- Burry has been shorting U.S. markets since the pandemic

- In August, the renowned investor dumped all his positions and kept only one company: Geo Group

- However, Scion Asset Management's latest 13F filing shows that the "Big Short" investor has bought five stocks last quarter

One of the world's most acclaimed bears, Michael J. Burry—famous for making billions by predicting the 2008 subprime mortgage crisis, which inspired the movie "The Big Short"—has returned to the markets.

On Monday, Burry's Scion Asset Management filed a 13F for the quarter, revealing he added five new stocks to his company's portfolio. They are:

- California-based rocket, hypersonic, and electric propulsive systems manufacturer Aerojet Rocketdyne Holdings, Inc. (NYSE:AJRD)

- Saint Louis, Missouri-based telecommunications and mass media company Charter Communications (NASDAQ:CHTR)

- Nashville-based prison management company CoreCivic (NYSE:CXW)

- Bermuda-based telecommunications company Liberty Latin America Ltd. (NASDAQ:LILA)

- West Chester, Pennsylvania-based media conglomerate Qurate Retail, Inc. (NASDAQ:QRTEA)

Burry's pivot comes after the famous investor liquidated almost his entire portfolio in August to keep only one stock: Geo Group (NYSE:GEO), another American prison operator.

Interestingly, out of the five stocks purchased by Scion last quarter, three are in the heavily battered telecommunications sector—this year's worst performer in the S&P 500.

Despite his latest moves, Burry has recently stated that he still expects the general market to fall further. Still, as it appears, even the famed bear has begun to see buying opportunities out there.

You can check out Burry's portfolio, performance, and latest filings in InvestingPro.

Meanwhile, today's PPI numbers appear to have given the market renewed breadth. As of this writing, the S&P 500 is up 1.7%, while the NASDAQ Composite is jumping by 2.5%.

Cryptocurrency world aside, where the FTX affair is creating quite a few problems for the sector in general, global markets seem more positive after last week's inflation figures.

