Across Australia, there were 16,083 new dwellings approved in May, up from 11,161 in April, according to the ABS.

- In seasonally adjusted terms, the number of new dwellings approved in Australia rose 20.6% in May.

- However, the number of new private sector houses approved only increased 0.9%.

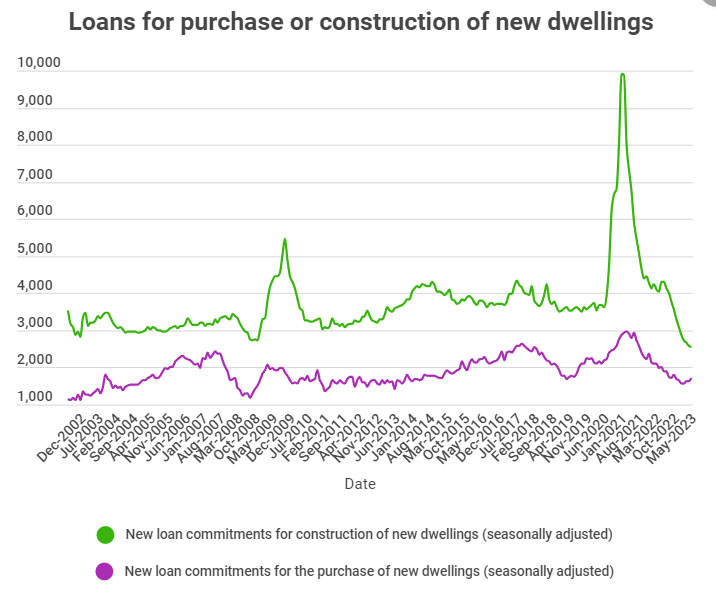

- Lending for the purchase or construction of new dwellings is 31.1% below this time last year.

However, most of this was non-residential, with the number of private sector houses approved rising just 0.9%.

Most of this increase can be put down to a huge jump in New South Wales, where there were 6,928 new buildings approved compared to 3,826 in April.

Again though, this jump was mostly non-residential, with 4,779 dwellings excluding houses approved compared to 2,295 in April.

Much of the residential activity was in apartment or attached dwelling approvals.

Daniel Rossi, ABS head of construction statistics, highlighted a large number of apartment developments approved in NSW in May.

Senior Westpac Economist Matthew Hassan says approval levels remain soft despite the apparent surge.

"The bottom line is that once we strip out what is very likely volatile high rise noise the underlying picture is much more subdued, pointing to at best approvals flattening out at weak levels through April and May," Mr Hassan said.

"With the effects of higher interest rates and surging building costs still coming through the front end of the dwelling construction pipeline, it's likely to remain subdued near term."

The National Housing Finance and Investment Coorporation (NHFIC) expects Australia to have 106,000 fewer homes than it needs by 2027.

AMP chief economist Dr Shane Oliver said with 400,000 migrants arriving this year - a 15 year high - this places further burden on the rental market.

"Talk of rising prices and shortages has in turn further boosted demand with an element of FOMO (fear of missing out) attracting buyers into the market who until earlier this year were still waiting for lower prices before coming back in," Dr Oliver said.

"At the same time the 'sticker shock' of rate hikes appears may have worn off for less interest rate constrained buyers, although this will likely prove to be temporary as rates keep rising."

Record low lending for new home building

The ABS also released lending indicators for May, which shows little sign of relief for housing shortages across Australia.

The number of loans issued for the purchase or construction of a new home rose 1.9% in May, but this year has still seen extreme lows, according to Tim Reardon, Chief Economist at the Housing Industry Association (HIA).

"[The May increase] still leaves the last three months 31.1% below the same quarter a year ago," Mr Reardon said.

He also said Australians shouldn't take much solace from the spike for new multi units approved.

"Approvals for multi-units rose in May by 59.3 per cent but this was driven almost entirely by New South Wales bouncing back from some exceptionally weak months. Nationally, approvals of multi-units still remain 9.9 per cent lower than at the same time the previous year," Mr Reardon said.

He said the impact of the cash rate increases are only just beginning to manifest in the number of construction loans, and future monetary policy decisions could further hamper construction.

"Every additional interest rate increase weighs further on [building] activity in 2024," Mr Reardon said.

"Experts warn not to be fooled by huge jump in dwelling approvals" was originally published on Savings.com.au and was republished with permission.