December boom: Where to find the highest returns

- DocuSign (DOCU) is a leading provider of e-signature and related solutions

- The shares cratered in mid-November on weaker management guidance for Q4

- The Wall Street consensus outlook is bullish, with 50%+ expected 12-month price appreciation

- The market-implied outlook (calculated from options prices) is bearish through 2022

- With the substantial disagreement between the market and the analysts, I compromise on a neutral rating for DOCU

DocuSign (NASDAQ:DOCU) soared during the pandemic as the demand for e-signature and related document management services expanded dramatically. As businesses returned to some degree of normalcy, investors became more cautious.

Since hitting a YTD high close of $310.05 on Sept. 3, DOCU had declined in the month leading up to reporting Q3 earnings, falling 24.6% to close at $233.82 on Dec. 2. Reporting after trading hours on Dec. 2, the company beat the consensus estimates for EPS and revenue for Q3, but management’s Q4 revenue forecast was lower than expected and the shares fell dramatically. DOCU is currently trading at $144.48, down 35% for the YTD and down 47.9% over the past three months.

Source: Investing.com

DocuSign’s CEO, Dan Springer, indicated that the weaker growth outlook was due to a faster-than-expected recovery from pandemic-driven remote working conditions.

For a rapidly-growing company like DOCU, valuation is very dependent on projections of earnings growth. A revision in management guidance can substantially shift the share price. Even so, seeing the 42% slide in a single day was startling.

Because so much of the value of DOCU depends on the market’s expectations rather than current results, it is important to be aware of the market’s overall view. Specifically, it is important to look at consensus outlooks, as well as at the dispersion among individual analysts and traders.

The Wall Street analyst consensus outlook is widely-followed. Another place to gauge market expectations is in options trading. The price of an option on a stock reflects the market’s consensus estimate of the probability that the shares will rise above (call option) or fall below (put option) a specific level (the strike price) between now and when the option expires.

By analyzing the prices of call and put options at a range of strike prices, it is possible to construct a probabilistic price outlook that reconciles all of the options prices. This is called the market-implied outlook and represents the consensus view among buyers and sellers of options on the stock. This approach to inferring market expectations is well-established in quantitative finance.

I have calculated the market-implied outlooks for DOCU through 2022 and compared these to the Wall Street analyst consensus outlook. While consensus outlooks combine the views of those whose forecasts will be more accurate with those that will be less accurate, a wide range of research concludes that consensus estimates are often the best basis for decisions.

