By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

With 7 days to go before one of the most dramatic U.S. presidential elections in history, politics is clearly overshadowing economics. According to the latest poll from ABC News/Washington Post, Hillary Clinton and Donald Trump are neck to neck with Trump leading Clinton by a single percentage point (within the margin of error) for the first time in nearly 6 months. The growing possibility of a Trump presidency has made investors nervous and they expressed their worries by selling stocks and the U.S. dollar. At this stage even an optimistic Fed may not be enough to rescue the dollar. The only hope is that the polls start to show a wider margin in favor of Clinton because otherwise, we could see greater financial market volatility and risk aversion.

For currency traders, it is important to recognize that the currencies that performed well well Tuesday are the same ones that rallied last Friday when the FBI reopened its investigation into Clinton’s emails. The Swiss franc, euro and Japanese yen were the strongest gainers, giving investors a sense of which currencies will do particularly well if Trump becomes the next President of the United States on November 8. The Canadian dollar barely budged but the Mexican peso dropped close to 2%. If Clinton wins by a solid margin, the same currencies that rose Tuesday will fall on November 8. However if the outcome is tight with one side calling for a recount, the uncertainty will trigger a renewed decline in the dollar, irrespective of the Fed’s plans for monetary policy.

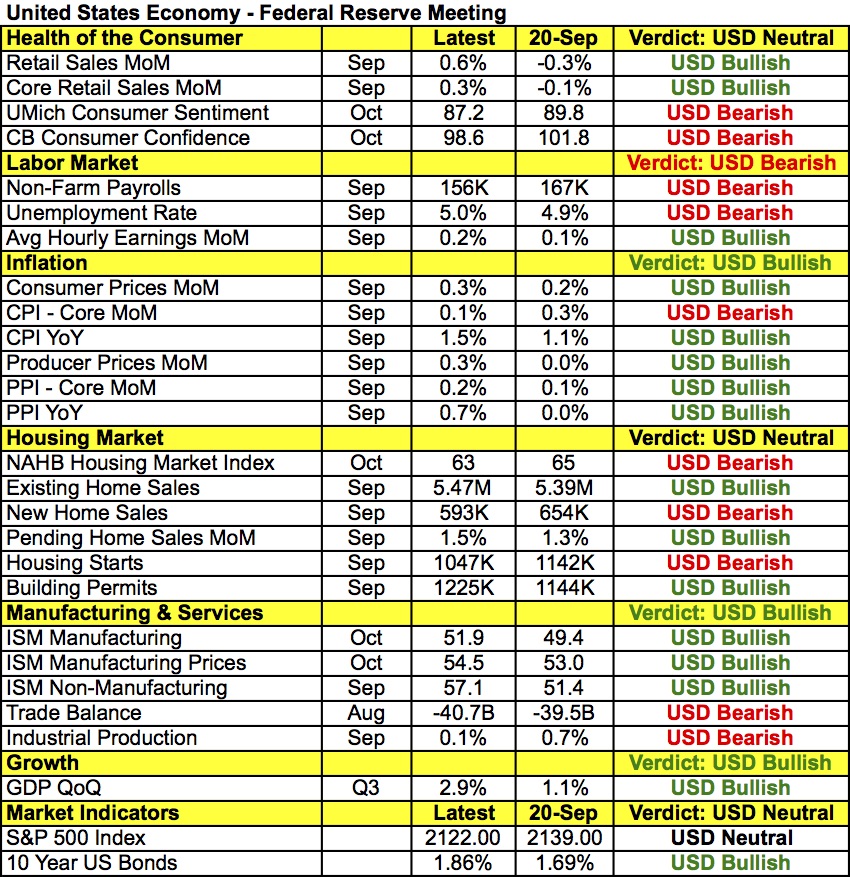

The U.S. dollar sold off Tuesday despite better-than-expected manufacturing data. The national ISM manufacturing index bucked the trend of the regional reports and rose to 51.9 from 51.5 in October. Treasury yields were up for the better part of the North American trading session but eventually succumbed to risk aversion. According to the table below, there’s been slightly more improvement than deterioration in the U.S. economy since the September FOMC meeting. Retail sales, manufacturing activity, earnings and inflation are up while consumer confidence and job growth slowed. Considering recent central-bank rhetoric and their general openness to raising interest rates once this year, there’s enough momentum in the U.S. economy to justify a rate hike. The FOMC statement should remain optimistic, highlighting the improvements in the economy. The same 3 Fed Presidents will most likely vote to raise interest rates immediately but if this changes in any way, U.S. fundamentals will return to focus. However if the FOMC statement remains virtually unchanged, investors could take the greenback lower as their focus quickly shifts back to politics.

USD/JPY broke below 104 Tuesday leaving 103 as the next major level of support level for the currency pair although some buyers could sweep in near 103.50. The Bank of Japan left interest rates unchanged and pushed out their forecast for bringing inflation back to target from 2017 to the 2018 fiscal year. The BoJ maintained a pessimistic tone, acknowledging the risks to inflation and growth despite a nice rise in the manufacturing PMI index.

