- Defense stocks have lagged the S&P 500 despite rising geopolitical risks

- But these stocks could finally be gearing up to overtake the index

- As orders start to flow in for these three companies, their stocks could be poised for a rally

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

Amid escalating geopolitical risks in the past few months, attention has turned to defense stocks. While challenges in the defense industry have affected their performance relative to the index since last year, the continued influx of orders these companies are receiving suggests things could be about to change for this sector.

There was a surge in global military spending following Russia's invasion of Ukraine last year. Total global spending surged by 3.7% YoY to reach just above $2 trillion. Recent events, such as the conflict between Israel and Hamas, highlight the enduring trend of increased defense spending globally.

This ongoing geopolitical uncertainty has prompted countries to bolster their defenses, indicating that defense stocks may become prominent in long-term investment portfolios. So in this piece, we will take a look at three prominent defense companies you can consider adding to your portfolio as countries keep increasing their defense budgets.

Defense Stocks Have Lagged the Broader Market

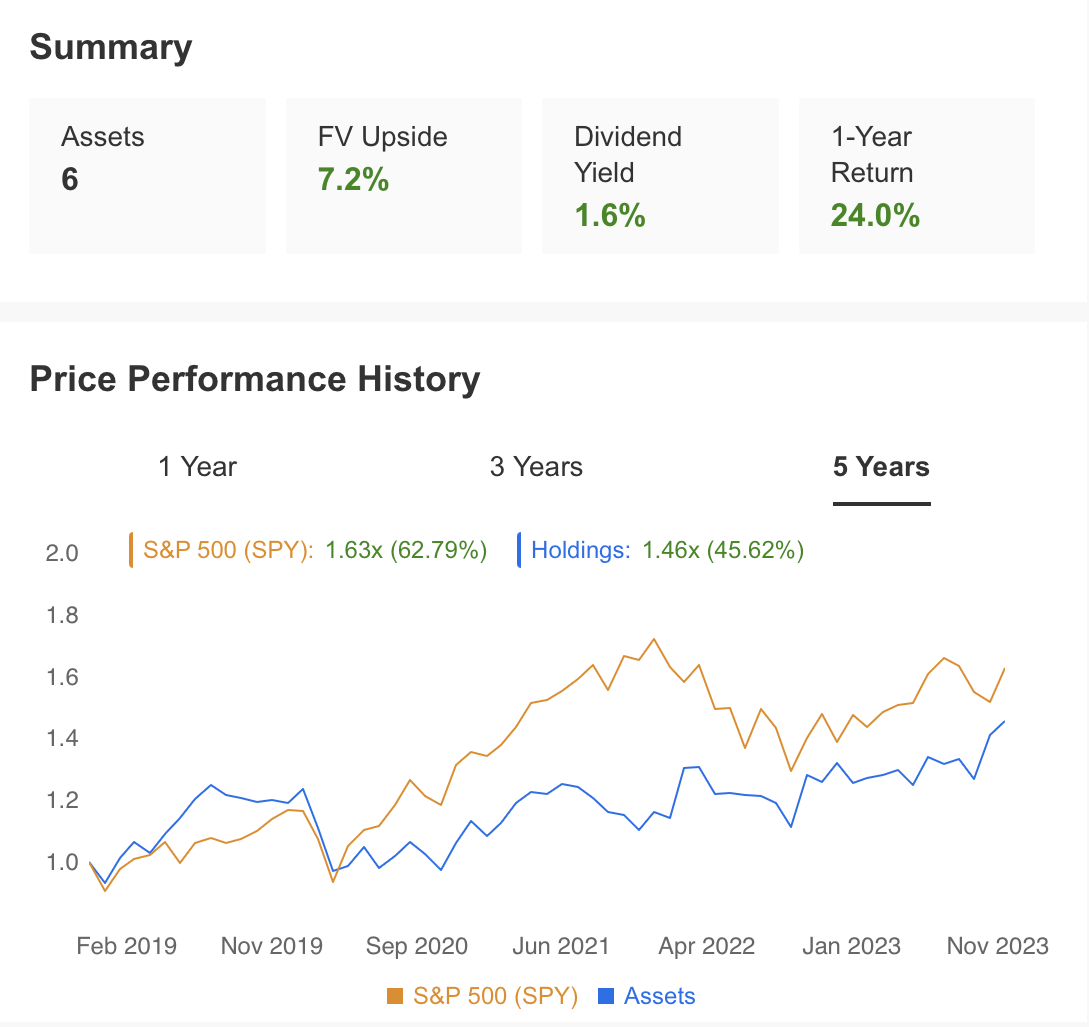

Examining the long-term performance, a portfolio comprising 6 defense stocks has lagged behind the S&P 500 since 2020. Despite a moderate upward trajectory for both the S&P 500 and defense stocks after 2020, the latter has lagged behind as the former continues to surge.

