Overnight saw ECB President Mario Draghi speaking on monetary policy before the European Parliament’s Economic and Monetary Committee in Brussels.

Going by Mr Draghi’s high personal entertainment standards, last night’s speech was rather uneventful in both shenanigans and market moving material.

Draghi outlined the standard risks to Europe’s inflation and growth outlook having increased due to the emerging market slowdown but qualified the statement by stating that the central bank needs more time before deciding on the direction of any further possible stimulus and that the ECB is ready to beef up its 1 trillion+ Euro asset buying program if needed. A big hedge on the Fed if ever there was one.

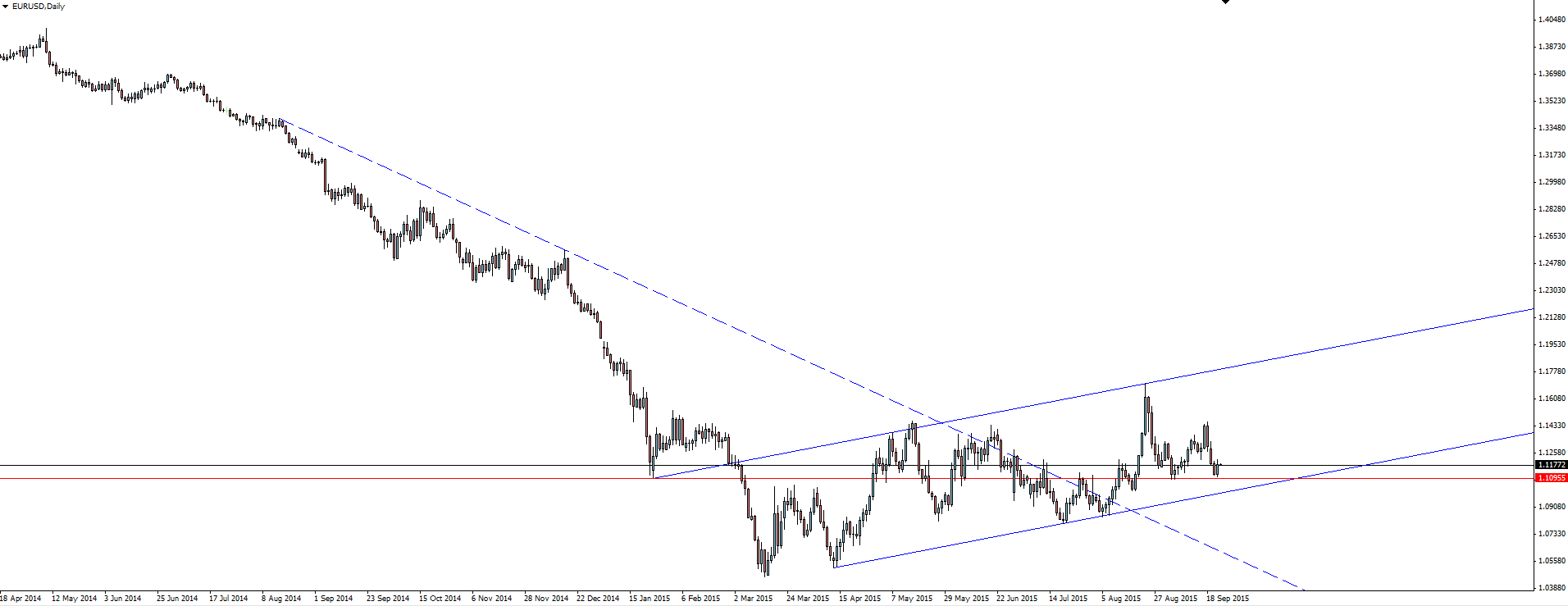

He went on to say that price growth will take longer than previously expected to rise back to the ECB’s target of 2%, but more evidence is needed to conclude whether China’s slowdown, the rising euro (see the chart below) and falling oil prices will divert inflation from its projected path.

“The asset purchase program has sufficient in-built flexibility.”

“We will adjust its size, composition and duration as appropriate, if more monetary policy impulse should become necessary.”

The deluge of PMI’s overnight didn’t alter the macro picture, but the Chinese Caixin Manufacturing PMI falling to its lowest reading in 6.5 years will continue to give central bankers soundbites.

EUR/USD Daily:

The Euro bounced off the level of interest we spoke about yesterday but while price is still in the middle of that short term channel, risk management for taking short term positions is still an issue for me.

On the Calendar Thursday:

NZD Trade Balance

EUR German Ifo Business Climate

EUR Targeted LTRO

USD Core Durable Goods Orders m/m

USD Unemployment Claims

Chart of the Day:

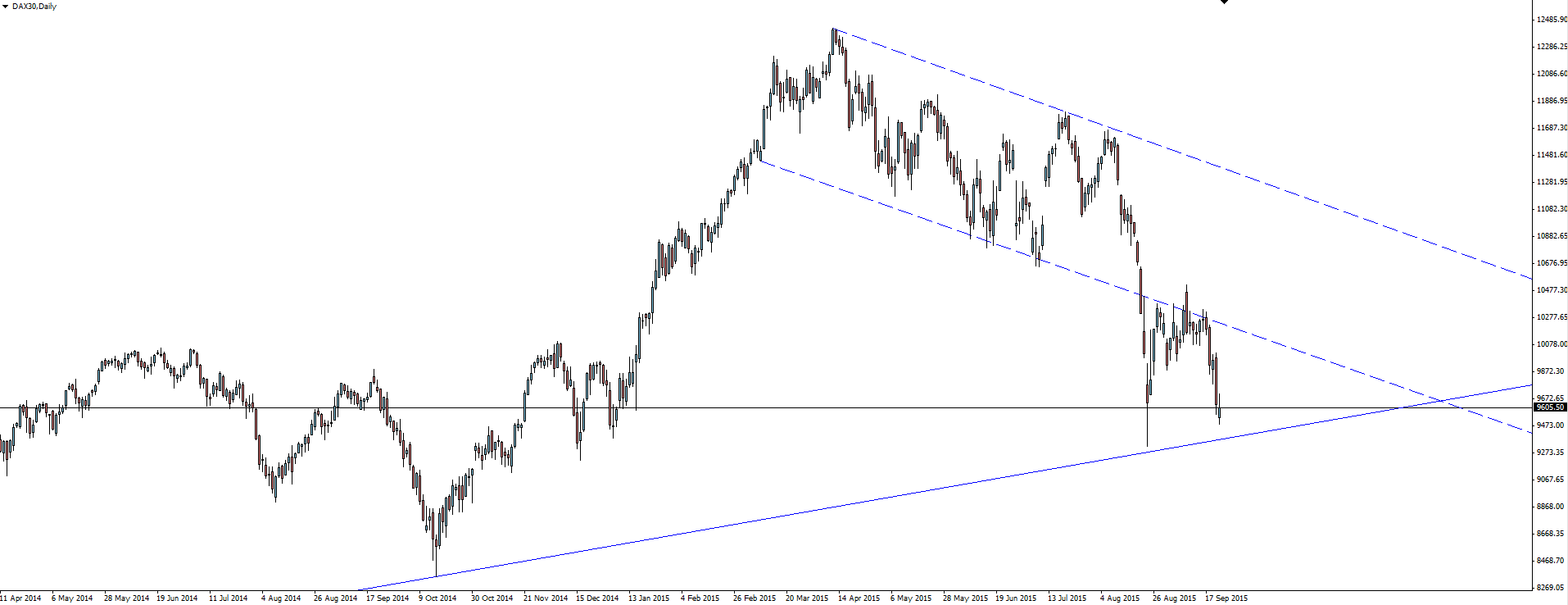

With the fallout from yesterday’s Volkswagen (XETRA:VOWG) emissions scandal starting to settle, the German DAX took quite a hit overnight during the European session.

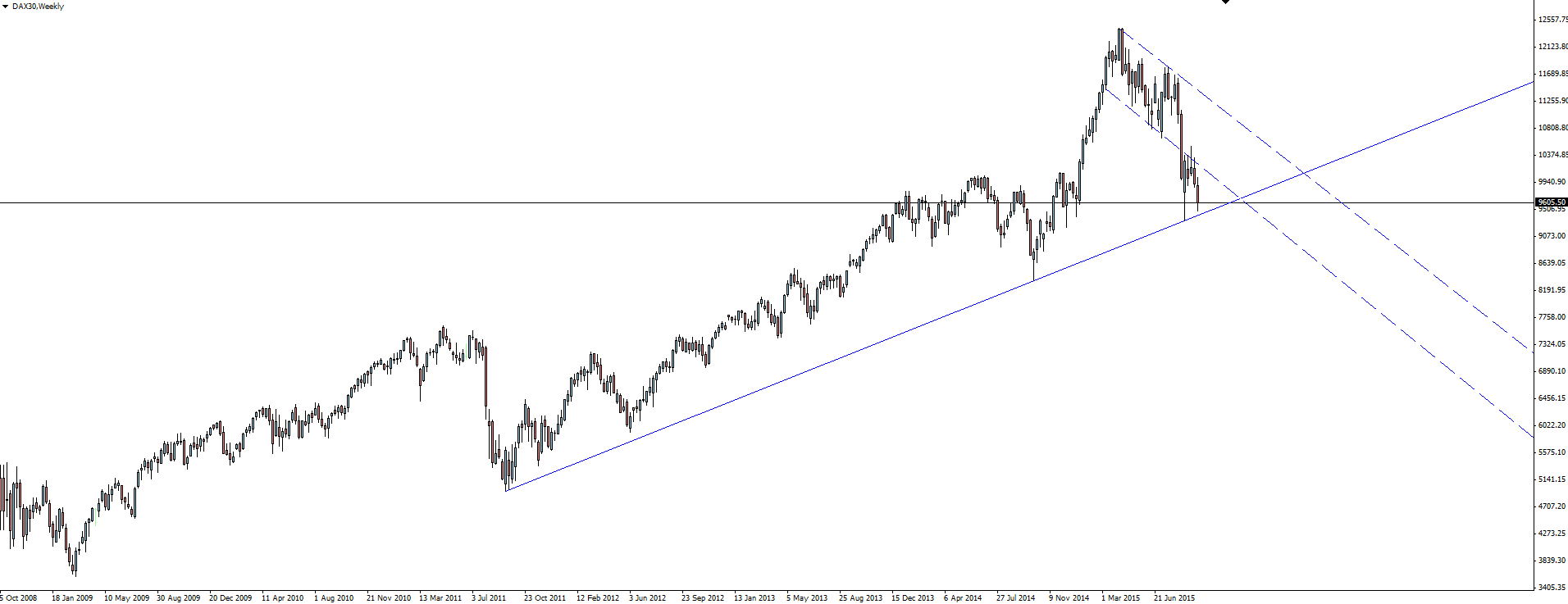

After featuring the DAX in our chart of the day section around a month ago, we today re-visit the German Index.

While still in a major bullish trend, price has pulled all the way back to weekly trend line support.

The daily has seen price kick down from where we were re-testing the short term flag support as resistance a month ago, providing a nice continuation short. Now with price back at both swing lows and major weekly trend line support, buyers surely wont be far away.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex Broker Vantage FX Pty Ltd, does not contain a record of our MetaTrader 4 prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade Forex. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.