Economic growth continues to defy expectations of a slowdown and recession due to continued increases in deficit spending.

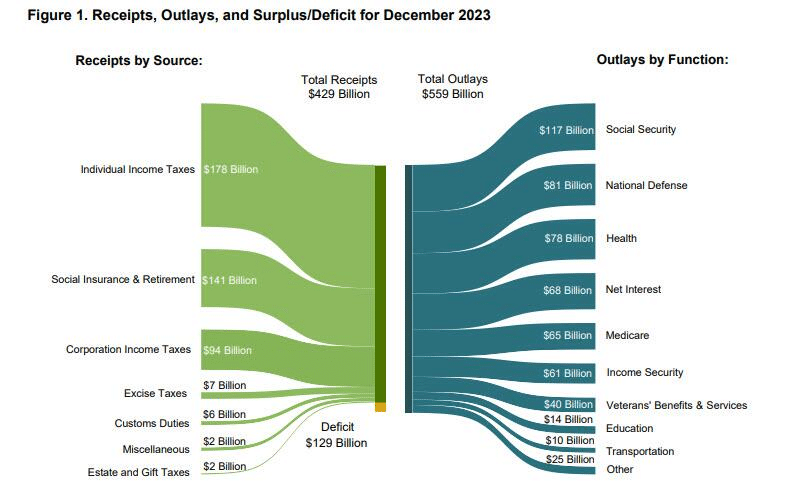

The U.S. Treasury recently reported the December budget deficit, which shows the U.S. collected $429 billion through various taxes while total outlays hit $559 billion.

As noted, the problem remains on how the economy has avoided a recession despite the Fed’s aggressive rate hiking campaign.

Numerous indicators, from the leading economic index to the yield curve, suggest a high probability of an economic recession, but one has yet to occur.

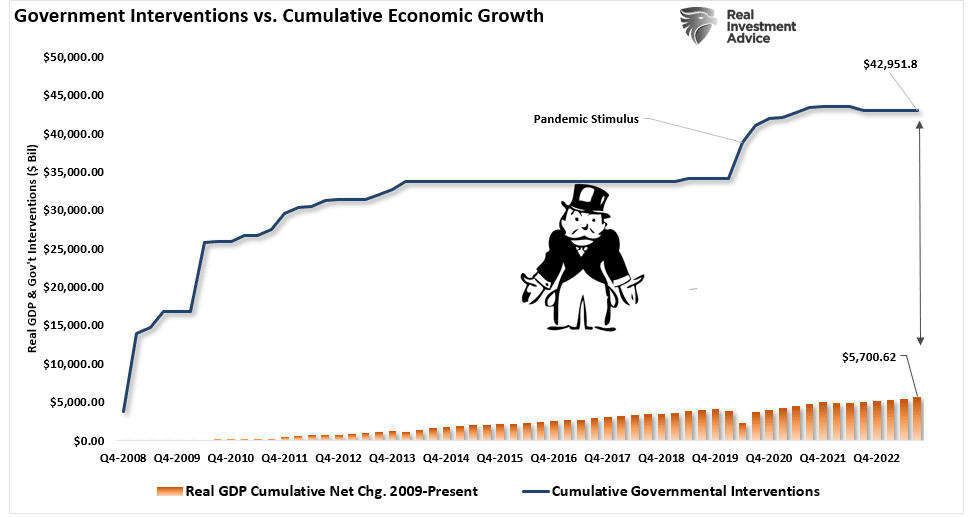

One explanation for this has been the surge in Federal expenditures since the end of 2022 stemming from the Inflation Reduction and CHIPs Acts.

The second reason is that GDP was so grossly elevated from the $5 Trillion in previous fiscal policies that the lag effect is taking longer than historical norms to resolve.