Source: InvestingPro

The U.S. defense industry has grappled with challenges that were reflected in the earnings reports of companies within this sector. Issues during the production phase, impeding delivery targets, alongside supply chain and employment challenges, have been notable hurdles.

Nevertheless, the substantial backlogs and orders stand out as key factors with significant upside potential for these companies in the upcoming periods. This resilience indicates that market demand remains robust despite geopolitical risks. Overcoming fundamental challenges pressuring the margins of defense industry firms holds the potential for a substantial surge in both margins and earnings within the defense market.

So without further ado, here are the three stocks:

1. Rtx

Rtx (NYSE:RTX) is currently the largest defense company among the companies we evaluate, with a market cap of $118.3 billion. Although its P/E ratio remains higher than other companies at 36.2X, the company is well-positioned for long-term investment with a dividend yield of 2.9% among dividend payers.

This inference can be supported by the company's $190 billion backlog of orders as of Q3. Approximately $75 billion of these orders come from the defense sector. Accordingly, if the company overcomes the supply process and production problems, which are seen as the structural problems of the sector, it will be inevitable for the company to achieve a healthy cash flow.

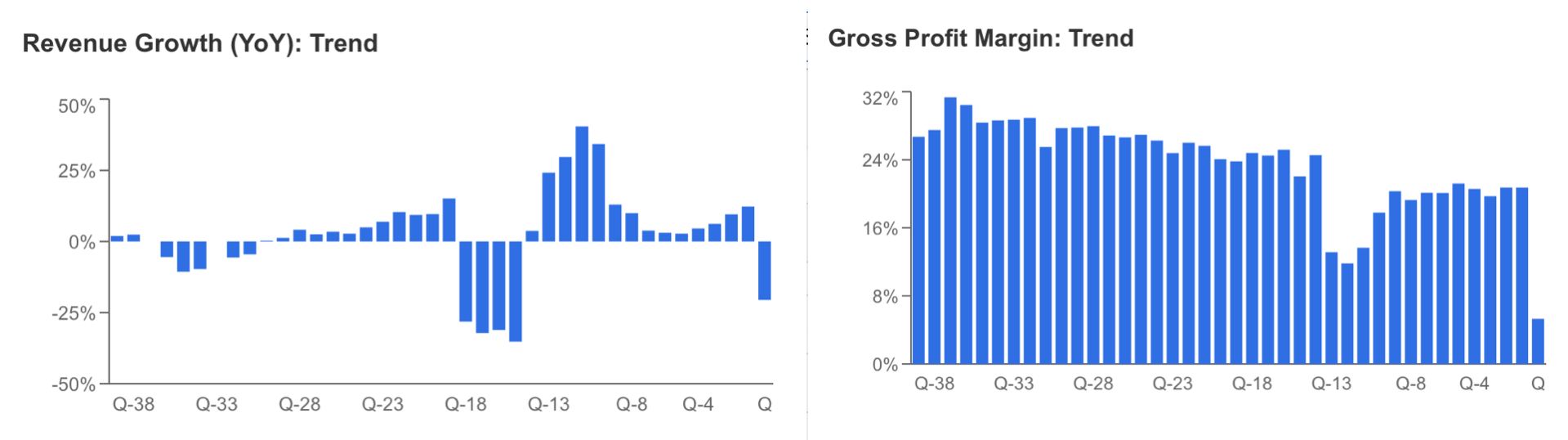

On the other hand, while the company announced a sharp decline in revenue in its last quarter earnings report, it seems likely that revenue growth will return to positive territory in the coming periods with the delivery of backlog orders. In addition, the improvement in the gross profit item affected by the revenue decline will be closely monitored.

