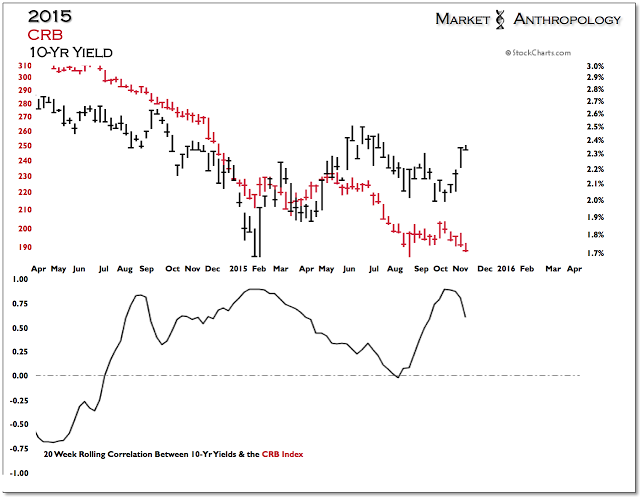

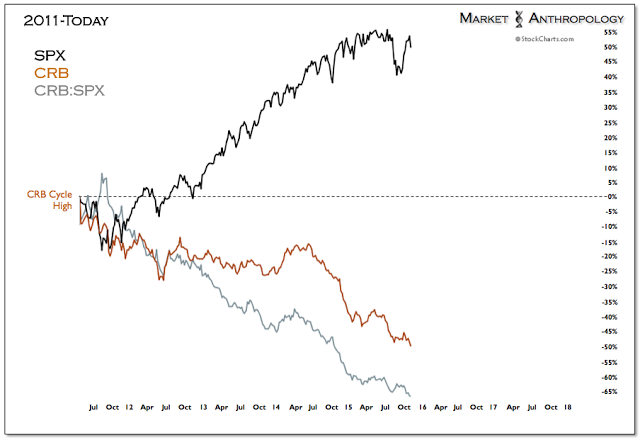

Of late, we've heard from a few macro traders that are looking for the Treasury market to catch up with the recent decline in commodities (Figure 1). Essentially betting that the dominant disinflationary trends established since 2011 are still firmly in place and driving broader market relationships, they offer the position (long/long-term Treasuries) presents good risk/rewards - considering the significant decline in long-term Treasuries over the past few weeks and assuming underlying market conditions have not shifted.

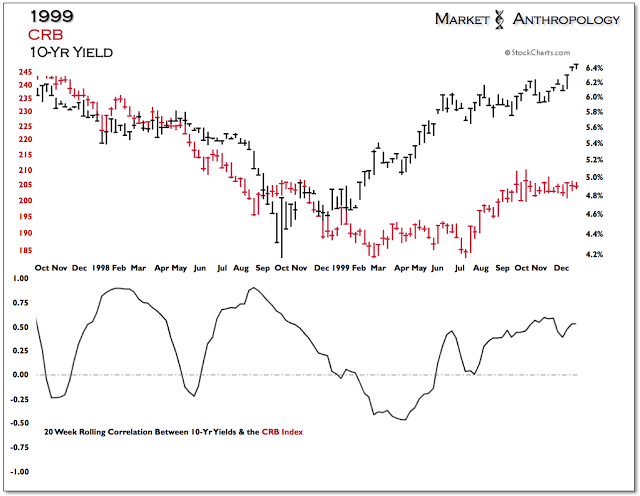

As much as we can understand the intuition of the trade based on recent market history, it would be made against the grain of how the inflation and interest rate cycle typically turns from an intermarket perspective (i.e, 1st yields -> 2nd commodities -> 3rd equities), which appears to be taking shape, albeit, along a roughly nine month horizon to date (yields February/commodities November?).

