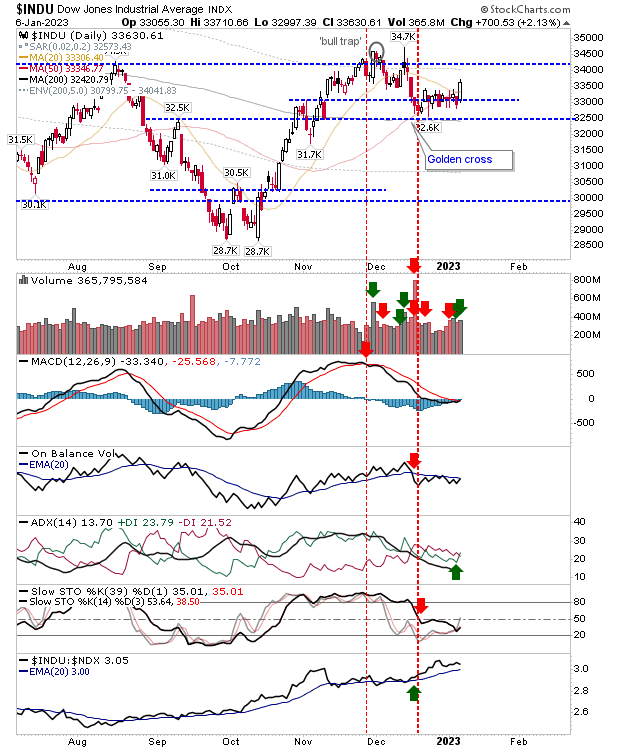

A healthy close to Friday's action saw confirmed accumulation across leading indexes, but not all managed to escape their trading ranges. The Dow Jones Industrial Average gained over 2% with a new ADX (trend) 'buy' trigger on higher volume accumulation, with new 'buy' triggers in the MACD and On-Balance-Volume in the works.

The only caveat is that momentum (slow stochastics) are in a bit of a no-man's land - I would want to see this cross the mid-line to restore bullish momentum. The Dow Jones is the index best placed to drive toward new all-time highs and carry other indexes.

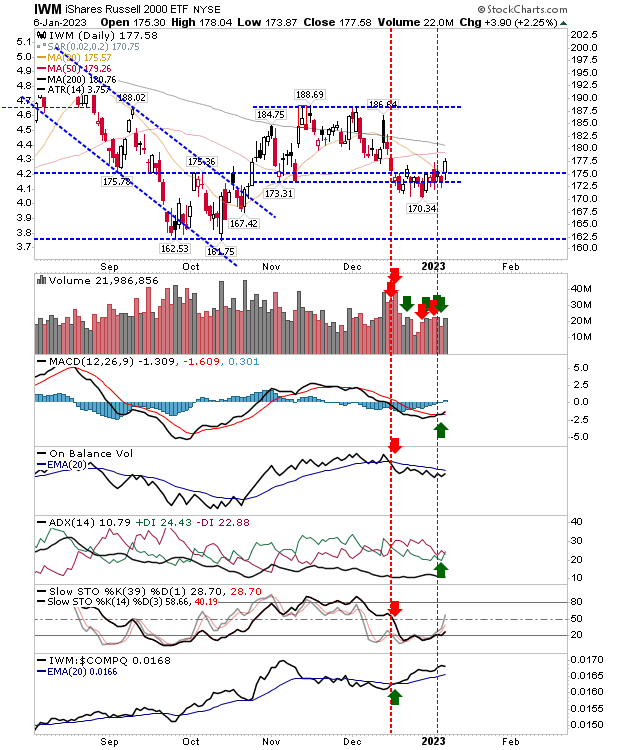

The other index which could mount a rally from here is the Russell 2000 (IWM). It closed with a move outside its trading range on higher volume accumulation, supported by a new MACD trigger 'buy' and ADX trend 'buy'.

The index has outperformed peer indexes and offers a trading opportunity. The risk-to-reward ratio can be measured from a loss of $170.34 (IWM) with upside targets of the 200-day MA and $188, a resistance from November.