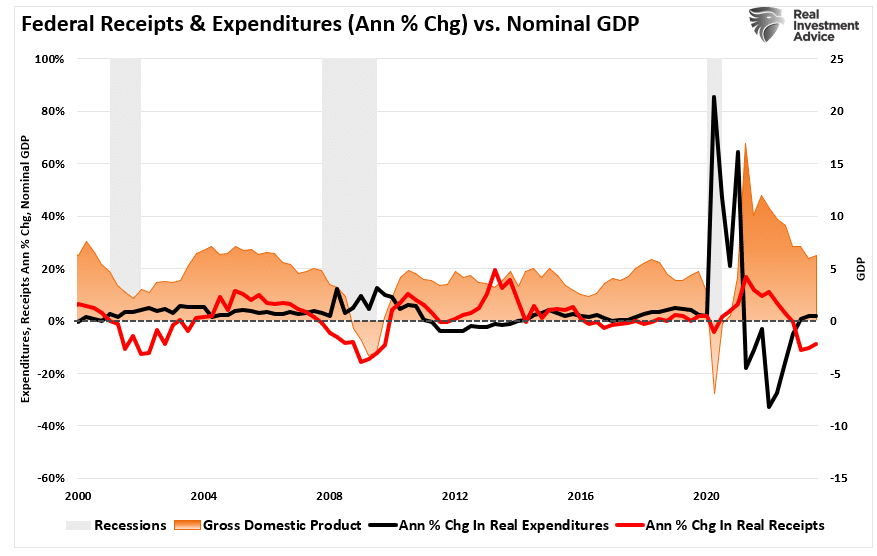

However, that red line in the chart above is the most interesting. Notice that while Federal expenditures are rising, Federal tax receipts are falling. Such is why the national deficit is increasing.

When we discussed this previously, many thought the shortfall was temporary. To wit:

“California’s tax payments are delayed due to the emergency declaration. However, that doesn’t account for the magnitude of the decline in filings.

Secondly, given the shuttering of the entire economy in 2020, which also delayed filings nationwide, the extent of the current decrease seems more than just a single event.”

Given the length of time and the fact the collection rate fell further, it suggests there is more to the decline.

Tax Receipts Send A Warning

The change in Federal receipts is essential as the Government’s revenue is from the taxes on both corporate and individual incomes.

Unsurprisingly, if revenues and incomes decline, such would reflect economic activity.

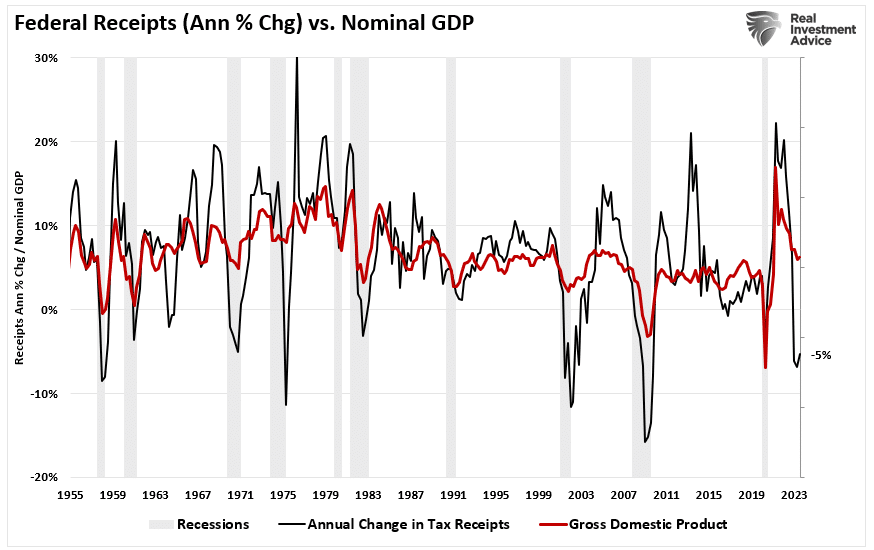

As shown below, there is a very high correlation between the annual change in Federal receipts and economic growth.

Historically, when the yearly change in Federal receipts falls below 2% annual growth, such has preceded economic recessions. Federal receipts’ yearly rate of change is currently a negative five percent (-5%).

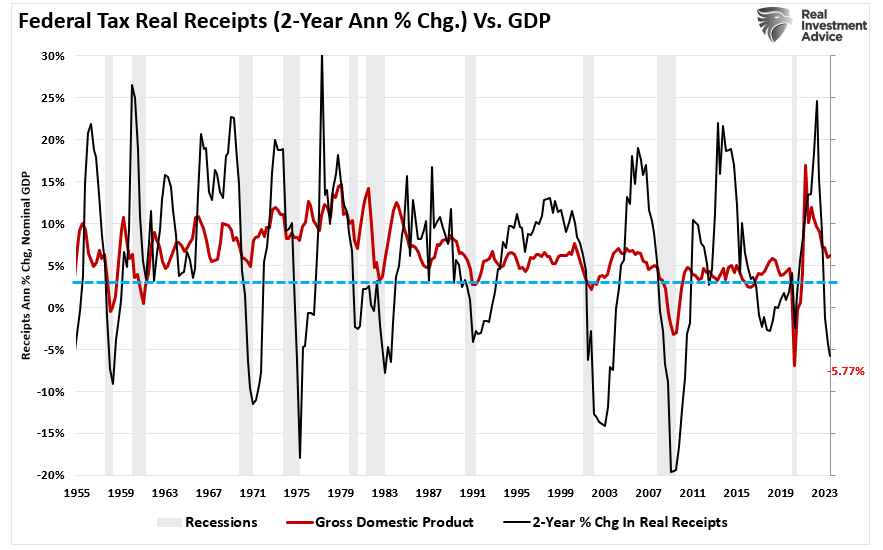

We see the exact correlation by smoothing the data and using inflation-adjusted tax receipts on a 24-month rate of change. Again, a recession follows when tax receipts fall below 2% annual growth rates.