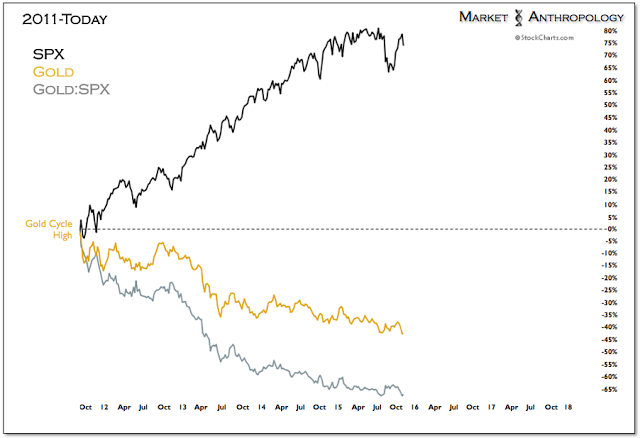

Our general view going into the end of the year is that long Treasuries does not offer a favorable risk/reward profile (see here) and suggest traders follow the move in yields that we believe points towards a cyclical shift higher in inflation, that should ultimately benefit the commodity sector relative to US equities and Treasuries.

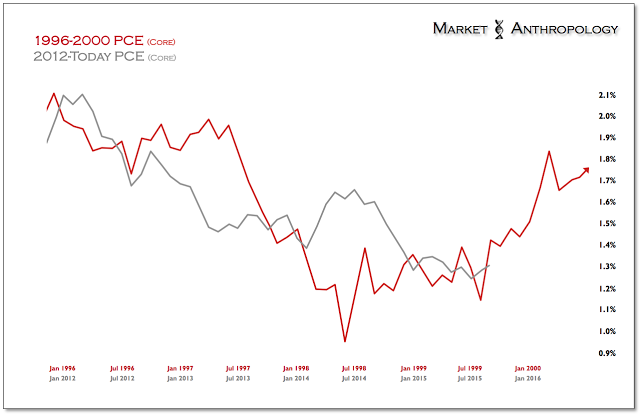

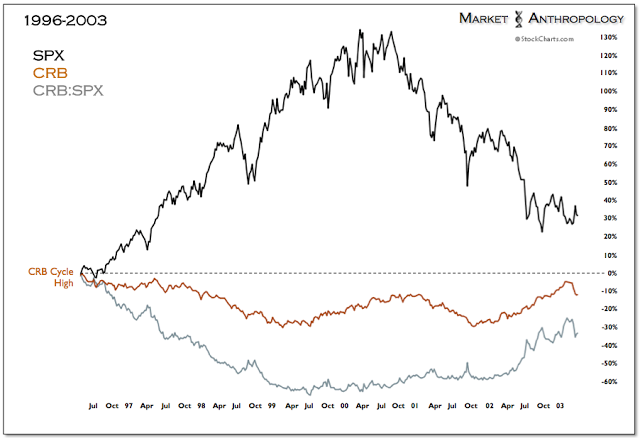

Although commodities (CRB) have remained a losing proposition as markets have become heavily influenced by the drawn-out data dependence of reading the Fed's tea leaves and ambiguities associated with ZIRP, there remain similarities with the previous major disinflationary cycle that exhausted in 1999 as the Fed shifted their policy stance.

