- Embracing patience in investing can significantly enhance your chances of long-term success.

- A simple strategy of holding investments for 10 to 15 years yields impressive odds of profitability.

- Often, the most effective approach is to resist the urge to overtrade and focus on a steady, long-term plan.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

When investing, doing less can often be more productive than overtrading.

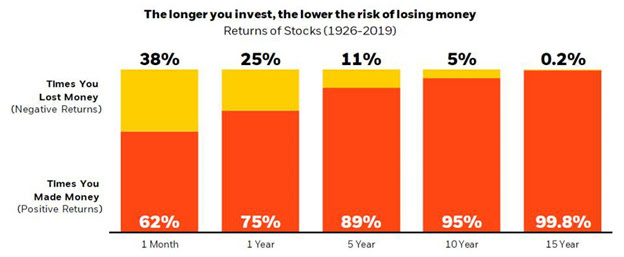

Take a look at the insightful chart below. It illustrates a key insight: the more patience we show as investors, the greater our chances of profiting.

For instance, if we invest in a simple ETF tracking the S&P 500 and hold it for at least 10 years, we have a 95% chance of ending that period in profit. Extend that horizon to 15 years, and the odds approach nearly 100%.

Now, we're not talking about holding investments for 30 or 40 years—periods that can seem daunting. Considering today's average life expectancy of about 83 years, a 10 to 15-year investment horizon feels quite manageable.

Yet, here's the kicker: the average holding period for stocks in a portfolio is just six months. It’s easy to see why many investors end up losing money.

Even more intriguing is a study by Jeffrey Ptak at Morningstar. For a stock to be included in the S&P 500, it must meet three criteria:

- A market capitalization greater than $8 billion.

- High liquidity and a U.S. base.

- Positive earnings in the last quarter and the previous year.

The S&P 500 itself follows a specific strategy, applying these criteria and conducting quarterly reviews to adjust its composition. Each year, about 20 stocks change.

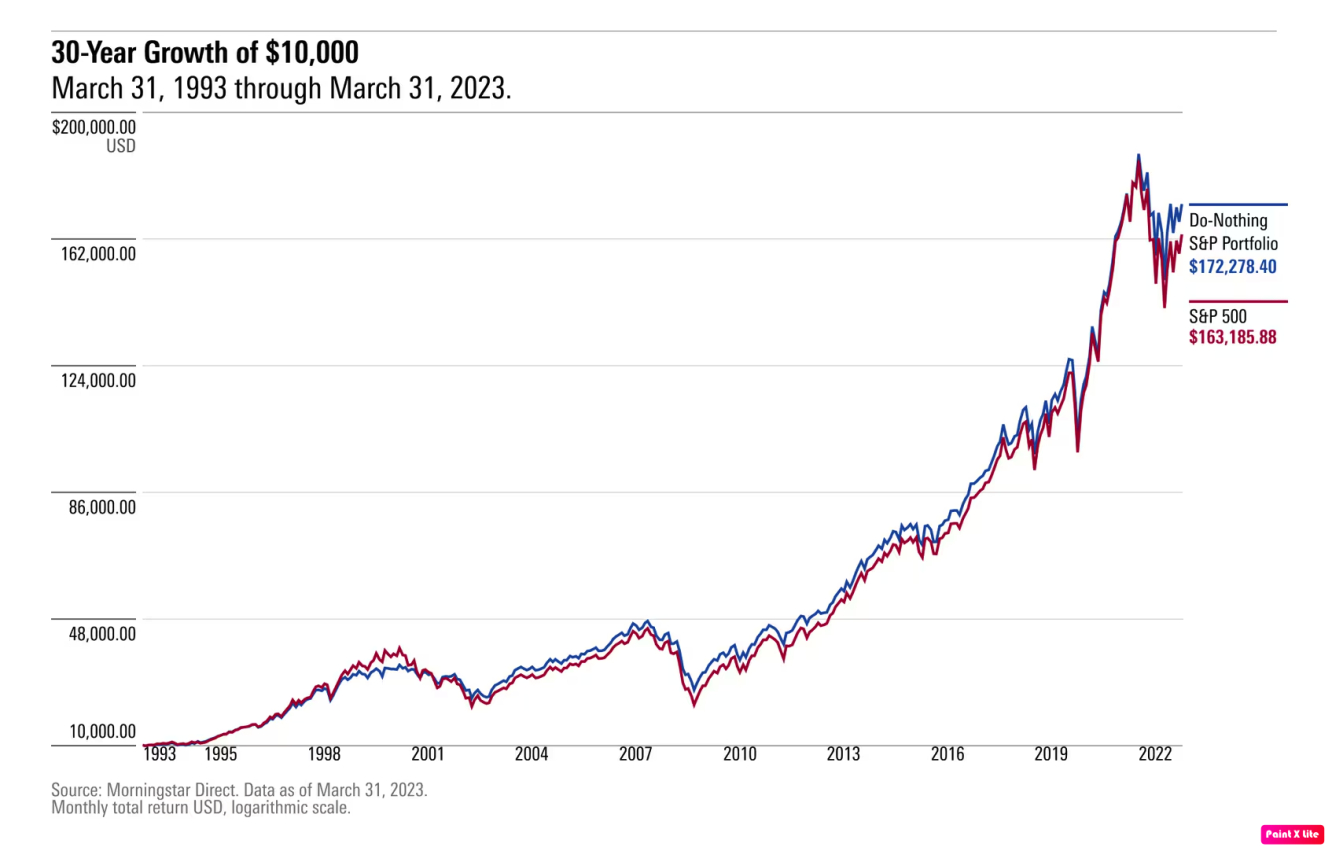

Ptak’s study, which began in 1993 and spanned 30 years, posed a simple question: What if we held the same stocks without making quarterly changes? The results are shown in the image below.

Too often, investors confuse simplicity with ineffectiveness or poor performance. In reality, simplicity can yield the best results. Unfortunately, simplicity isn’t always exciting, and many people prefer the thrill over the path to real profits.

So, instead of chasing the latest trends or jumping from one investment to another, consider embracing a longer-term strategy. After all, in the world of investing, sometimes doing less could result in achieving more.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.