Source: InvestingPro

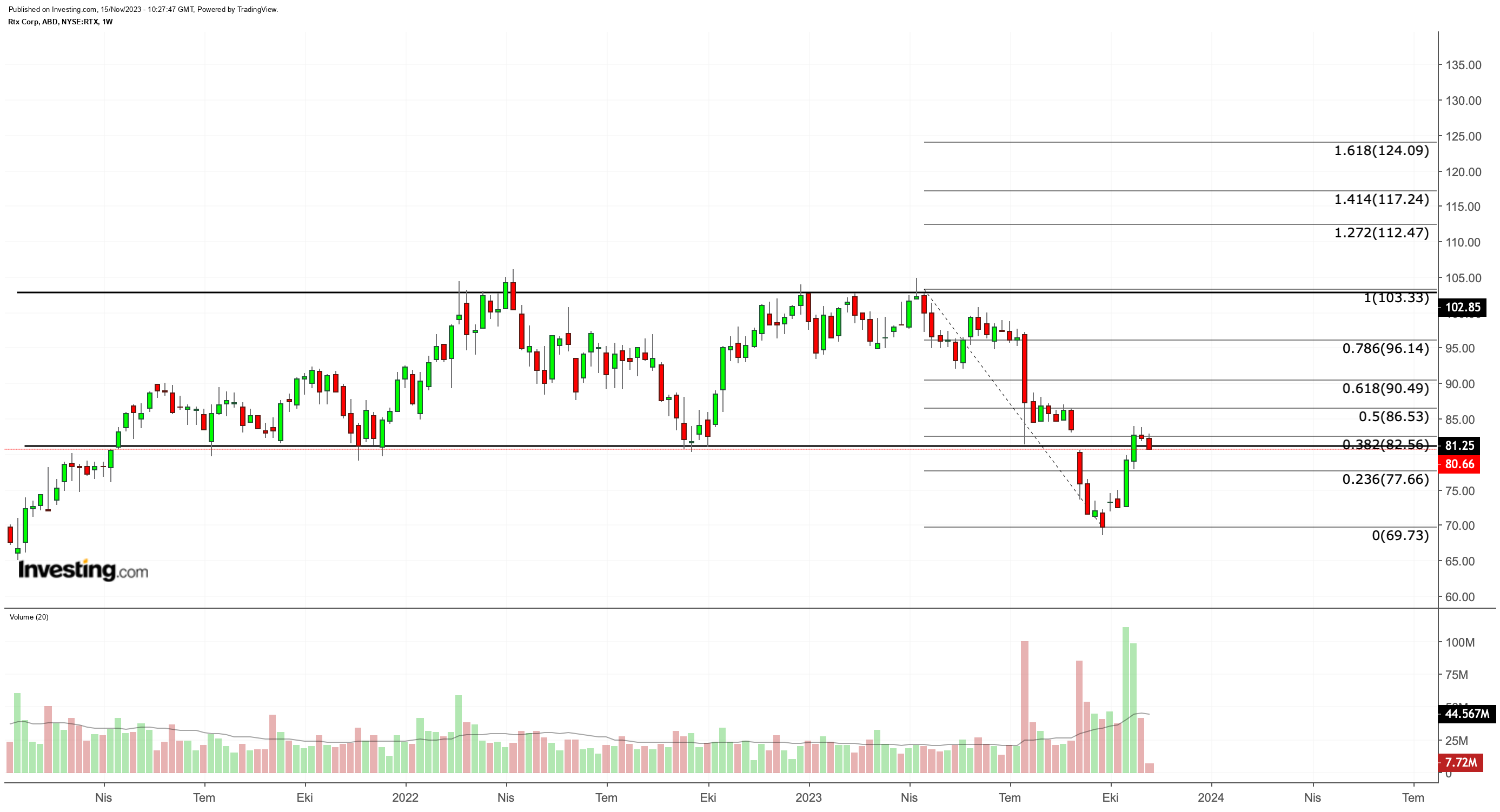

Looking at the price performance of the stock, it is seen that the downward momentum was reversed in the increasing tension environment in October, while the share interrupted the recovery movement in the $80 band after showing a partial value increase of 15%.

RTX, which is currently testing the price level that has been used as long-term support since 2021, has the potential to technically move its rise toward the $100 band if it can establish ground above this level.

