Important Takeaways for EUR/USD and USD/JPY

· The Euro started an upside correction from the 1.0940 zone.· There was a break above a key bearish trend line with resistance near 1.1025 on the hourly chart of EUR/USD.

· USD/JPY started a strong upward move above the 122.00 and 123.50 resistance levels.

· Recently, there was a move below a major bullish trend line with support near 123.00 on the hourly chart.

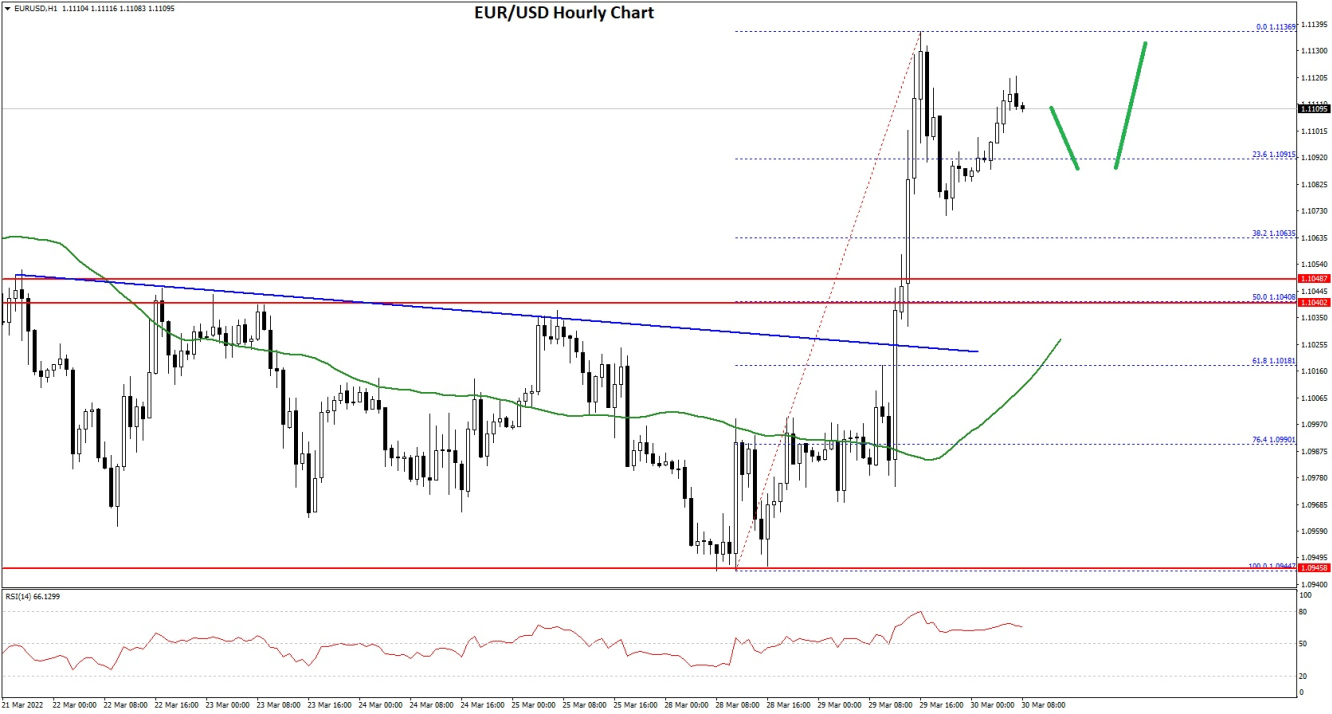

EUR/USD Technical Analysis

This past week, the Euro started saw bearish moves below the 1.1050 level against the US Dollar. The EUR/USD pair declined heavily below the 1.1000 support zone.The pair even broke the 1.0980 level and settled below the 50 hourly simple moving average. A low was formed near 1.0944 and the pair is now correcting higher. There was a move above the 1.1000 resistance levels.

Besides, there was a break above a key bearish trend line with resistance near 1.1025 on the hourly chart of EUR/USD. The pair climbed above the 1.1050 resistance and the 50 hourly simple moving average.

It formed a high near 1.1136 and is currently consolidating gains. It tested the 23.6% Fib retracement level of the recent increase from the 1.0944 swing low to 1.1136 high.

An immediate support is near the 1.1080. The next major support is near 1.1040 or the 50% Fib retracement level of the recent increase from the 1.0944 swing low to 1.1136 high, below which the pair could drop to 1.1000 in the near term.