Wall Street Analyst Outlook for DOCU

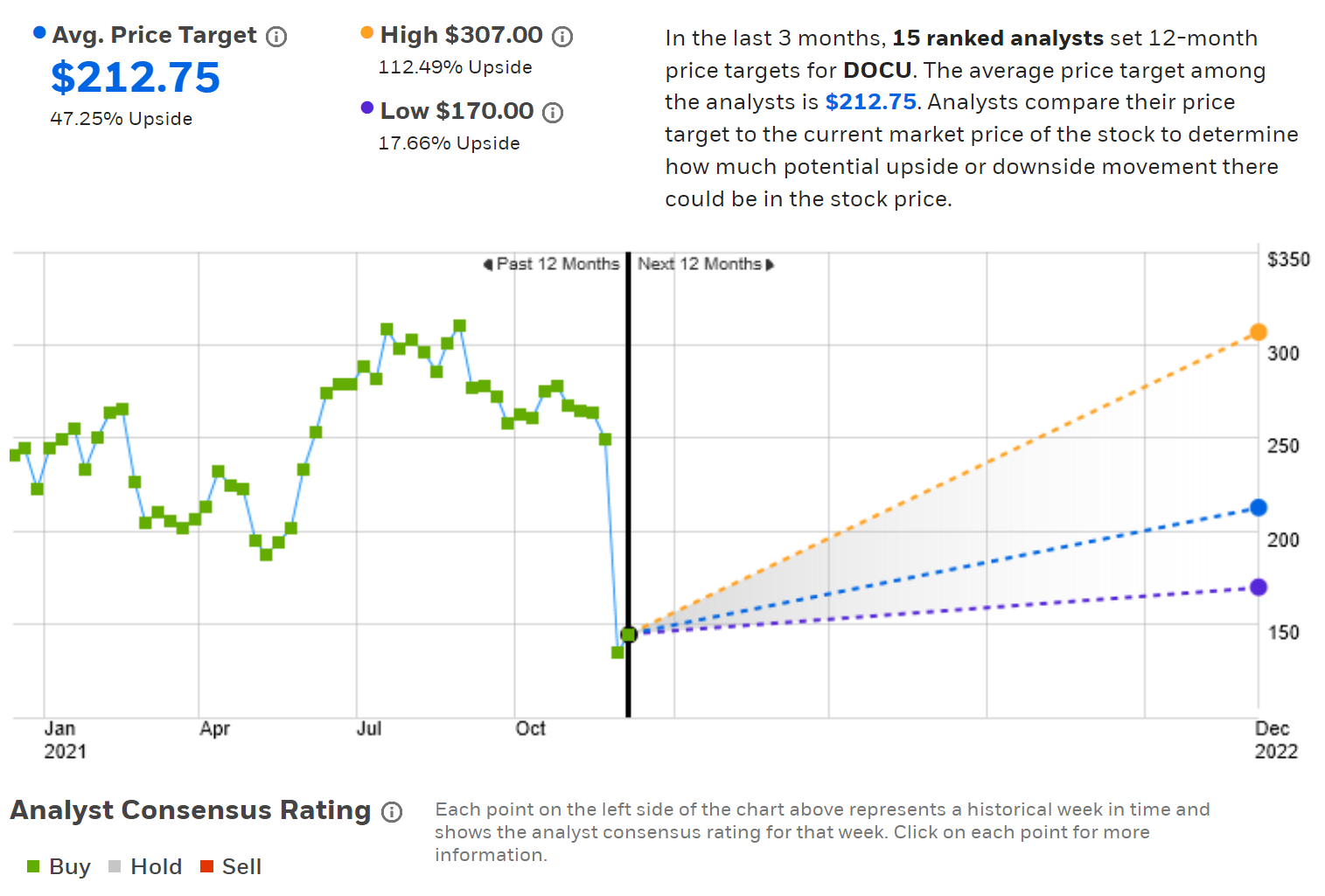

E-Trade calculates the Wall Street consensus outlook for DOCU using the views of 15 ranked analysts who have published ratings and price targets within the past 90 days. The consensus rating for DOCU is bullish, as it has been all year, and the consensus 12-month price target is $212.75, 47.25% above the current share price. Even the lowest price target is 17.66% above the current level. There is a high level of dispersion among the analyst outlooks, and this reduces confidence in the predictive value of the consensus.

