A fall in US Crude Oil Inventories has set the oil futures market aflutter with renewed hopes of a stronger price for the commodity. Unfortunately, the oil bulls will likely be in for a very short celebration as the minor blip in prices will ultimately be unsustainable. In fact, the recent rally may be symptomatic of another plummet for oil prices in the coming weeks.

Undoubtedly, the current oil rally to around the 38.00 handle has been bolstered by the recently posted US Crude Oil Inventories result. The result came in at -4.94 Million, representing an appreciable fall from its historically high levels. Subsequently, the result drew the oil bulls out from their hiding places and the ensuing rally propped up the commodity's price.

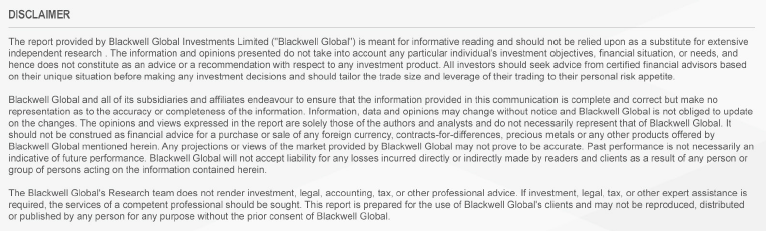

However, the move comes as little surprise given that the commodity had so recently become significantly oversold. If anything, the recent rally comes as a reaction to the stochastic oscillator reading and is simply being exacerbated by the US results.

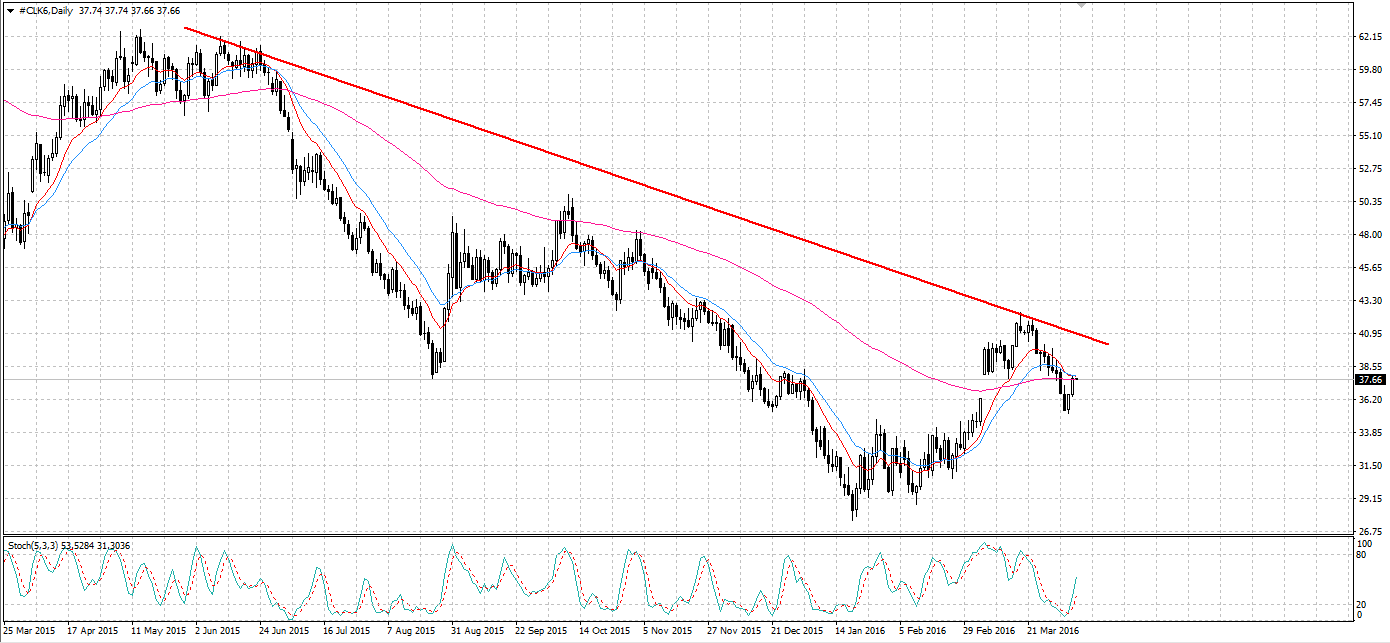

Even in the event that a rally did truly take off, oil is likely to be constrained by the long-term bearish trend line. As a result, the rally would only serve as a corrective movement in a consolidation pattern. Furthermore, the recent movement is explainable by looking at Fibonacci retracements. Specifically, the rally began as oil found support at the 50.00% Fibonacci retracement and has only really been temporarily pushed above the 61.38% retracement by the Crude Oil Inventories result. As a result, the commodity will eventually be pulled back as the bulls exhaust their buying power.