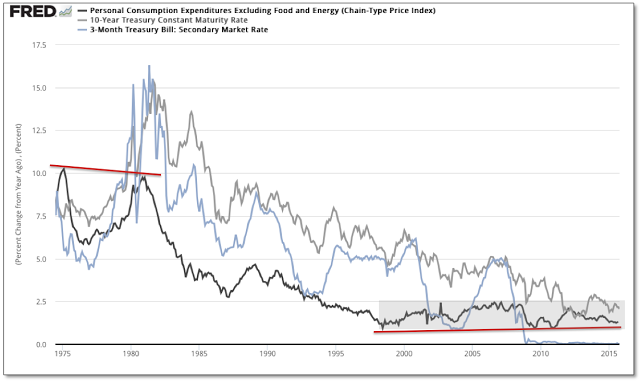

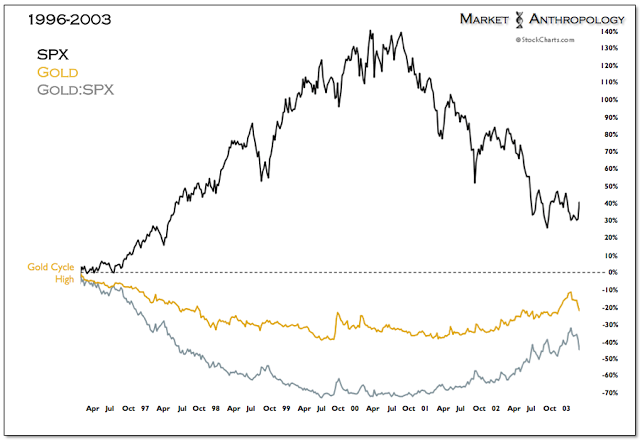

Just as inflation (core PCE) peaked and diverged well before the broader interest rate cycle turned down in the fall of 1981 and the secular bull market in equities began the following summer in 1982; inflation led the move lower into the bottom of the trough in the late 1990s and turned up just before the equity market cycle was cresting (Figure 3). This period also marked the secular lows for commodities, namely in oil as well as in gold.

Although we don't anticipate a bear market in US equities commensurate with the dot-com bubble, we do expect a similar cyclical shift between the equity and commodity markets that on a relative performance basis strongly favors commodities (long-term).

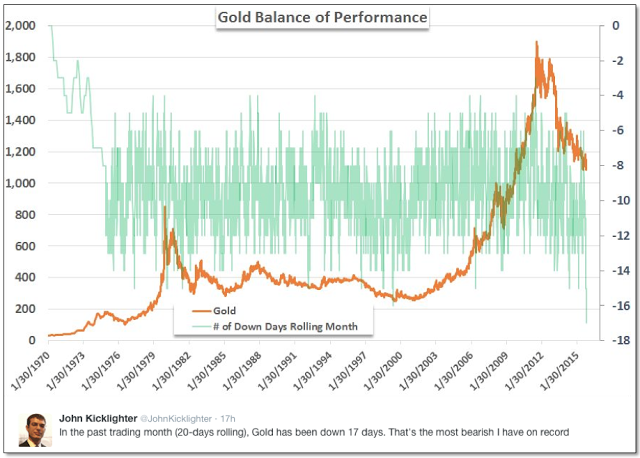

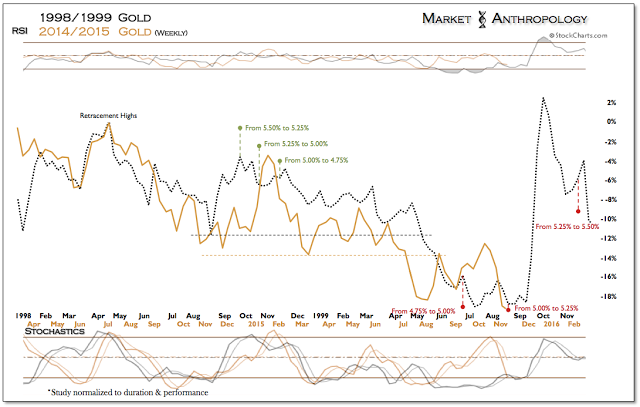

Gold, which has been lambasted lower on fears of rate hikes by the Fed over the past month back down to its August 5th closing low, just eclipsed its previous record this Wednesday from June 1999 of 16 down days in a month (rolling 20 sessions - h/t John Kicklighter - Figure 5). While it's safe to say it's been mostly a fool's game picking durable bottoms in gold over the past few years, recent action personifies market extremes, commensurate with gold's secular low in 1999 which took place directly after the Fed moved in June.

As we commented towards coming into the previous lows this summer (see here), although the actual shift by the Fed may roil gold over the near-term (Figure 6), it delineates that the economy has arrived in the late transition phase of the cycle, where commodities typically outperform equities as inflation finds a foothold and the virtuous disinflationary trend exhausts.