Stocks were mostly flat to slightly up yesterday, with the S&P 500 getting a boost in the last 10 minutes due to a big closing imbalance. Other than that, it was a pretty quiet day.

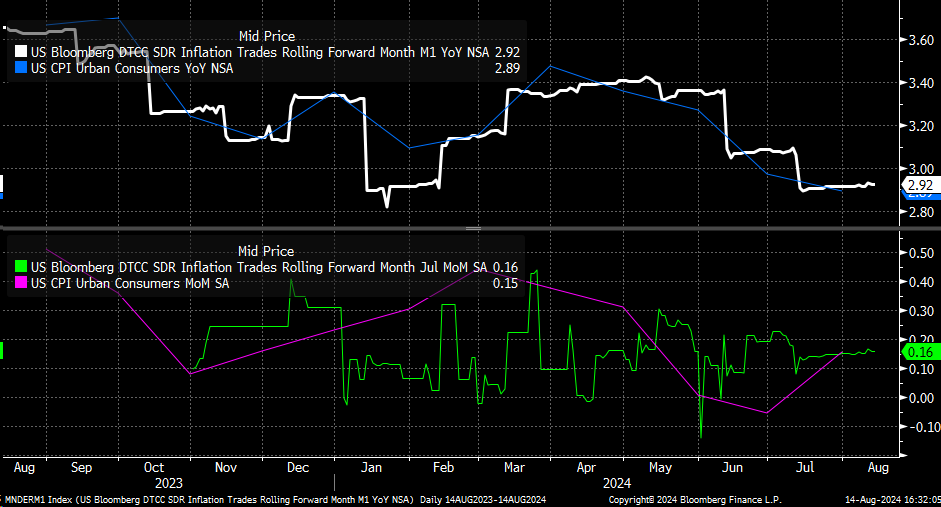

The CPI (Consumer Price Index) report came out yesterday and showed lower inflation than expected, which was in line with what the CPI swaps were predicting.

The swaps were expecting a month-over-month increase of 0.16%, and the actual number came in at 0.15% when rounded to the second decimal place. This shows that the swap pricing was very accurate this month.

This data means that the possibility of rate cuts in September is still on the table. Whether there will be one or two cuts will depend on the next job report and CPI report, both of which will be released before the September 18 meeting.

Today's Jobless Claims, Retail Sales Are Crucial

This keeps the trends we’ve talked about on track, suggesting a steeper yield curve and the continued unwinding of the USD/JPY trade. If the CPI number had been hotter, it would have slowed down this process.

Now, the focus shifts to today’s jobless claims data and retail sales. Additionally, The USD/JPY is just trading within a range right now, which is giving the stock market a chance to catch its breath.

But it goes beyond just the USD/JPY trade; it’s more than that. We know how important the USD/CAD (the exchange rate between the US dollar and the Canadian dollar) is to the S&P 500 as well.

The 1.385 level for the USD/CAD has marked bottoms (points where the S&P 500 stopped falling) before.

USD/CAD - S&P 500 Correlation

For now, the USD/CAD has done that again. However, the USD/CAD hasn’t really pulled back much, and the trend is still upward, so it’s hard to draw any firm conclusions just yet.

Anyway, if you’re looking for a place where the market might turn, this could be an important spot of resistance (a level where the S&P 500 might have trouble moving higher).

This area marks the 61.8% retracement level (a technical point where prices often reverse) and fills the gap left behind from August 1.

So, this could be a region that acts as resistance. I’m not saying the market will or won’t turn lower; I’m just letting you know about the possibility of this happening.

To me, at this point, this continues to look like a technical bounce out of oversold conditions.

We can see what today brings.