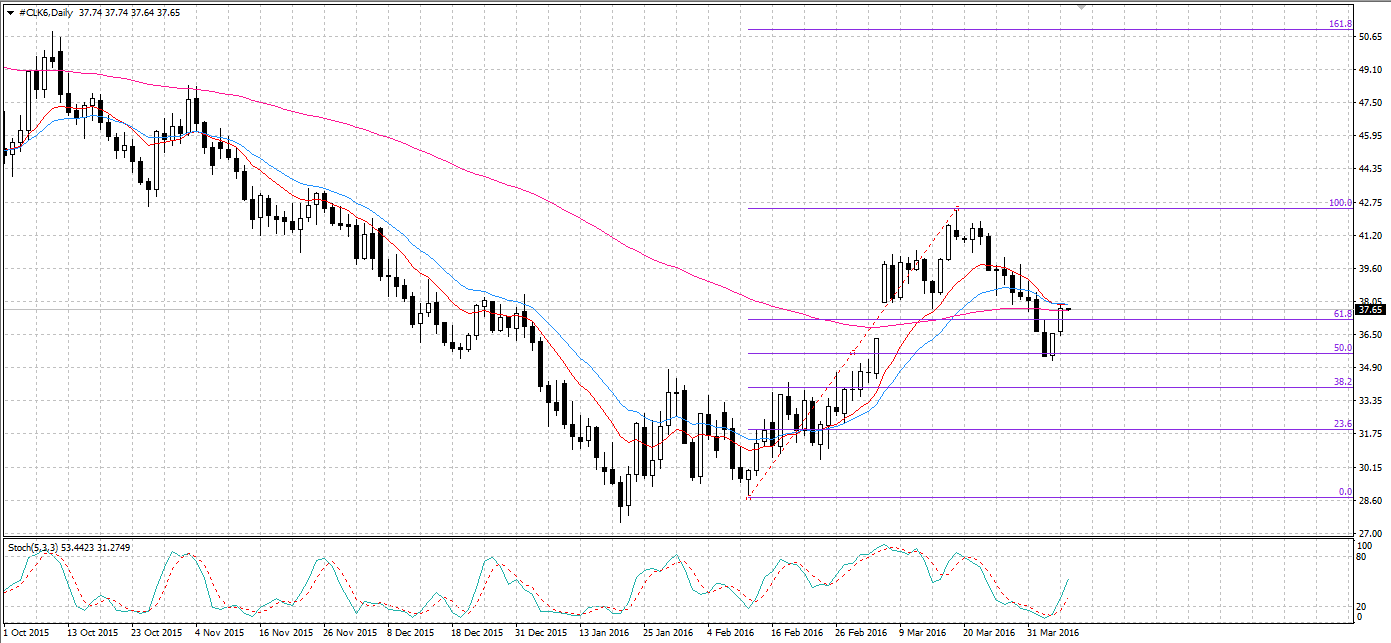

However, the downside movement may not be proportional to the upside movement we have just seen. Consequently, oil could be setting itself up for yet another plunge down to the 28.18 price level. Namely, a nascent Three-Drive pattern represents a real threat to high oil prices. As a result of this, the market will be watching for the formation of a second leg in the pattern whilst the effect of the Crude Oil Inventories result subsides.

Should the pattern be confirmed, the commodity could tumble down until finding support at the January low of 28.18.Subsequently, the commodity will become oversold and should correct itself by moving back to the 33.64 zone of resistance.

Ultimately, the completion of this pattern could leave oil back where it started before the OPEC-induced February rally. As a result, the OPEC Doha meeting on April 17th will be highly influential in assisting this pattern in completing.

Specifically, a failure to come to a comprehensive output freeze will go a long way in sending the price of oil plummeting. Conversely, an agreement to halt growth in production could upset the Three-Drive before it completes.