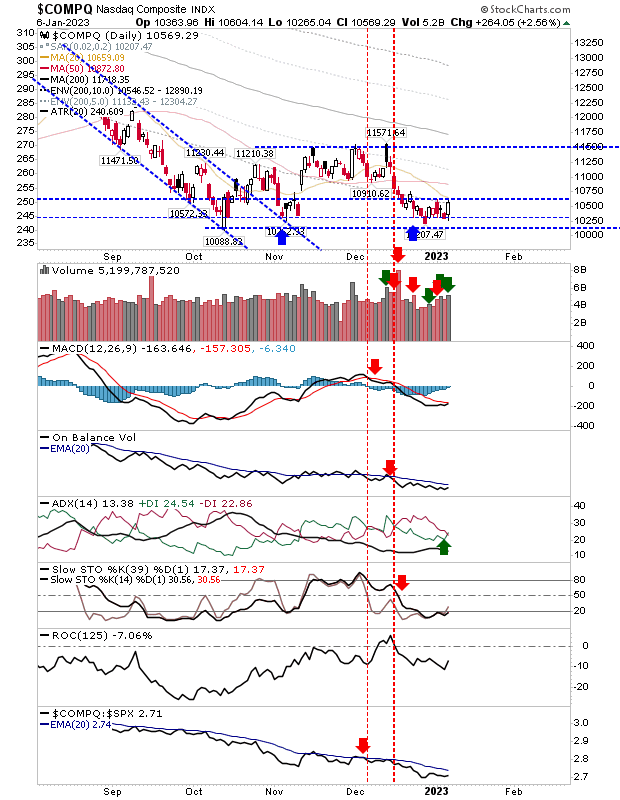

The Nasdaq 100 is where things go a little sour. Yes, the index recorded a +2.5% gain on higher volume, but this wasn't enough to take the index out of its range and is still pegged by 20-day MA resistance.

There was an ADX (trend) 'buy' signal, and it's close to a MACD 'buy', but really, we need to see a shift in the On-Balance-Volume trend if a meaningful rally can come out of here.

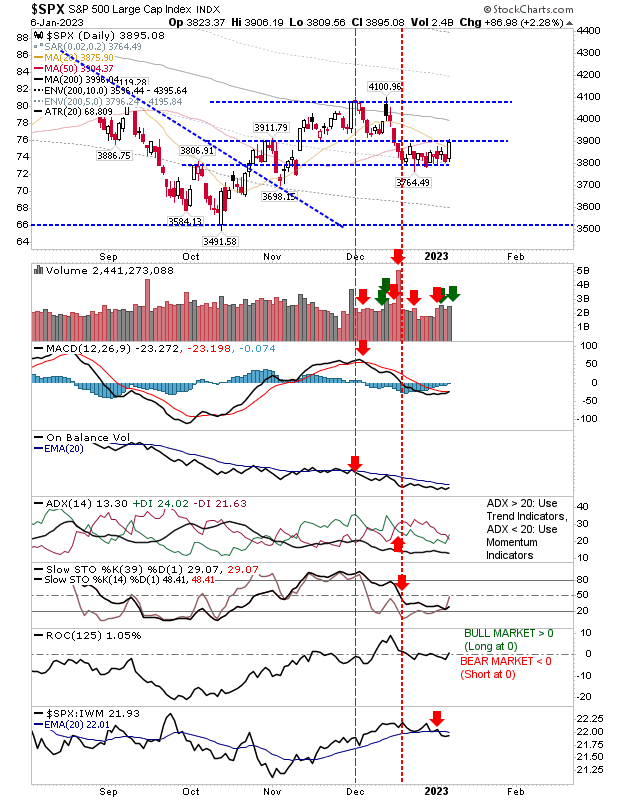

The S&P 500 is in a similar position to the Nasdaq, with a gain that hasn't cleared resistance and technicals still a net negative; it has much work to do.

The S&P 500 did close above its 20-day and 50-day MAs, but it needs to do more early in the week if there is a chance of gaining momentum from Friday's efforts.

We want to see a positive start to the week, defending Friday's buying - because losses will only keep indexes stuck in the mire and threaten the range breakouts for the Dow Jones Industrial Average and Russell 2000.