Animal spirits have come off the boil lately, but these are still early days for deciding if risk-on sentiment for equities has hit a wall or is in a holding pattern that allows markets to consolidate the gains of late. The analysis arises from a set of ETFs to gauge the risk appetite, based on prices through yesterday’s close (Apr. 24).

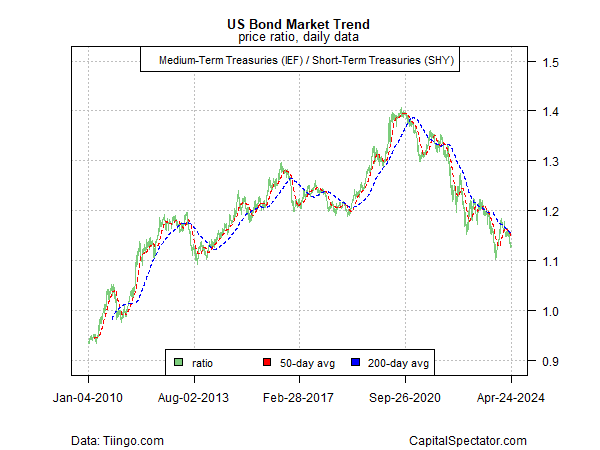

A key factor that could create trouble for stocks is the return of reflation pressures. So far, equities have been comparatively resilient. But further deterioration in bond prices will likely create stronger headwinds.

Today’s review updates a profile from earlier this month, which found that the risk-on bias for equities was intact. More than two weeks later, the signaling hasn’t changed much, which is to say that the recent weakness in markets has been relatively mild to date.

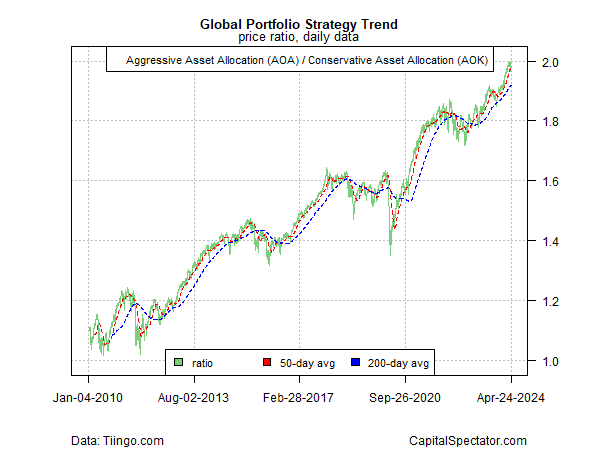

Let’s start with a big-picture profile based on an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). For the moment, this trend continues to defy gravity and remains near a record high—a sign that risk appetite remains strong.

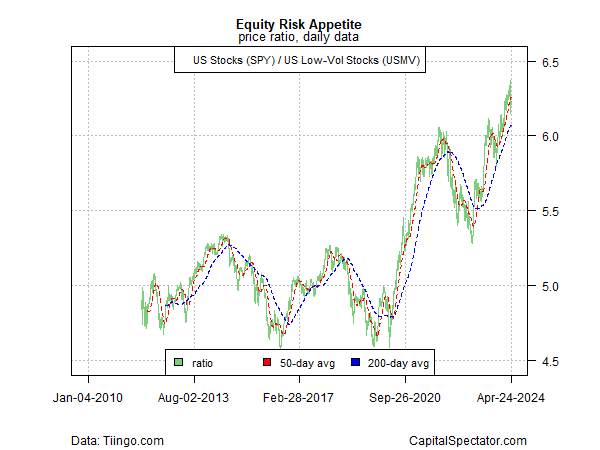

For US shares, a pullback in risk appetite is a bit more conspicuous lately, but the risk-on trend still looks solid via a comparison of US equities (SPY) vs. a low-volatility subset of stocks (USMV).

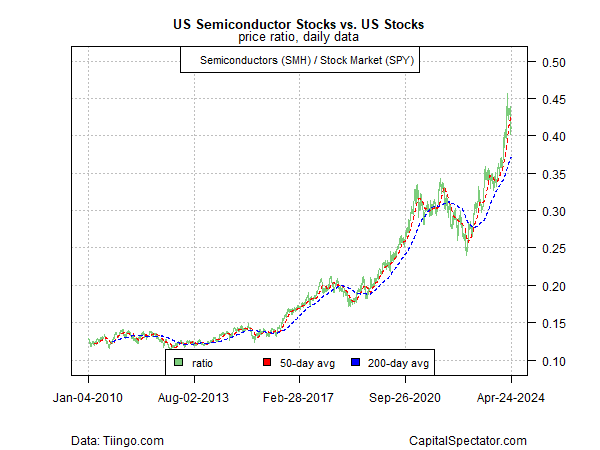

A key bellwether for monitoring the US risk appetite is also holding up rather well during the recent bout of selling, based on the ratio of semiconductor shares (SMH) (a business-cycle proxy) vs. a broad measure of US equities (SPY (NYSE:SPY)).

The bond market, however, remains a bearish outlier in the current environment, based on medium-term government bonds (IEF) relative to their shorter-term counterparts (SHY). The recent slide in this ratio suggests that US fixed income remains firmly in a risk-off condition.

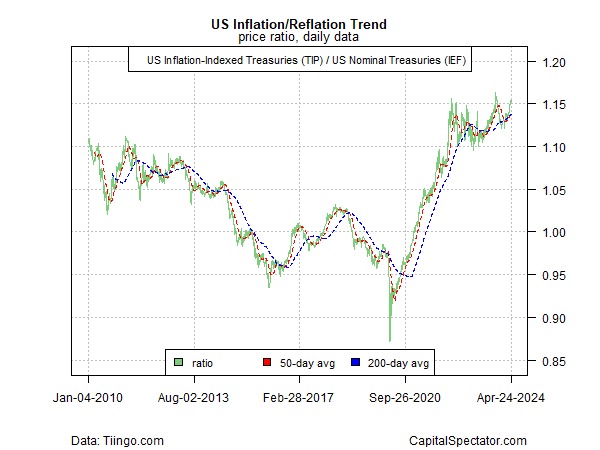

A crucial component of the headwind for bonds is the hint that reflationary risk may be brewing anew, based on the ratio of inflation-indexed Treasuries (TIP) vs. medium-term government bonds (IEF). This indicator has rebounded recently, which suggests that the bond market will continue to struggle.

Will the fallout for bonds spill over into the equities market? For the moment, there’s been minimal collateral damage to stocks. But if the bond market continues to deteriorate, it’s hard to imagine that stocks won’t eventually pay a price.