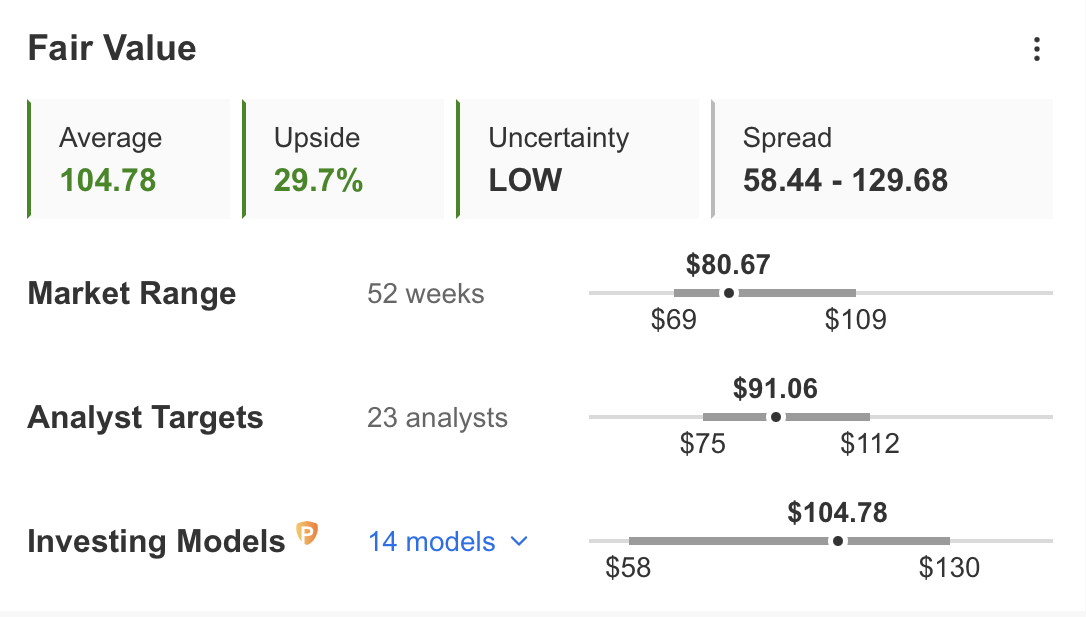

When the fair value analysis is checked on InvestingPro, it can be seen that RTX has the potential to rise up to $104 according to 14 models.

Source: InvestingPro

2. Lockheed Martin

Lockheed Martin (NYSE:LMT), another prominent defense company in this period, comes behind RTX with a market capitalization of close to $110 billion. While LMT offers a valuation below the sector with 15.8X P/E, it is among the defense stocks that can be preferred for long-term investors with a dividend yield of 2.8%.

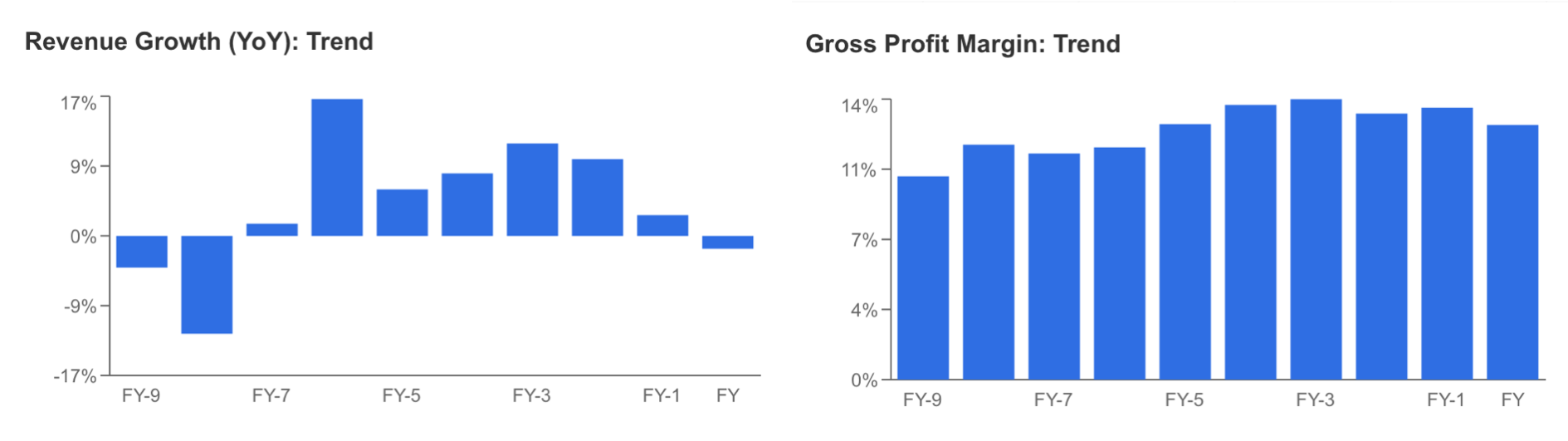

Lockheed Martin, which reported an order backlog of $159 billion in the first half of the year, is among the defense companies with growth potential and revenue growth could accelerate. Thus, revenue growth, which has continued to decline in the last 3 years, may reverse and profit margins may improve.