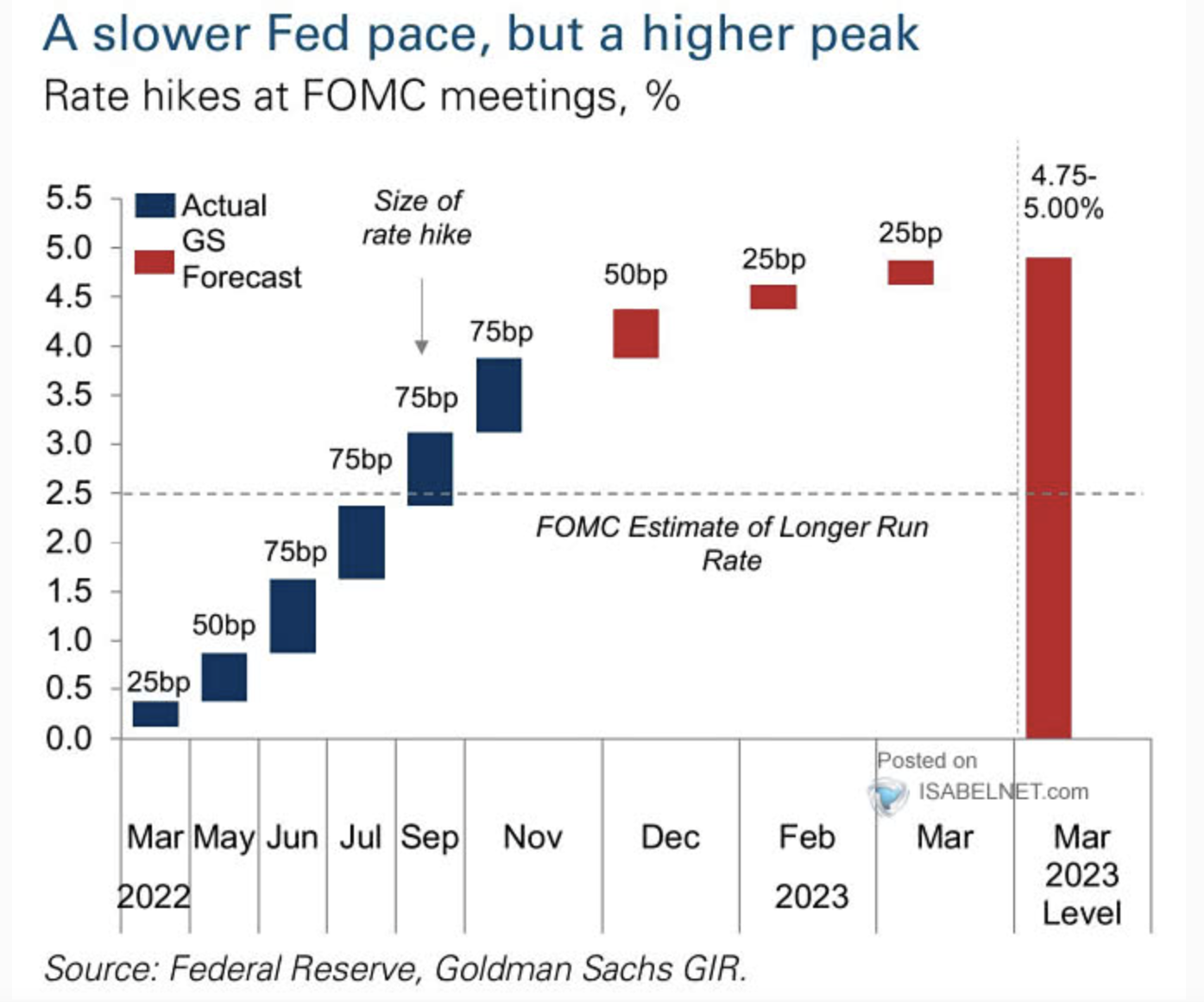

Below, I have given Goldman Sachs's estimates for upcoming rate hikes. As mentioned, I expect a 50 basis point increase in December and a total increase of between 5 and 5.50 percent from March to May as the final pivot point.

Source: Goldman Sachs

Therefore, Fed Chairman Powell's words will be even more important than the magnitude of the next hike by the Fed. Markets will surely appreciate it if he lets these hikes' so-called "light at the end of the tunnel" appear.

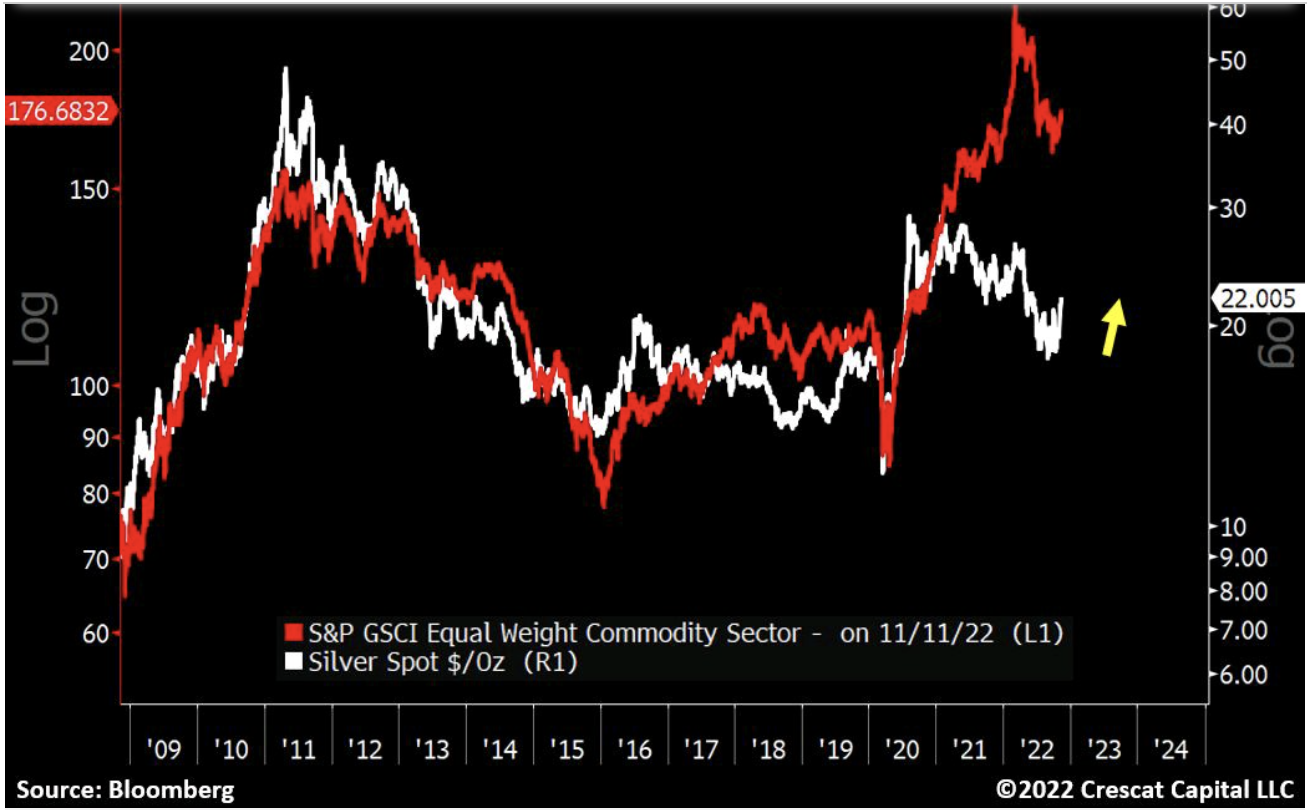

In the meantime, silver, which I reported a few weeks ago, continues to outperform. And it may have room for further recovery, as it is still lagging behind other commodities in the year. We shall see.

Source: Bloomberg

For the time being, we have to wait for developments in the next 2-3 weeks, the next Fed meeting, and then start to draw conclusions for 2022, which, as mentioned, could also have the right push to surprise investors between now and the end of the year.

Meanwhile, Warren Buffett and Michael Burry keep buying.

Disclosure: The author is long on the S&P 500 index.