- The energy sector cratered nearly 30% in June and July following an impressive run to start 2022

- After oil climbed to $130 back in March, the market stabilized somewhat despite ongoing geopolitical tensions

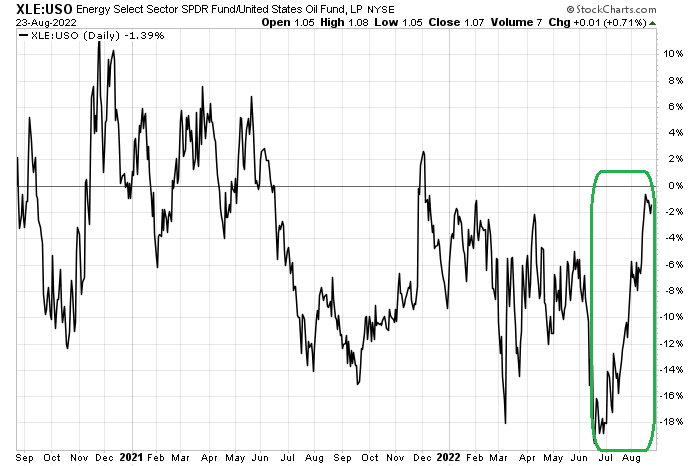

- Investors should monitor relative price action in energy shares versus the oil commodity for clues on sentiment in both markets

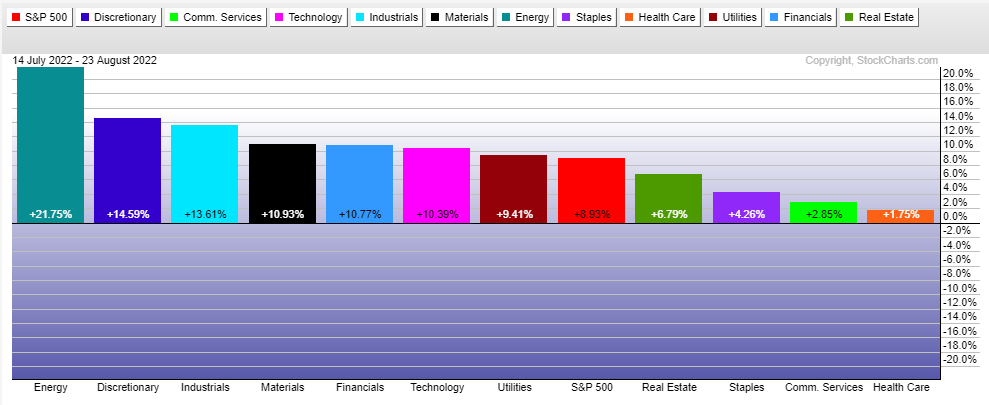

Don’t call it a comeback just yet. The energy sector has climbed on an absolute basis and relative to the S&P 500 over the past several weeks. The first half of 2022 featured tremendous outperformance among oil and natural gas names as a bevy of macro factors led investors to this cyclical and cheap market niche.

After the energy sector dipped to under 3% of the S&P 500 at its low in late 2020, the Energy Select Sector SPDR Fund (NYSE:XLE) more than tripled on a total return basis by this past June’s peak.

Unfortunately for the bulls, a nearly blow-off top in the group led to a hard and fast fall. XLE plunged 30% in a matter of weeks. However, since a low on July 14, energy equities are up more than 20%.

Energy Leads The Way

Source: StockCharts.com

All of this comes as oil prices trade not far from their lowest marks since January. The benchmark WTI crude oil prompt-month contract dipped to support near $86 on Monday before rumors spilled that the Saudis and OPEC+ sought to cut oil production after September, or even before then.

Moreover, parts of the Iran nuclear deal have also been called into question. Finally, oil traders continue to eye changes in levels at the Gulf Coast Strategic Petroleum Reserve (SPR) caverns which have been depleting lately.

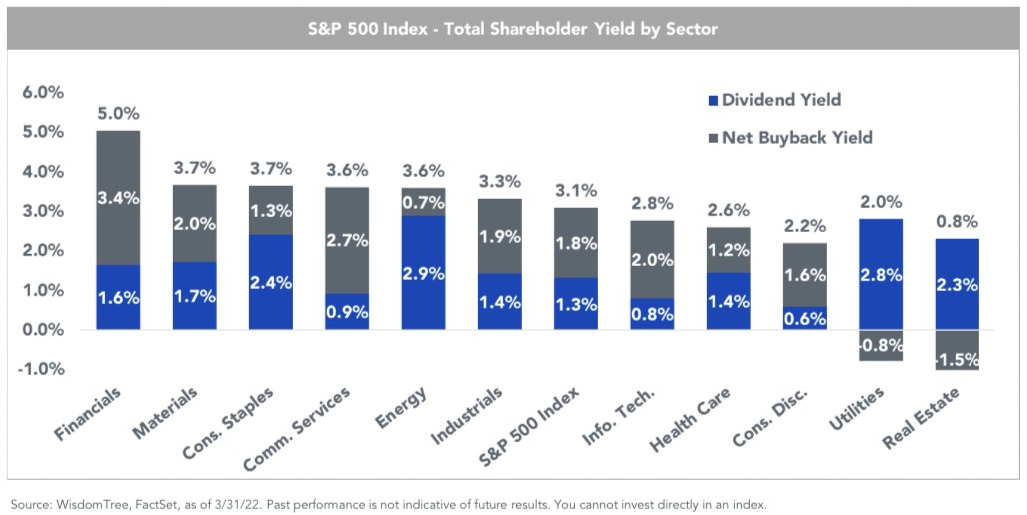

To say there are many shifting pieces in the energy market and oil patch is an understatement. Don’t forget about a strong second quarter earnings season for oil and gas companies, too. The group of stocks continues to pump out hefty free cash flow and is rewarding shareholders through dividends and buybacks.

Energy Sports The Biggest Dividend Rate

Source: WisdomTree

I like to see what’s happening with the price of energy shares relative to oil prices. As a technician, I can spot where the relative strength is. Right now, shares of oil and gas companies are beating the popular United States Oil Fund ETF (NYSE:USO). That is a bit of a trend change versus price action earlier in the year when USO was outpacing the XLE sector fund. Maybe the takeaway is that there is more optimism about the equities rather than the commodity after a geopolitically turbulent first half of 2022.

Energy Stocks Exhibit Recent Bullish Relative Price Strength To Oil

Source: StockCharts.com

That doesn’t mean tensions with Russia, a tentative Iran deal, and unpredictable OPEC+ moves are tossed aside by any means. I simply interpret the relative price strength among energy shares as a positive for the markets.

Most exploration and production players, as well as the big integrateds, remain highly profitable with oil hovering near $90 to $95.

Oil Prices Surged to $130 In March, But Now Sputter Near $94

Source: Investing.com

The Bottom Line

Investors should keep tabs on the relative performance of the energy sector versus crude oil prices. The comparative charts can provide clues on the sentiment snapshots of both oil equities and the commodity.

Disclaimer: Mike Zaccardi does not own any positions in the securities mentioned in this article.