Source: E-Trade

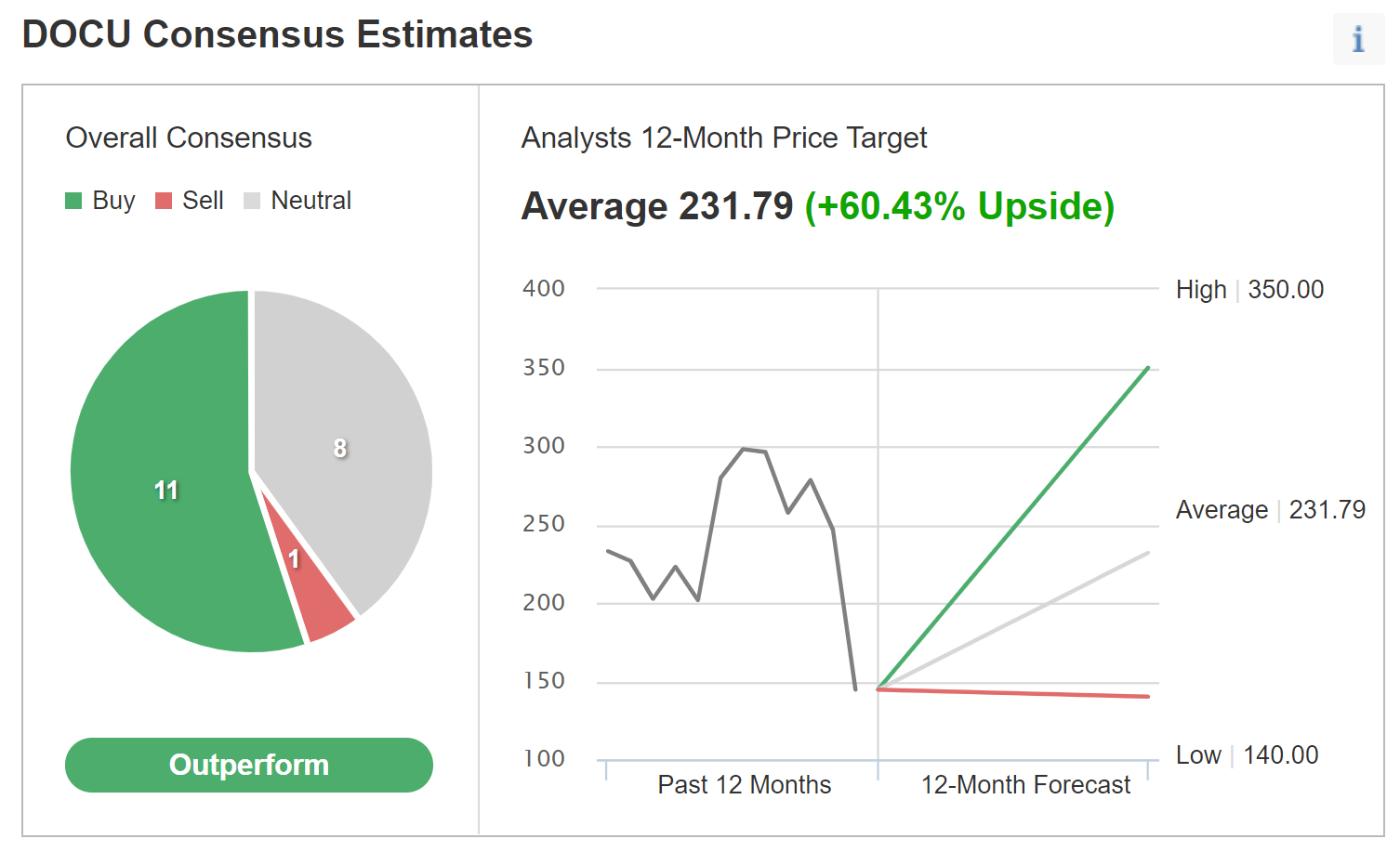

Investing.com calculates the Wall Street consensus outlook by aggregating the views of 20 analysts. The consensus rating is bullish and the consensus 12-month price target is 60.4% above the current price. Similar to E-Trade’s consensus, there is a high level of dispersion amongst the price targets.

Source: Investing.com

When there is recent material information that impacts the outlook for a stock, the consensus estimates may be somewhat out-of-date. This is certainly a consideration for DOCU. While there have been a number of downgrades since Dec. 2, a trailing 90-day window for ratings may include those that were issued before the recent announcement. That said, with ten days since the news, one would hope that analysts who want to change their ratings or price targets would have done so by now.

The Wall Street consensus outlook for DOCU for the next 12 months is bullish, with expected gains of 50% or more, but the spread in the individual price targets reduces confidence in the consensus outlook.

Market-Implied Outlook for DOCU

I have calculated the market-implied outlook for DOCU to mid-2022 (using options that expire on June 17, 2022) and through the end of 2022 (using options that expire on Jan. 20, 2022).

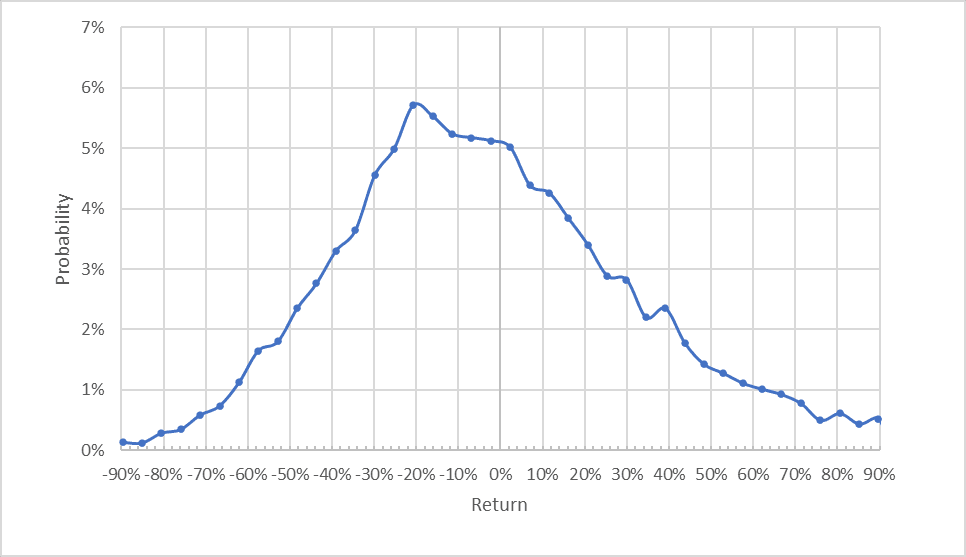

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for DOCU to the middle of 2022 is substantially skewed, with the highest probabilities corresponding to negative returns. The well-defined peak probability is at a return of -20% for this period. The annualized volatility calculated from this distribution is 57%. This is a bearish outlook.

