Global markets

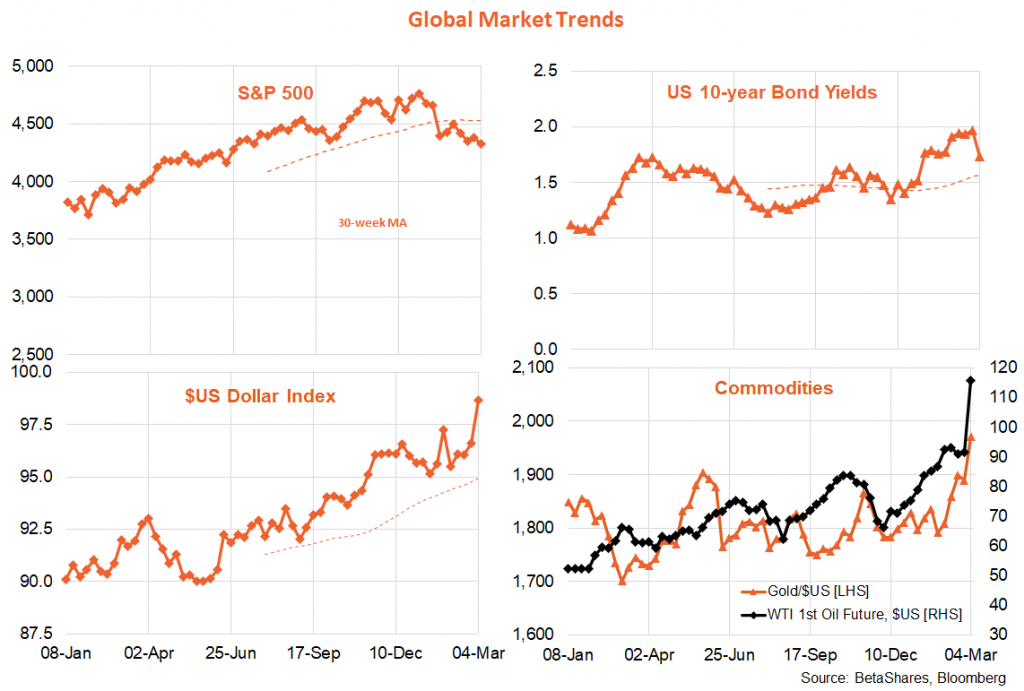

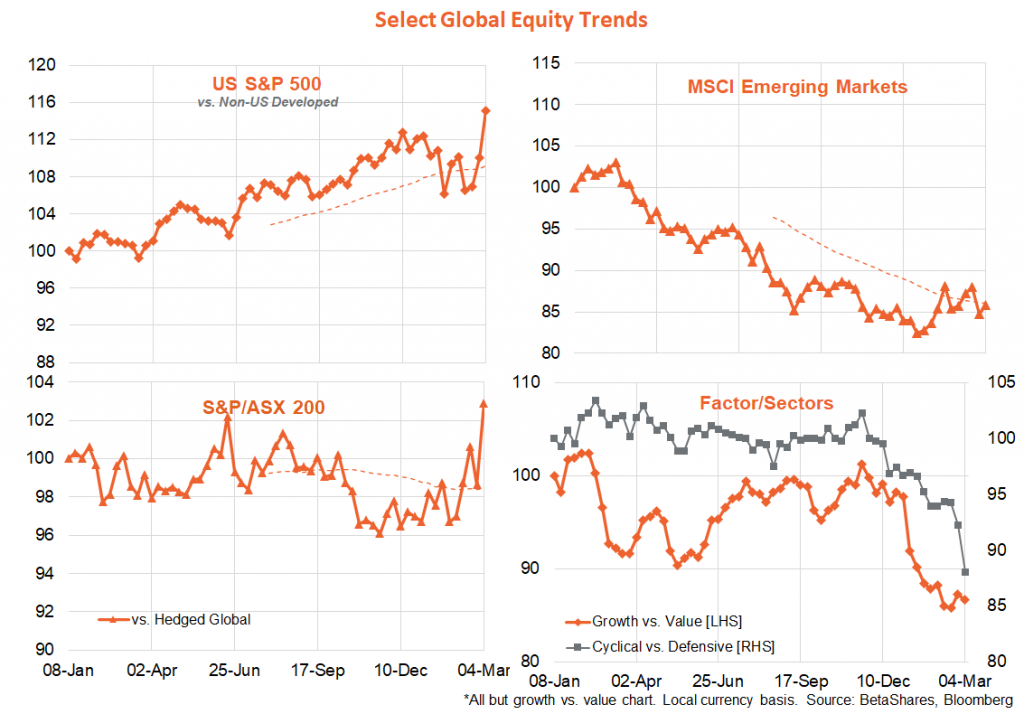

The intensification of Russia’s invasion of Ukraine – along with Putin’s nuclear talk – saw world oil prices surge 26% last week to US$115 a barrel, which in turn saw global equities decline by 2.4%. Grain/food prices are also moving higher. All that said, the decline in equities was perhaps not has bad as might have been expected given some are openly debating the risk of a global nuclear war! The S&P 500 was down only 1.3% over the week, while local stocks rose – helped by strength in the mining sector.

The one saving grace for equities last week was Powell’s confirmation that at least the Fed won’t be raising rates next week by more than 0.25%. U.S. February payrolls on Friday also surged by much more than expected – though wage growth, for a change, was surprisingly benign. It’s what Keating might have called a “beautiful set of numbers”. Could it be that wages are now high enough, and COVID fears low enough, to cajole more back into the U.S. workforce?

