- Rising US unemployment and recession fears have weakened the US dollar.

- The EUR/USD pair is nearing the key 1.10 level, poised for potential gains.

- Economic data and a potential Fed rate cut could influence the EUR/USD direction.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Rising fears of a potential recession and escalating tensions in the Middle East have fueled anxiety in the market recently.

Investors are growing increasingly concerned about the potential for a recession as economic indicators point to a weakening growth outlook.

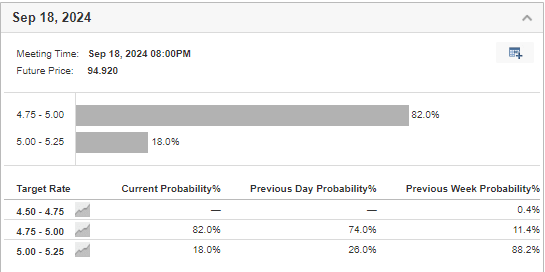

This heightened uncertainty, alongside the possibility of a larger-than-expected interest rate cut at the Fed's September meeting, has caused the US dollar to weaken, boosting the EUR/USD pair.

The EUR/USD pair is now challenging the critical 1.10 level, with a potential breakout poised to ignite further upside momentum.

Are We on the Brink of a Recession?

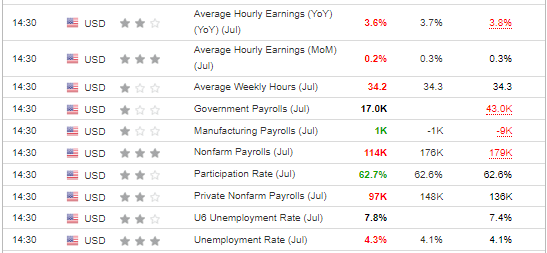

Investors are scrutinizing US economic data for recession signs. Interest rate cuts, typically a response to recessions, often coincide with deeper stock market declines. The market downturn began on Thursday after disappointing manufacturing data, exacerbated by unexpectedly poor payroll figures.

Yesterday’s ISM services index, which exceeded forecasts, provided some relief, preventing a more significant market decline. Upcoming economic health readings are crucial as further signs of a recession could deepen market losses.

Warren Buffett sold a major stake in Apple (NASDAQ:AAPL), which further fueled market anxiety, signaling a potential shift in investor sentiment. The Oracle of Omaha's actions underscore concerns about overvaluation in some leading names.

EUR/USD on the Brink of a Bull Market?

The weakening US dollar has fueled a strong surge in the EUR/USD pair, putting buyers in a dominant position. Currently, the demand side has stalled around the local resistance near the key level of 1.10.

Despite this pause, pressure on the 1.10 level remains. A successful break through this resistance could pave the way for a move towards the December highs near 1.11. Given the strength of the buyers and the absence of significant U.S. economic data this week, a reversal in direction seems unlikely.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.