Source: InvestingPro

In Lockheed, the investment in next-generation defense technology with R&D studies approaching 3 billion dollars this year can be considered as a factor supporting growth.

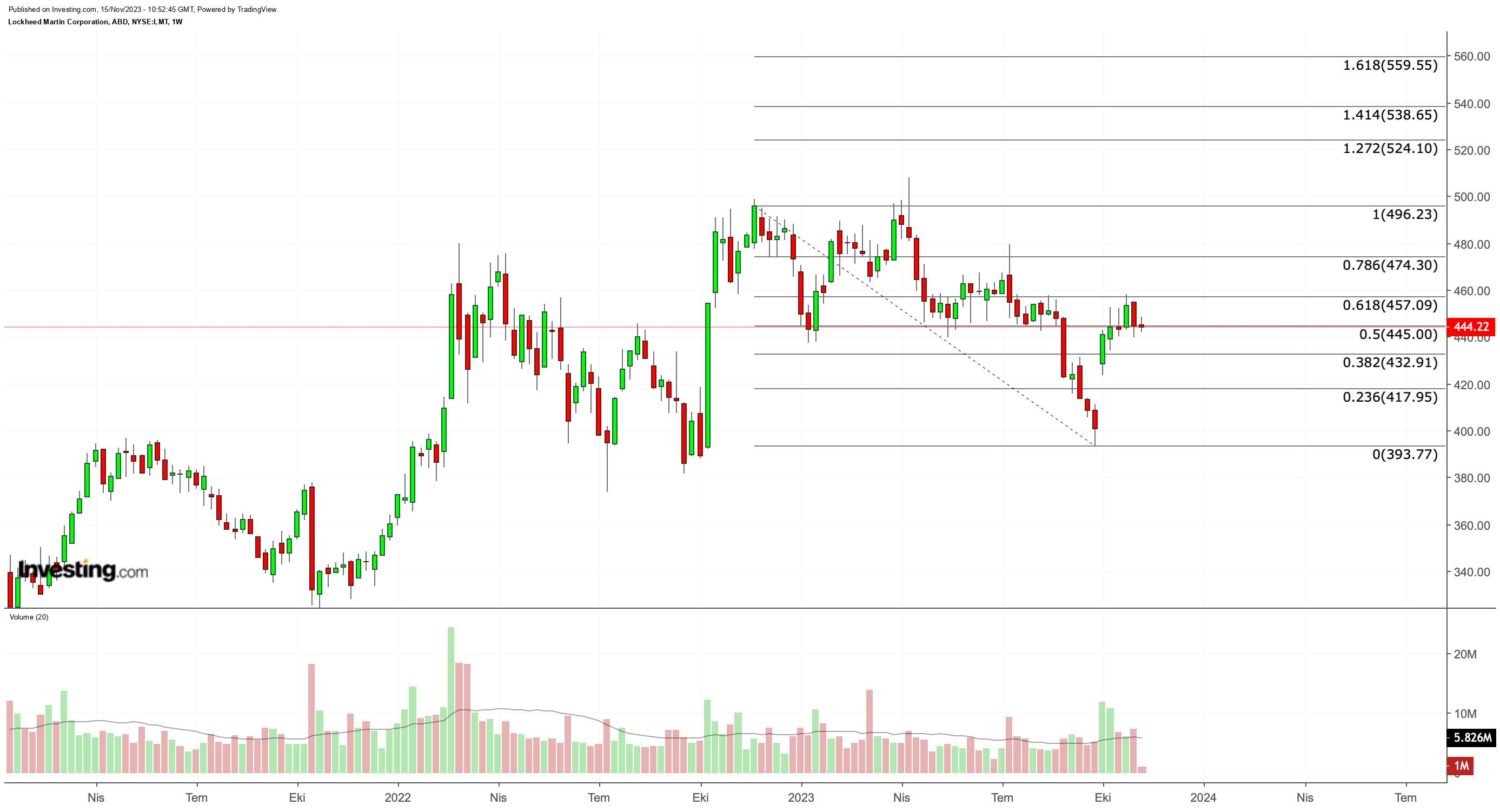

Looking at the LMT stock technically, it is seen that with the October bounce, the price reached the Fib 0.618 correction level at $457 according to the short-term downward momentum. In case of a weekly close above this resistance, the recovery trend may continue and the share price may continue its trend up to the range of $525 - 560.