I like this measure better as it accounts for the “lag effect” in the economy. The 2-year yearly change in receipts has fallen well below the 2% warning line and is currently at -5.77%.

While tax receipts suggest economic weakness is more pervasive than headlines suggest, the deficit spending flows keep economic growth from becoming recessionary.

The Frog And Deficit Spending

If we look at the current economy, there is no noticeable collapse in the dollar, private capital, rampant Inflation, or recession. However, like bringing the water to a slow boil, the frog doesn’t realize it is in trouble until it’s too late.

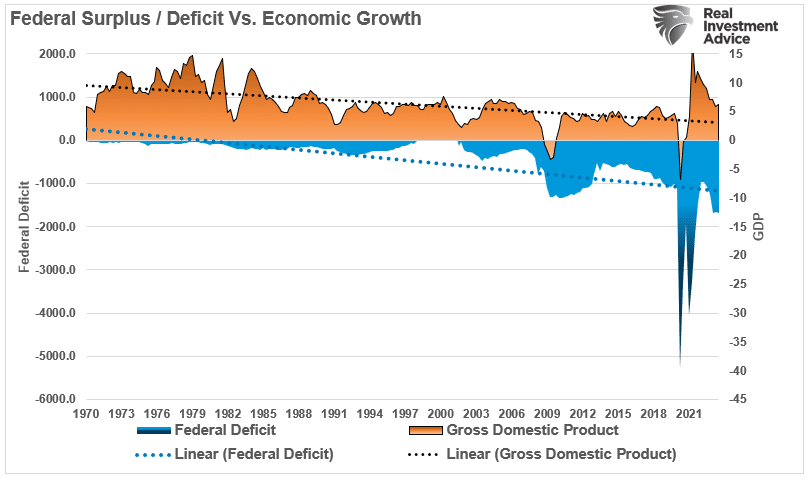

The government’s serious endeavors into deficit spending began with Ronald Reagan in 1980. Since then, politicians concluded that a lot should be better if a little deficit spending is good.

For politicians, there are only positive benefits of deficit spending increases. More spending provides a short-term boost in economic activity, which gets them re-elected to office.

However, the water temperature is clearly rising in the longer term.

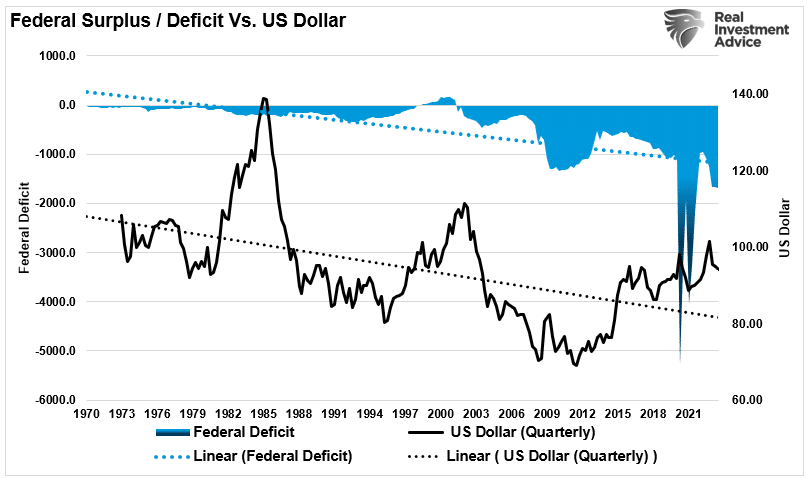

While the dollar hasn’t collapsed under the weight of deficit spending, the negative strength trend relative to other currencies is slowly rising in temperature.

