Last night we heard from three Fed policy makers separately explaining their rationale for initiating liftoff at one of the Fed’s two remaining meetings of 2015 with the bulk of comments around unemployment, economic growth and whether international headwinds are actually a cause for concern while setting policy.

The highlight most definitely was St. Louis Fed president James Bullard’s appearance on CNBC’s Squawk Box program which saw him fire a few sarcastic parting shots at network personality Jim Cramer.

Bullard said that Cramer has more or less been cheerleading the Fed to keep interest rates near 0% because it will help the stock market. Calling this “unsavoury,” Bullard appeared clearly unhappy with Cramer’s commentary.

Although in Cramer’s right of reply I was expecting more fireworks, the exchange is still gold and well worth a look this morning!

With Bullard not a voting member of the FOMC, Federal Reserve Bank of Atlanta president Dennis Lockhart and San Francisco Fed President John Williams’ comments, while not as entertaining, were maybe more notable:

“I want to stress a basic point. Financial market swings per se are not my central concern. The broad Main Street economy is my essential concern.”

“In my mind, it was a close call.”

Hedging their bets and nothing we didn’t already know. Talk has become cheap and these sorts of comments don’t cause the moves that a hawkish Fed speaker or two once would have caused. Markets know it’s coming, now they just want to see action.

On the Calendar Tuesday:

Autumnal Equinox Day in Japan.

JPY: Bank Holiday

AUD: HPI q/q

GBP: MPC Member Shafik Speaks

USD: FOMC Member Lockhart Speaks

Chart of the Day:

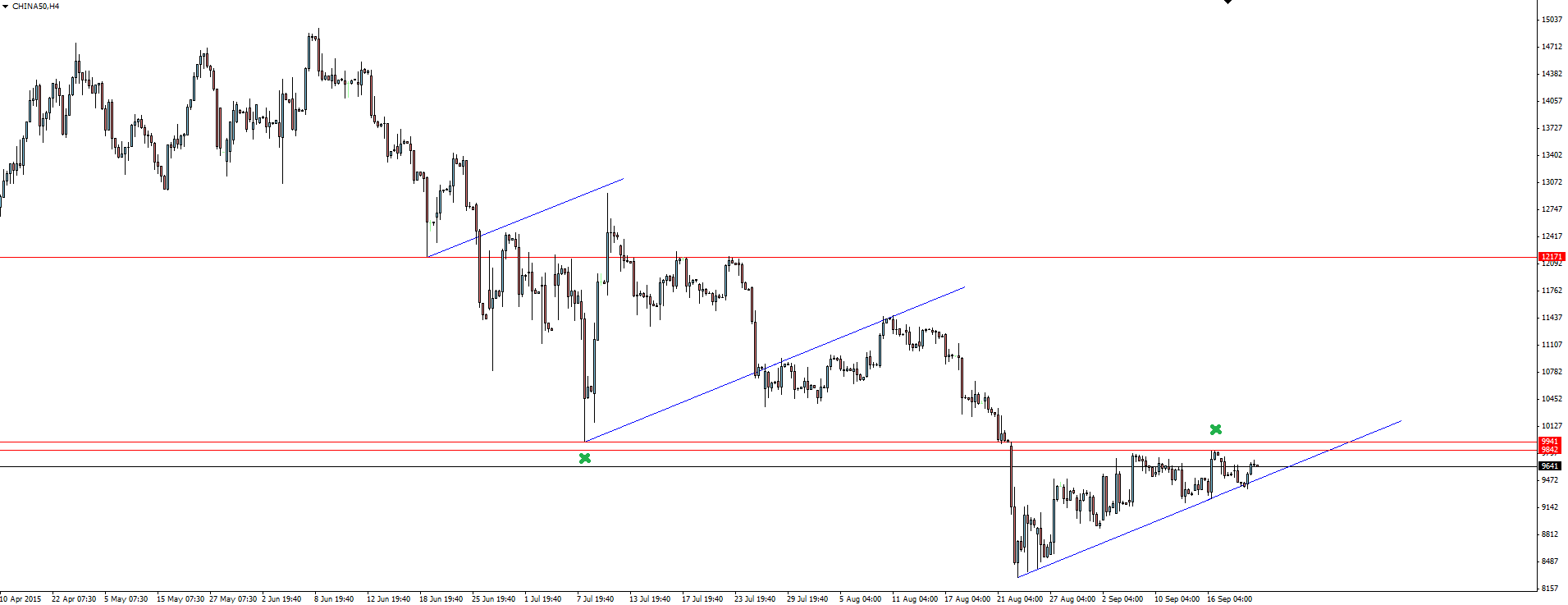

Back into the world of Indices trading today, with the look at the China A50 index chart.

The CHINA50 is not a market that gets a lot of attention but as we’ve said before, it’s a market that obeys technical levels nicely.

With Chinese stock indices in a well publicised downtrend, it’s interesting to note the technical structure of how price has stepped down between levels. As you can see on today’s chart, each time the CHINA50 has broken a level of support, it has flagged along a trend line and failed at the re-test of previous support now acting as resistance.

Price has again formed a flag pattern after breaking the most recent level of support and is currently re-testing previous support as possible resistance. Are you looking to position yourself for the breakout?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex Broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade Forex. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.