Source: InvestingPro

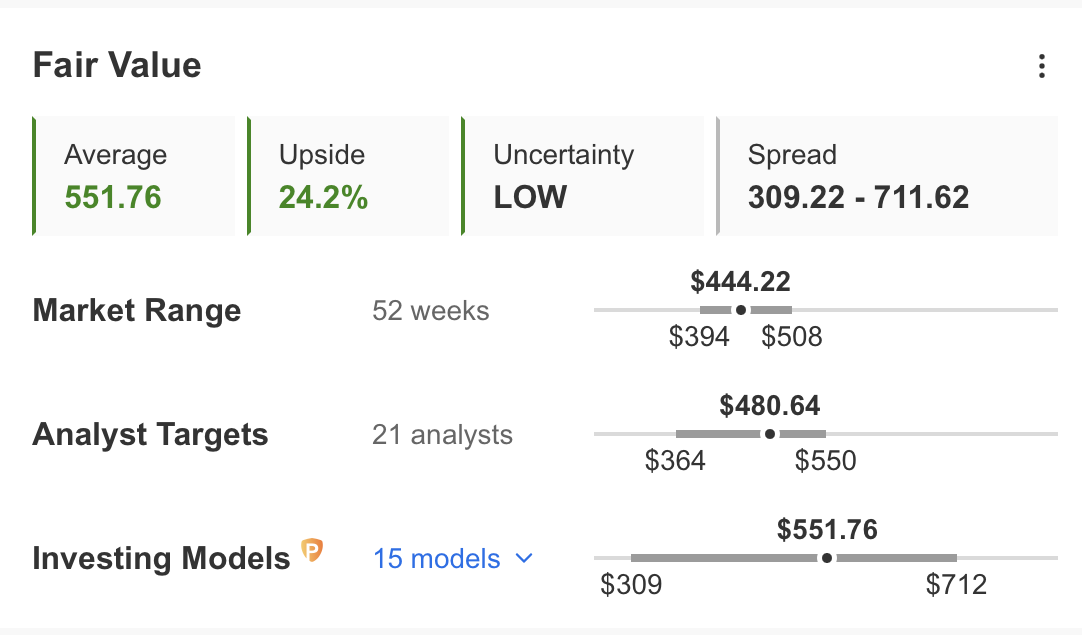

InvestingPro fair value calculation also reveals that LMT has the potential to rise up to $550 in line with the technical outlook with a 25% increase in value within a year.

3. Leonardo

With a market capitalization of $5.1 billion, Leonardo DRS (NASDAQ:DRS) is relatively small compared to other defense industry companies, but with a high growth potential.

Leonardo stands out as a provider of defense products and technology and continues to expand its product range every year. According to its latest financial results, the company has a high P/E ratio of 34.4X. The stock is overvalued in the short term with an upward trend since June 2022.