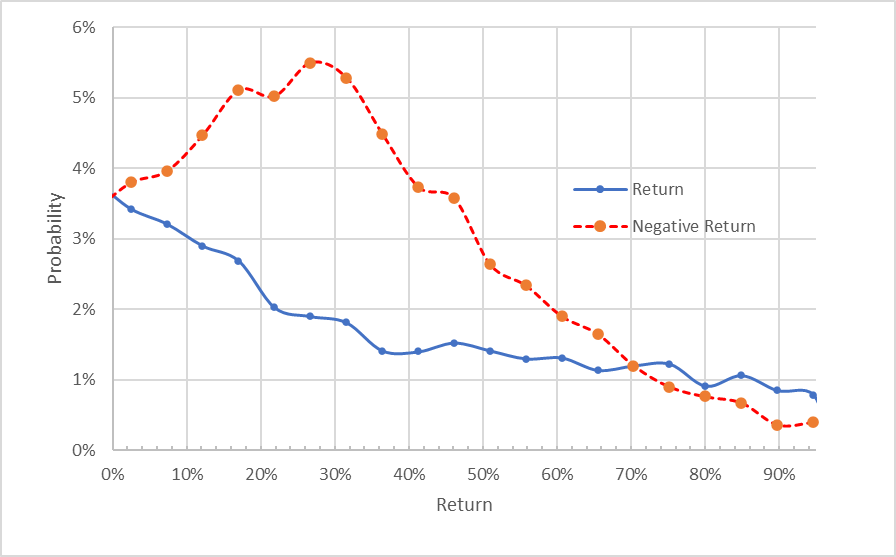

Another way to view the market-implied outlook is to rotate the negative return side of the distribution about the vertical axis (see chart below).

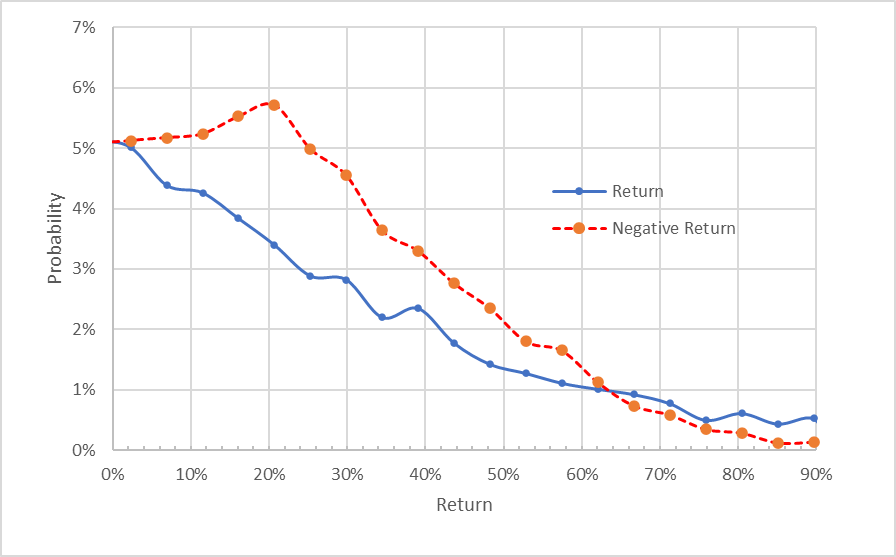

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

This view highlights the asymmetry in probabilities between positive and negative returns of the same magnitude. The probability of negative returns is markedly higher than for positive returns of the same magnitude over a wide range of the most-probable outcomes (the dashed red line is well above the solid blue line over the left ⅔ of the chart). The probability of extremely large positive outcomes is, however, higher than for positive returns of the same size.

The outlook for the 13.3-month period to Jan. 20, 2023 is consistent with the view to the middle of 2022. The probabilities strongly favor price declines over gains. The peak probability corresponds to a price return of -27% and the annualized volatility is 52%. This is a bearish outlook for 2022. As expected for a stock with such high positive skewness, there is a ‘fat tail’ favoring very large positive returns, although these occur with a very low overall probability.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlooks for DOCU are consistent with what I have calculated for a range of riskier growth stocks. There is a high probability of losing money along with a low probability of very large gains. This type of highly-skewed bet is common among the type of stocks that Cathie Wood favors. I have obtained similar market-implied outlooks for Teladoc (NYSE:TDOC) (in February and July), Peloton (NASDAQ:PTON) (in February and September) Zoom Video (NASDAQ:ZM) (in late November), for example.

Summary

DOCU is an innovation growth story and a market-leader in e-signature and contract management. The company enjoyed a massive windfall from the COVID pandemic, but that accelerated growth appears to be waning.

The market was shocked by management’s forward guidance at the start of December and the shares have collapsed. The Wall Street consensus outlook remains bullish, although a number of analysts have downgraded the stock and reduced price targets.

Thanks to the massive decline in the share price since Dec. 2, the Wall Street consensus 12-month price target for DOCU is about 50% above the current price. By contrast, the market-implied outlook, representing the consensus view of the options market, is substantially bearish.

The most-probable price return for the period from now until June 2022 is -20%. The most-probable price return to January 2023 is -27%. Especially given DOCU’s high volatility, the range of plausible returns is broad. With the substantial disconnect between the analyst consensus and the market-implied outlook, I am compromising on a neutral rating for DocuSign.