- US dollar tumbled following weak US economic data

- Meanwhile, the EUR/USD pair has rebounded strongly

- The USD/PLN has broken a long-term uptrend, and the CAD/JPY is preparing to break out

Following Federal Reserve Chairman Jerome Powell's speech last week that didn't provide any clues regarding monetary policy, investors shifted their focus to macroeconomic indicators.

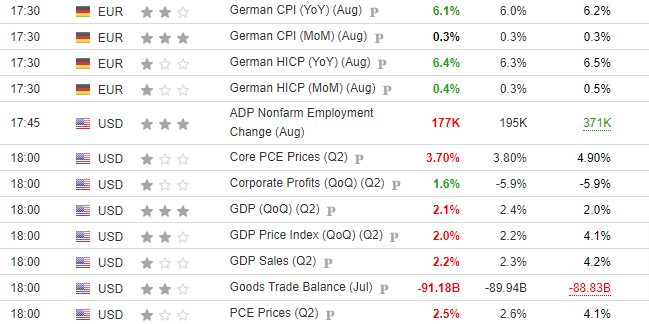

Yesterday's GDP, GDP price index, and ADP non-farm employment data came in lower than expected and the US dollar tumbled in response. This somewhat lowered the probability of another interest rate hike.

Source: Investing.com

Looking at the macroeconomic calendar, it's important to highlight the persistently high levels of inflation in Germany.

Although its downward momentum has slowed, the inflation rate remains consistently above 6% year-on-year. If similar data emerges for the entire eurozone, it could send a strong signal on the EUR/USD currency pair.

EUR/USD Rebounds After Prolonged Downtrend

The EUR/USD pair has declined for over a month, but that indicates a correction rather than a new downward impulse. Towards the end of the previous week, sellers approached the correction zone, situated around the price level of 1.0770.

The strong bullish response, influenced in part by a weakening US dollar, has signaled a bullish sentiment.

As we break through the upper boundary of the descending price channel, we're setting the stage for an attempt to breach the supply zone positioned around the price level of 1.12.

Conversely, the bearish scenario finds support around the 1.0650 region, where we saw the formation of local troughs in late May and early June.

USD/PLN Breaks Below Price Channel Bottom

Turning our attention to USD/PLN - the Polish zloty paired with the US dollar - we see a similar pattern to other dollar pairs.

The situation mirrored periodic strength in the US dollar, which in turn triggered corrective movements. For USD/PLN, this trend led us close to the supply zone near PLN 4.15 and also resulted in the formation of a head-and-shoulders pattern.

Sellers are likely targeting the 4.03 area, situated near the local support level, as their initial goal. The primary level that may draw sellers' attention is the July low, which has already dipped below the psychological PLN 4 per dollar mark.

In terms of defensive strategies, possible stop-loss placements could be considered above 4.15 or after a clear invalidation of the recent downward move.

In the medium term, it's crucial to keep an eye on the upcoming parliamentary elections in Poland, as regardless of the outcome, they are expected to significantly impact the Polish zloty's exchange rates.

CAD/JPY Preparing to Breakout?

Shifting our focus to CAD/JPY, let's examine its technical situation. August has brought about a tightening consolidation phase, hinting at a potential upward breakout.

This scenario gains traction due to the Bank of Japan's persistently dovish stance, suggesting no major changes to the monetary policy in the near future.

If an upward breakout occurs, the next logical target for the bulls would be the round-number resistance levels situated around 109 and 110 yen per Canadian dollar.

On the other hand, a breach of the lower boundary of the developing ascending triangle would be bearish, potentially leading to an extended consolidation ranging between 108 and 106 yen.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.