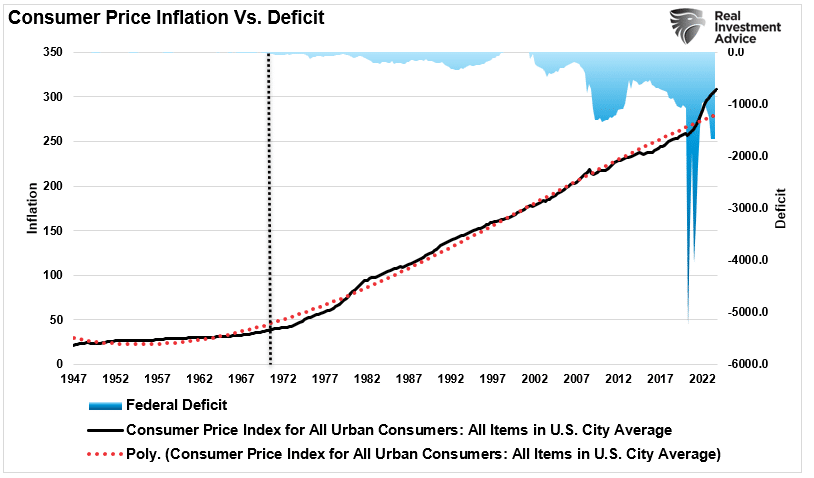

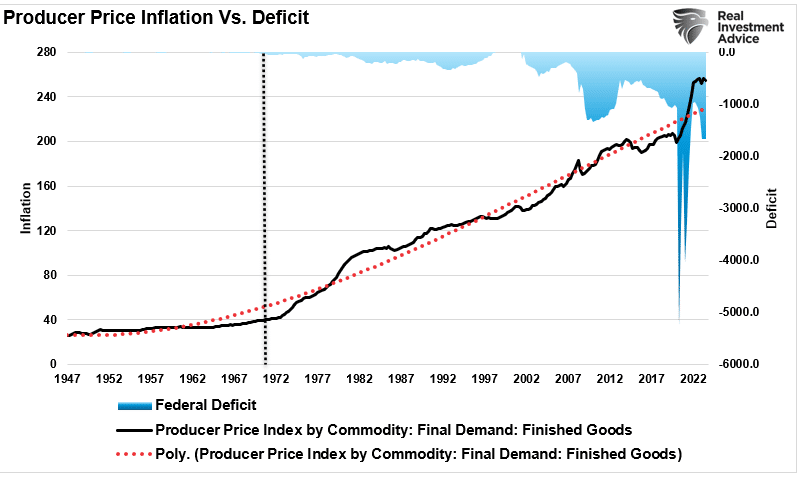

Of course, as the dollar weakened and deficits grew, Inflation, for both producers and consumers, rose.

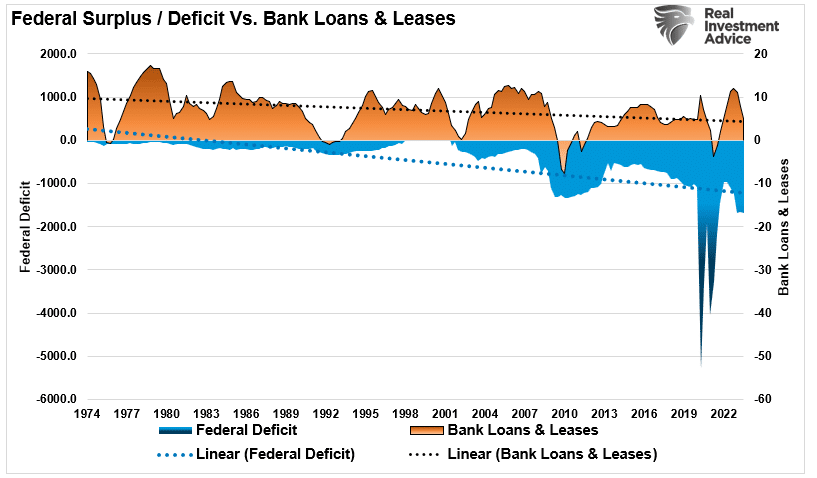

While deficits may not appear to crowd out private investment, the rise of behemoth companies like Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), and others do crowd out innovation and new company formations.

Such activities require capital, and a reasonable correlation exists between the ebbs and flows of deficits and capital acquisition.

Not surprisingly, as the dollar weakens, the movement of capital slows, and Inflation rises, the economic growth rate slows.

Such should not be surprising as debt used for non-productive purposes diverts money from productivity to interest service.