As might be expected given the surge in oil prices, commodity themes were on fire last week, with continued solid gains in our OOO), QAU), FUEL) and FOOD) ETFs. The $A also rose, despite risk-off sentiment and the rise in the $US index – with the $A displaying solid gains against third currencies such as the Euro.

Bond markets, however, are focusing on the growth implications of higher oil prices and geo-political risk – with U.S. 10-year bond yields down a whopping 23bps to 1.73%.

Less noticed by markets was a promise by Powell (in response to a question from Senator Richard Shelby) that he’d be as tough on the economy as Volcker was in the early 1980s if that was what was required to wring current high inflation out of the system. We’ll see! But having just dealt with a 1918-style global pandemic, markets are now having to contemplate both a re-run of the 1962 Cuban missile crisis and/or a potential re-run of the 1980 Volcker-style attack on inflation. These are turbulent times.

The week ahead promises more potential risks, with the U.S. and Europe mulling the possibility of actually blocking Russian oil exports – which could see oil prices surge further unless more supply can be found elsewhere. The promise to give Ukraine more fighter jets could also help the embattled country hold on for a while longer.

Back to the U.S. economy, Thursday sees the release of the February U.S. consumer price index report, with headline annual inflation expected to rise to 7.9% from 7.5%. Core annual CPI inflation (i.e. excluding food and energy) is at least expected to edge lower to 5.9% from 6.0%. On Friday, consumer sentiment is expected to drop further, from levels which (many may be surprised to know) is already as low as seen in previous recessions – thanks to concerns over high inflation.

Of course, no-one’s talking about this – but one potential scenario in the days and weeks ahead is regime change in Russia. Even if Russia eventually wins out in Ukraine, the sanctions won’t be lifted and the Russian economy will be toast. Maybe, just maybe, this grim reality could be enough to see Putin eventually pushed out or arrested. Maybe I’m too hopeful – but were it to happen we’d likely see a collapse in oil prices and a squeeze higher in beaten-up tech stocks.

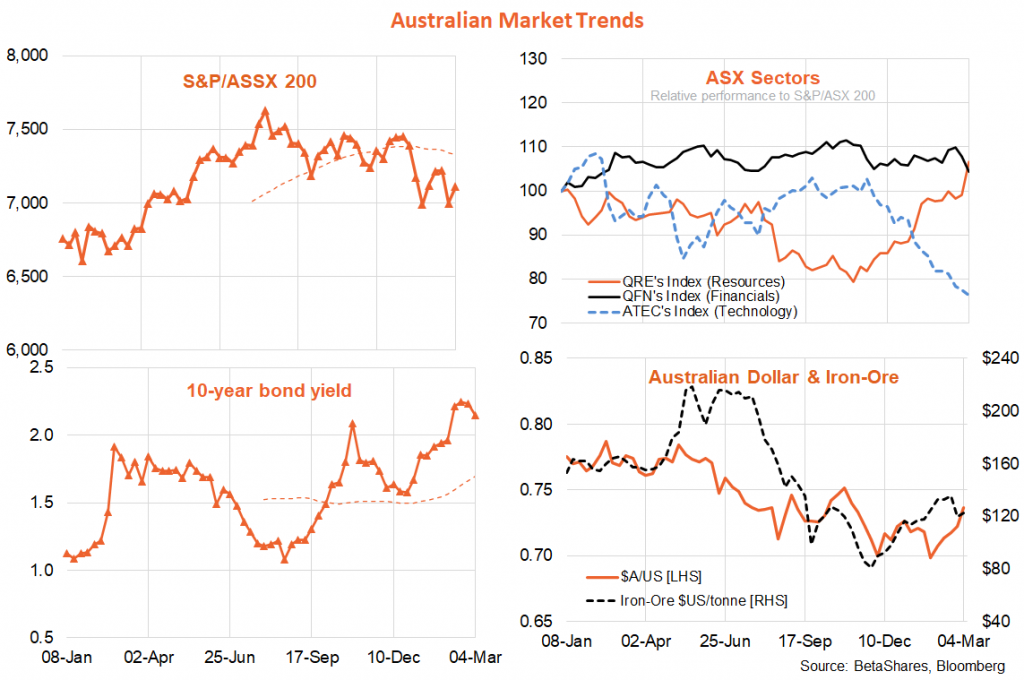

In terms of themes, the rebound in commodity prices and mining stocks is helping relative performance of the Australian market of late. Lower bond yields hurt financials last week and slowed the rotation from growth to value stocks. That said, there’s been a further big shift into defensive sectors from cyclicals.

Australian market

The Ukraine crisis – along with the recent benign wage price index report – gave the RBA further reason to reiterate its “patient” stand at last week’s policy meeting. One day later, the Q4 GDP report revealed a pleasing 3.4% re-opening rebound in growth, driven by a 6.3% surge in consumer spending as we headed back to shops, pubs and restaurants. We also saw further evidence of an overdue levelling out in house prices, with Sydney recording its first (small) decline in prices since late 2020 – even before the RBA has begun to raise rates!

RBA Governor Phil Lowe speaks on Wednesday, though it’s unlikely he’ll add much new on the policy front. The business (NAB) and consumer (Westpac) sentiment reports are released on Tuesday and Wednesday respectively. Confidence is being pulled in opposing directions of late, with a post-COVID economic re-opening underway but likely growing concerns with regard to inflation, interest rates and the war in Ukraine.