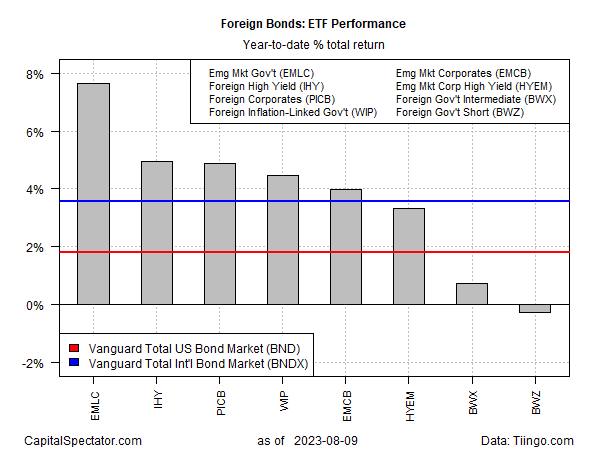

The global rise in interest rates may be peaking, a view that’s helped lift most corners of foreign bond markets year to date, based on a set of ETFs through yesterday’s close (Aug. 9).

Leading the rally: VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC). The fund is up nearly 8% in 2023. That’s well ahead of government bonds in developed markets ex-US with no currency hedging (SPDR Bloomberg International Treasury Bond ETF (NYSE:BWX)) and a foreign bond portfolio with currency hedging (Vanguard Total International Bond Index Fund ETF Shares (NASDAQ:BNDX)). EMLC is also outperforming a US investment-grade bond benchmark (Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND)) by a wide margin.

The downside outlier in the foreign bond space in 2023: is short-maturity fixed-income securities issued by governments in developed markets via BWZ, which is currently posting a slight year-to-date loss.

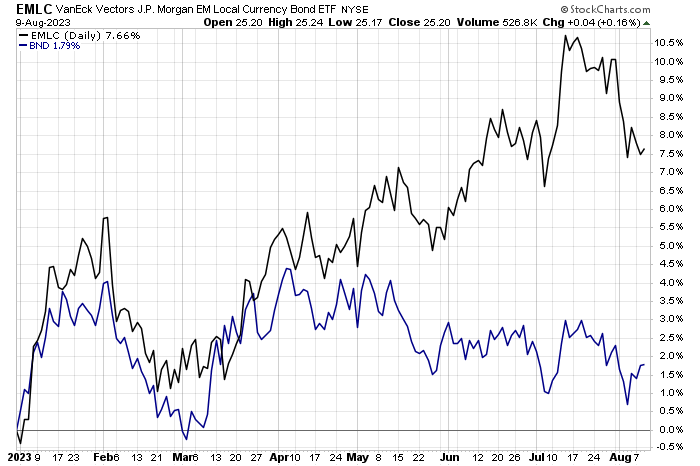

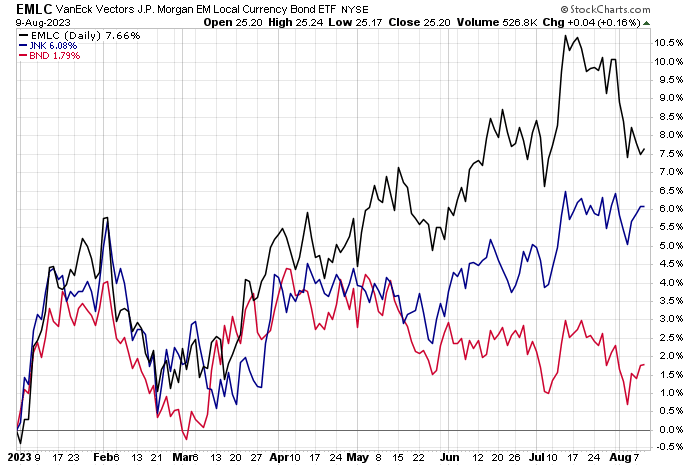

For nimble investors with a preference for tactical adjustments, the potential for exploiting low correlations between foreign and US fixed-income markets in the short term is alluring. Consider, for example, the recent rally in emerging markets government bonds (EMLC). Notably, the sharp rally contrasts with the flat performance of investment-grade US bonds (BND).

Then again, the recent rally in riskier tranches of fixed-income also unfolded in SPDR Bloomberg High Yield Bond ETF (NYSE:JNK), suggesting that US investors can still find opportunity without venturing offshore.

Should US investors own foreign bonds? It’s a hotly debated question, in part because there’s little, if any, consensus on how or whether to hedge currency risk, which can dominate performance and risk for US-based investors to a much higher degree with offshore bonds vs. foreign stocks.

Vanguard concludes “that maintaining a meaningful allocation to international bonds (30% of the total fixed income exposure) is a sufficient way for investors to improve risk-adjusted returns within their portfolios.”

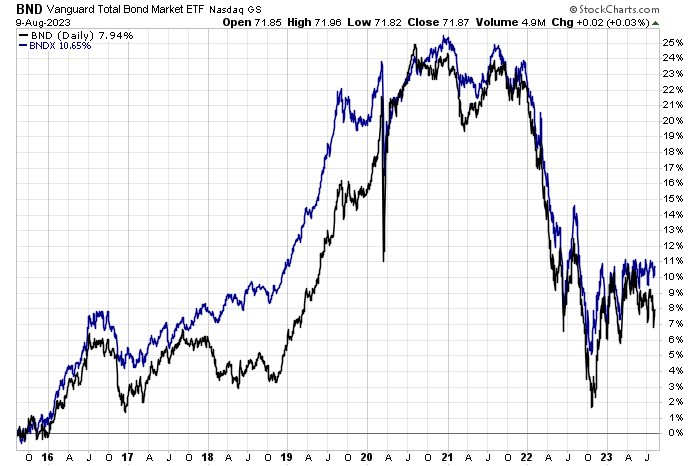

Perhaps, although Vanguard’s BNDX fund hedges out the forex risk, which begs the question: Does that negate most (or all?) of the international diversification benefits of foreign bonds?

Yes, or so it appears, based on performances in recent years for Vanguard Total US Bond Market Index Fund (BND) vs. Vanguard Total International Bond Index Fund (BNDX).

To be fair, global bond markets exhibit more than trivial differences in terms of risk and performance in the short term, and perhaps over the longer horizon too, depending on how you define foreign fixed income.

But the interest-rate factor, which appears to be increasingly driven by global forces, tends to drive results. In turn, minimizing global bond market beta in the search for diversification benefits is a bigger challenge compared with international diversification in equities.