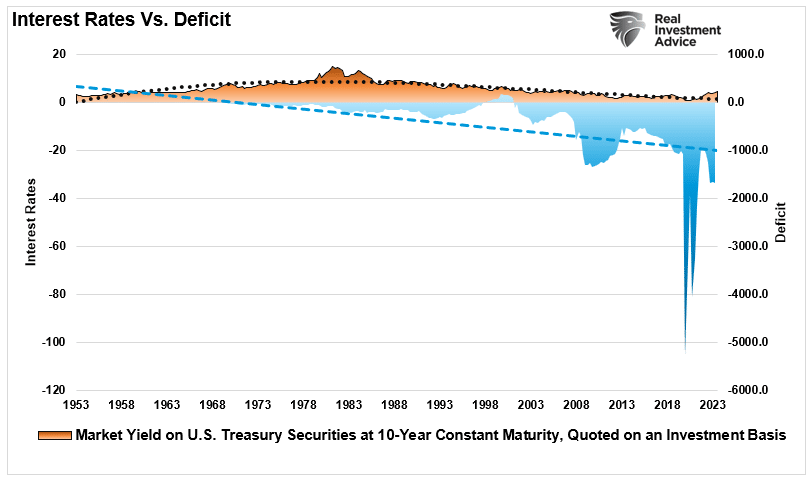

The one thing that deficits have not led to is surging interest rates and massive increases in borrowing costs.

However, that suppression of interest rates has come from two primary sources.

- Slower rates of economic growth

- Massive interventions by the Federal Government to suppress rates.

Given the sharp increases in Federal debt since 2008 to support economic growth, the economy can not sustain higher borrowing costs for long.

The Economy Is Close To Recession

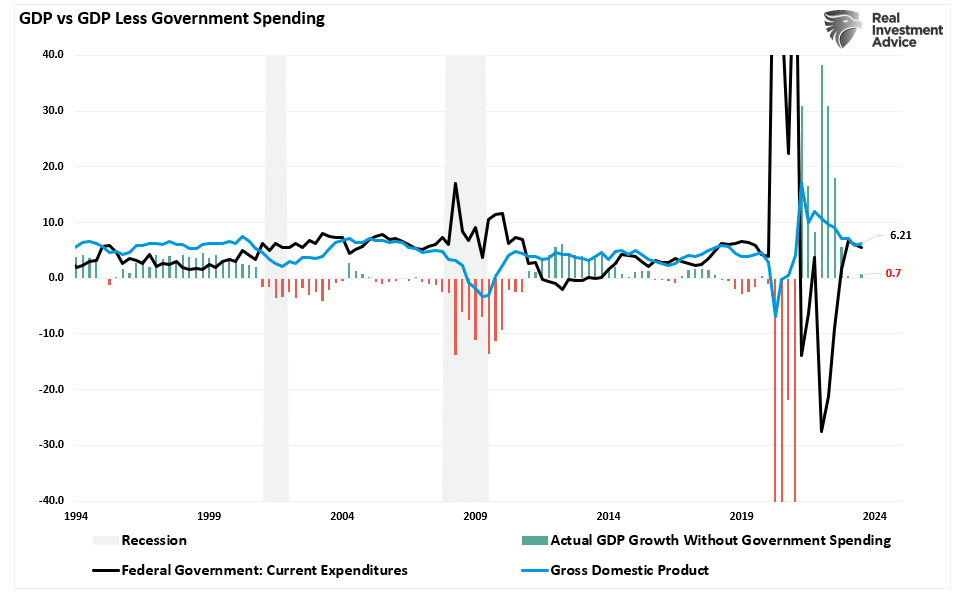

While economic growth continues to defy expectations on the surface, if it weren’t for increases in deficit spending, economic growth would be flirting with recessionary levels at just 0.7% in Q3 rather than 6.21%

In GDP accounting, consumption is the most significant component. Since deficit spending doesn’t filter down into the average household, it is no wonder why Presidential approving ratings are so dismal.

Should governments use deficit spending for “productive investments” during economic downturns? That answer is clearly in the affirmative category.

However, once the economy returns to growth, the deficits should be reversed into surpluses to prepare for the next inevitable downturn. Such is the entire underlying premise of Keynesian economic theory.

But, unfortunately, politicians, in their ongoing endeavor to get reelected, ignore the part about repaying debts.

While short-term deficits may have no consequences, the rising levels of corporatism, wage disparities, and wealth inequality provide ample evidence that something has gone wrong.

Are all the problems in the U.S. solely the result of rampant deficit spending? Of course not. The U.S. has also spent four decades making poor political and economic choices.

- Massive increases in consumer and corporate debt.

- A shift from productive to non-productive labor.

- Poor immigration policies.

- The slow erosion of the rule of law; and,

- An undermining of capitalism and a move to socialistic policies.

If you ignore all of the anecdotal evidence, an argument can be made for running continual economic deficits. However, suggesting “deficit spending” has no consequences is entirely wrong.

We can continue our path for quite some time, and probably longer than most imagine.

But, just because we haven’t realized it yet, it doesn’t mean we aren’t slowly being “boiled by deficits.”