An immediate resistance on the upside is near the 1.1120 level. The next major resistance is near the 1.1140 level. The main resistance is near the 1.1150 level. An upside break above 1.1150 could set the pace for a steady increase.

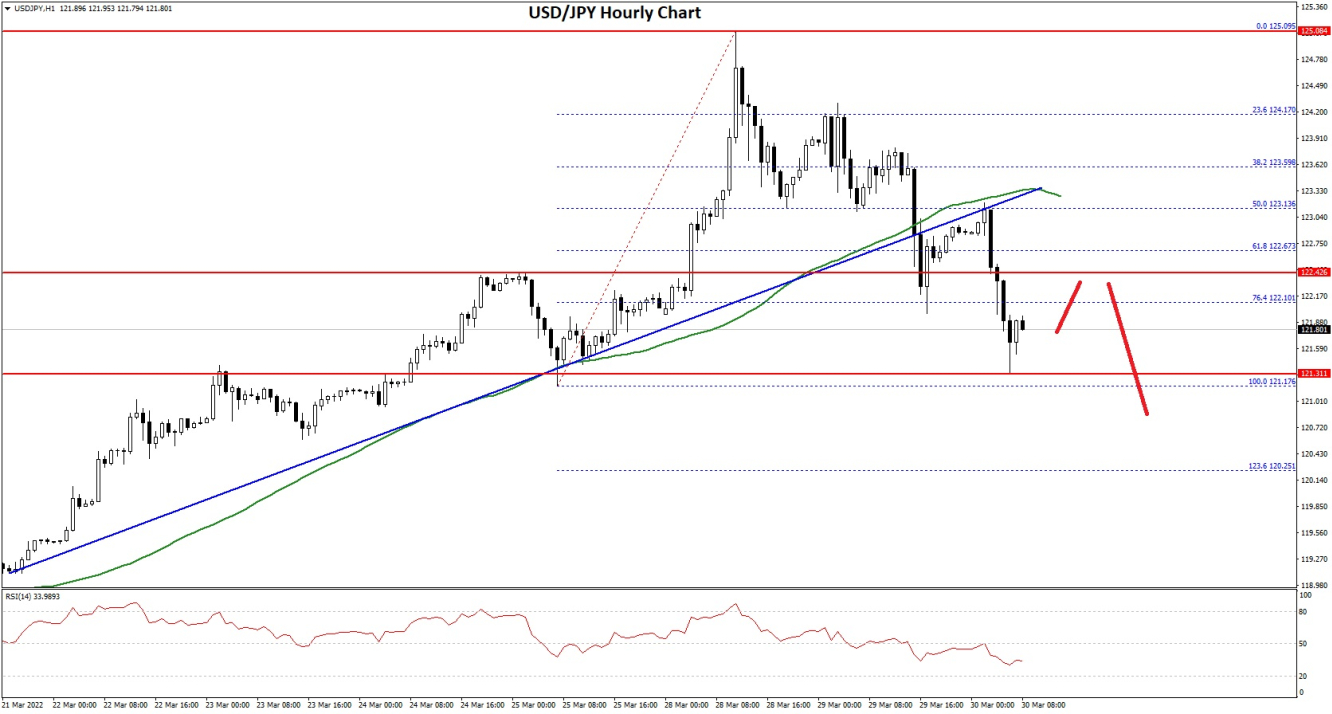

USD/JPY Technical Analysis

The US Dollar started a major increase after it broke the 120.00 resistance zone against the Japanese Yen. The USD/JPY pair broke the 122.00 level to move into a positive zone.The pair even traded above the 123.50 level and the 50 hourly simple moving average. It traded as high as 125.09 and is currently correcting gains. There was a move below the 50% Fib retracement level of the upward move from the 121.17 swing low to 125.09 high.

Besides, there was a move below a major bullish trend line with support near 123.00 on the hourly chart. The pair is now struggling below the 122.00 level.

An initial support on the downside is near the 121.10 level. The next major support is near the 120.25 level. It is near the 1.236 Fib extension level of the upward move from the 121.17 swing low to 125.09 high.

Any more downsides might lead the pair towards the 119.50 support zone, below which the bears might aim a test of the 118.50 support zone in the near term.

On the upside, an initial resistance is near the 122.50 level. The next major resistance is near the 123.20. Any more gains could send the pair towards the 124.00 level. The next key hurdle is near the 125.00 level.