Tuesday's best-performing currencies were the Swiss franc and euro. USD/CHF dropped to a 1-month low while EUR/CHF ended the North American trading session below 1.08 for the first time since June when it spent one day below this level the day after Britain decided to leave the European Union. Barring that big spike lower, this would be the first time EUR/CHF settles below 1.08 since December 2015. This is important because a strong franc invites intervention from the Swiss National Bank. A strong currency is a major problem for an export-dependent economy like Switzerland's and even though 2 years has passed, their decision to abandon the EUR/CHF peg in 2015 is a recent memory for many investors. SNB President Jordan reiterated his view that the franc is overvalued but now that the floor has been broken, we could see further losses as the SNB’s previous decision leads many speculators to bet that they won’t be in the market again soon. Meanwhile, with no major economic reports released from the Eurozone the strength of the euro was primarily driven by dollar selling and euro short covering. Resistance is at 1.1080 and even if the pair rises above this level, we believe that gains will be limited to 1.1150.

The Reserve Bank of Australia left interest rates unchanged, sending the Australian dollar sharply higher. Unfortunately, the rally lost momentum as U.S. dollar selling dominated trade. Despite some deterioration in labor-market conditions, the RBA remained optimistic with the statement containing a relatively positive tone. That combined with the rise in manufacturing PMI gave investors the confidence that the bias of the Reserve Bank is firmly neutral. Chinese manufacturing data also surprised to the upside, raising hope that the slowdown in Asia’s largest economy is easing. These developments should continue help AUD outperform other major currencies in the coming weeks. The New Zealand and Canadian dollars also traded higher versus the greenback. NZD was helped by the latest GDT auction, which saw dairy prices rising 11.4%. This increase was the second consecutive rise and the largest since the 16th of August, when prices rose 12.7%. The Loonie decoupled from oil Tuesay due in part to Canadian data. GDP matched expectations with an increase of 0.2% for the month of August. Although this increase was still less than the 0.4% rise in July, it shows that the country’s economy is still expanding. NZD was in focus Tuesday night with employment numbers scheduled for release.

Lastly the only currency that performed worst than the U.S. dollar on Tuesday was the British pound. Sterling failed to benefit from dollar weakness because of disappointing data. The U.K.’s Markit Manufacturing PMI index missed expectations coming in with a reading of 54.3 versus 54.4 expected. This report shows that the weaker currency failed to provide a significant boost to economic activity in October. The currency pair originally hit a 12-day high of 1.2280 before pulling back slightly to end nearly unchanged. No data is expected from the U.K. on Wednesday but Thursday will be a big day for the British pound with the Bank of England monetary policy announcement and Quarterly Inflation Report on the calendar.