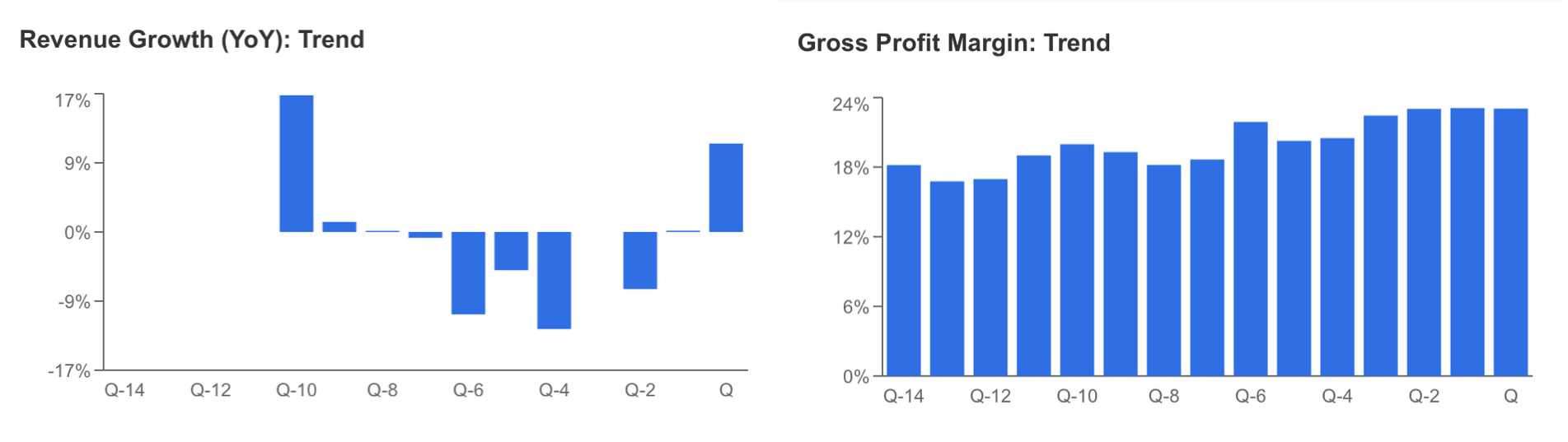

In addition, the company, which announced a strong balance sheet in the last quarter, was welcomed positively as revenue growth shifted to positive momentum and profit margin continued to be maintained in the 20% band. In addition, the company is pursuing an aggressive growth strategy through various mergers and acquisitions.

Source: InvestingPro

LRS, which has maintained its long-term uptrend with a 25% increase in value since October, reached the $ 20 level this week and technically looks like it has reached a critical resistance level for a correction phase.

Accordingly, if LRS performs a weekly close below $ 20, the possibility of a retracement towards the $ 16 - $ 18 range may increase. On the other hand, if the rally continues with a floor above $ 20, we can see that the momentum may continue toward the $ 28 - $ 30 range.

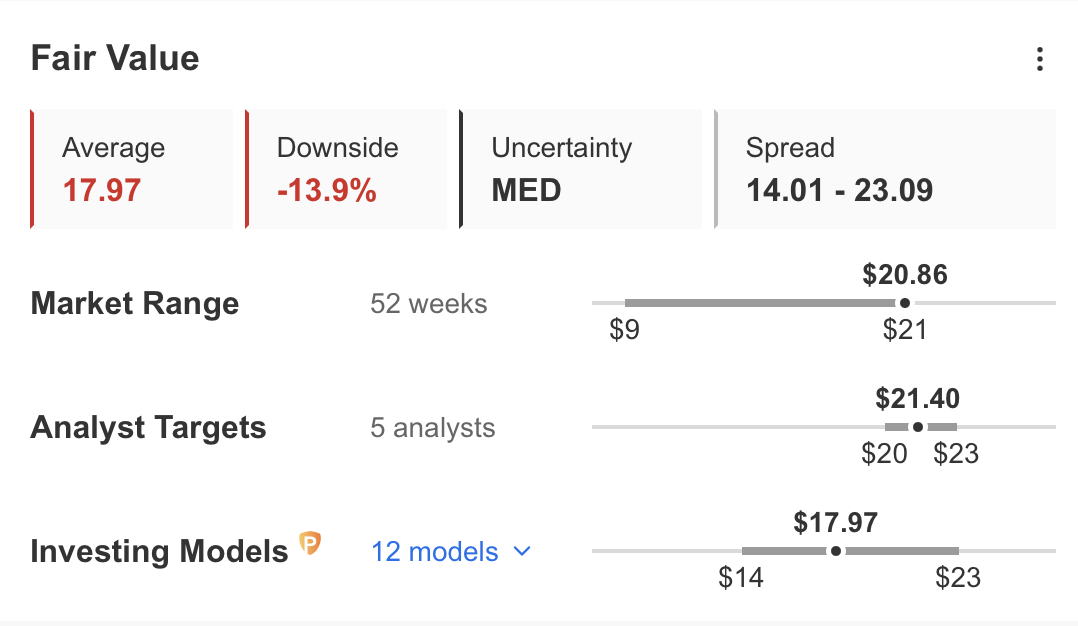

Overbought conditions stand out in the fair value analysis, while it is estimated that the stock may decline to $18 in the coming periods.

Source: InvestingPro

Conclusion

In summary, while defense stocks have generally underperformed in recent years due to supply problems, they have started to attract the attention of investors with the increase in geopolitical problems around the world.

As a result, in this period when world peace is under threat, the increasing orders of companies may cause a long-term rally by ensuring rapid growth as the current problems begin to be solved.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.