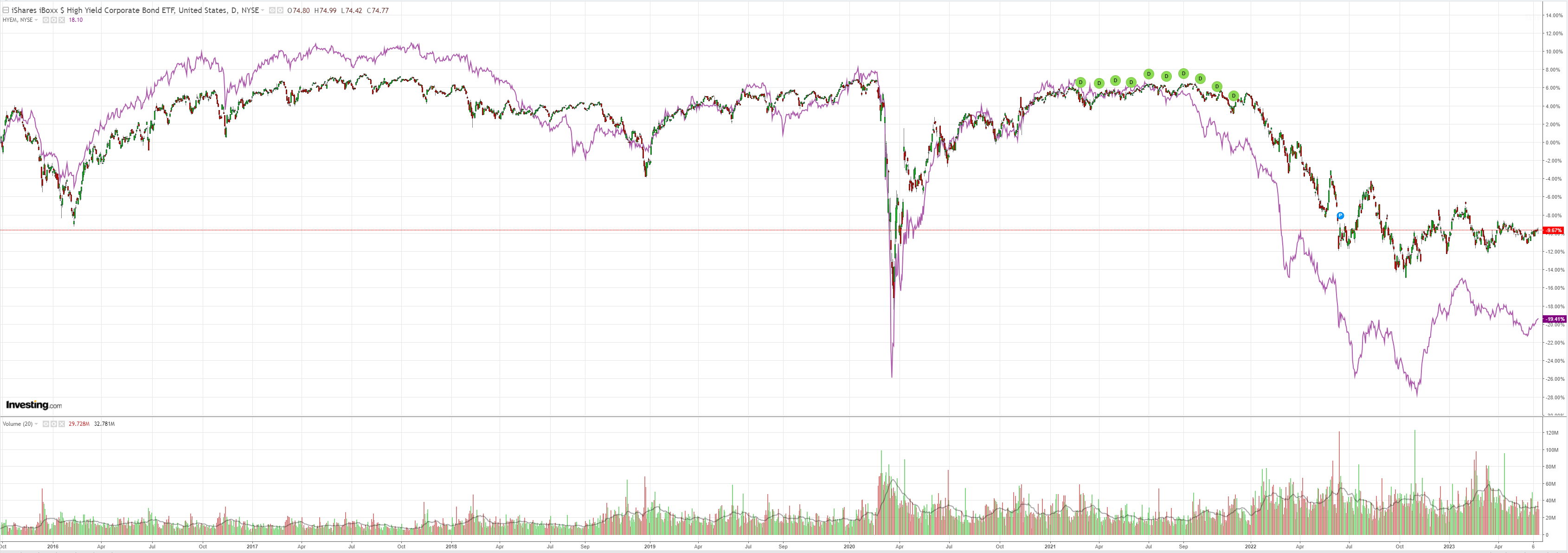

Junk yawn:

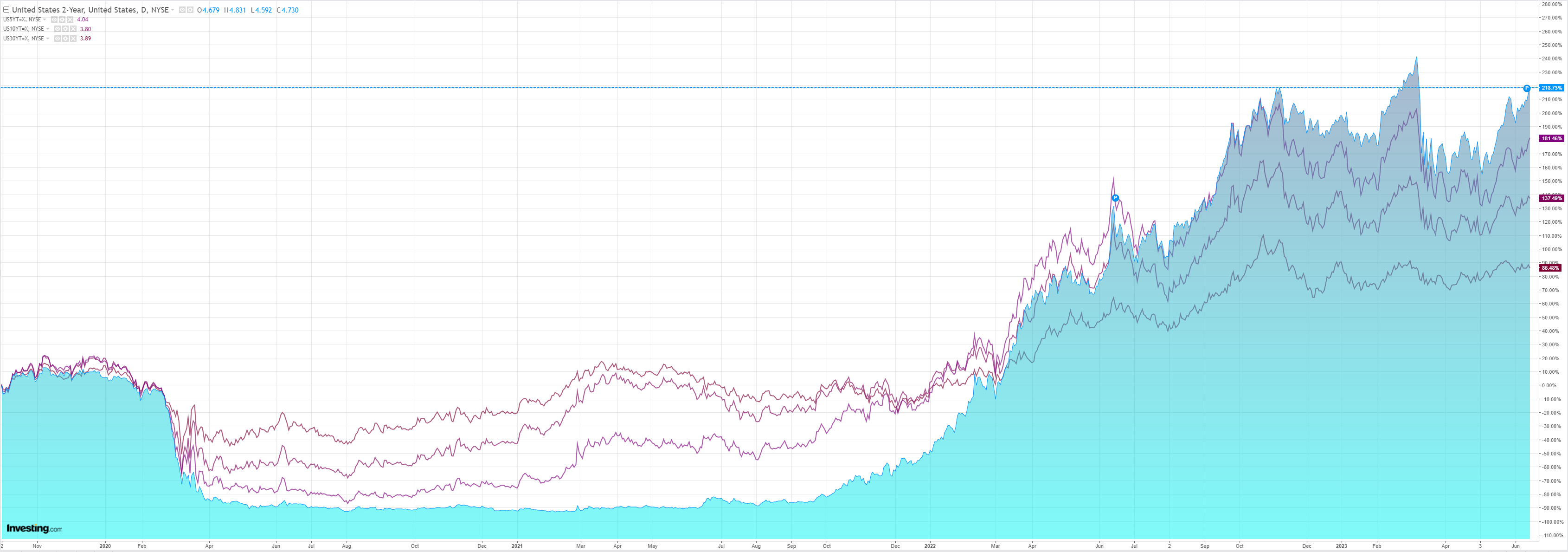

Treasuries backing up again, curve squashed:

Stocks only go up:

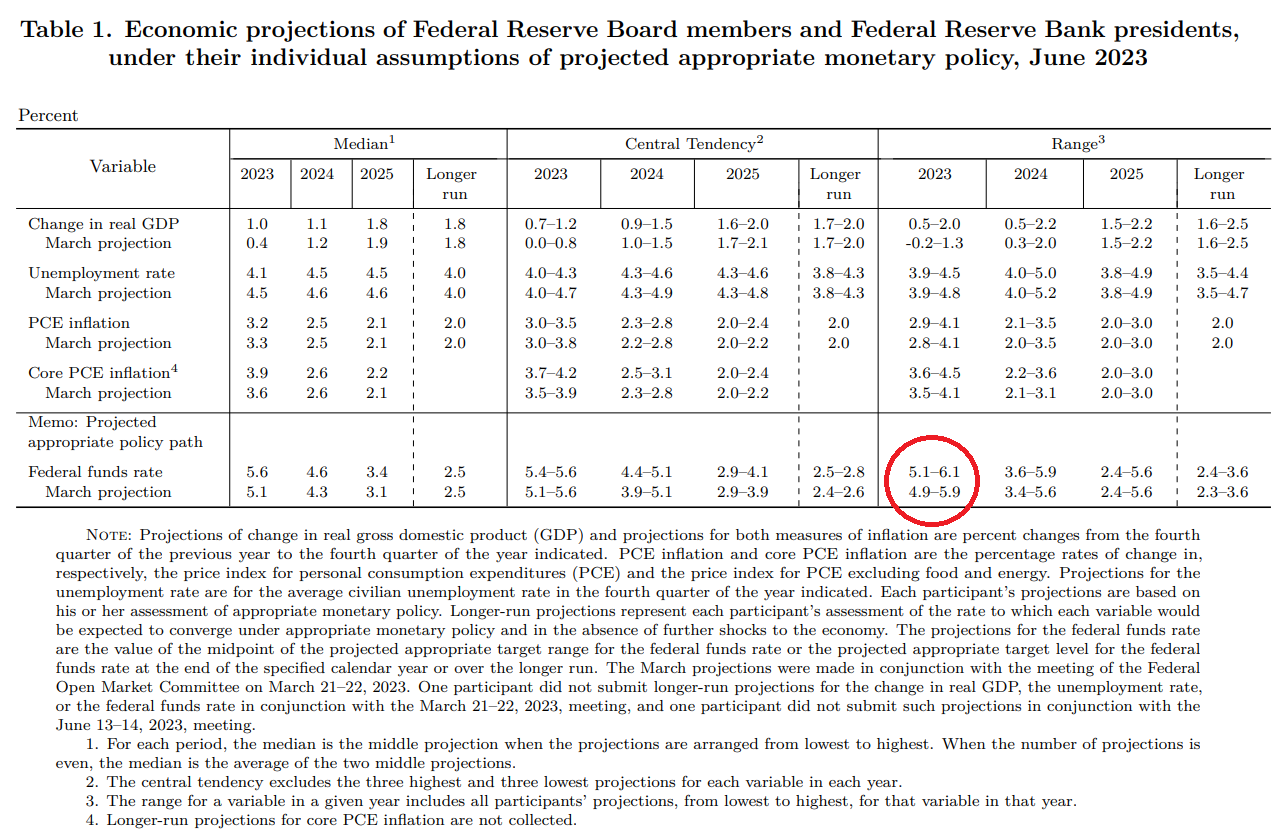

Basically, the Fed delivered a hawkish hold as expected. It also released its quarterly projections which suggest another two rate hikes:

Forex is still rerunning a mini-me version of the China reopening pattern:

- DXY sliding as the Fed slows and global growth is perceived as higher than the US;

- China stimulus helping it and Europe, lifting EUR;

- AUD up with commodities.

I have my doubts:

- The Fed is trying to kick one leg out and the higher markets go the more likely it will kick harder;

- Chinese stimulus is an all-or-nothing proposition given its liquidity traps, and

- Europe is heading for recession.

Beyond this short-term stuff, my base case is still a global recession, lower commodity prices and AUD.